A short-term correction is indicated for Bitcoin, Ethereum, and Ripple: Can a major trend shift follow?

![]()

Journalist

Posted: December 19, 2024

Share this article

- BTC, ETH, and XRP defended crucial short-term support levels.

- Will they bounce back to their new highs ahead of Christmas?

On Wednesday, 18th of December, the US Fed made another 0.25% interest rate cut, but its 2025 hawkish projection triggered Bitcoin’s [BTC] decline to $100K.

During the same trading session, Ethereum [ETH] dropped 6.8% while Ripple [XRP] dumped 10%. All the major digital assets eased at short-term support levels as analysts remained optimistic about risk-on assets.

So, will the big three bounce back or slide lower? Let’s explore charts for insights.

Bitcoin defends $100K: Will ETH, XRP rebound?

Source: BTC/USDT, TradingView

Since the 12th of December, BTC bulls have defended $100K. The recent FOMC meeting sell-off eased at the psychological level. This confirmed it as a support.

Interestingly, the 100-day EMA (exponential moving average), which stopped past BTC dumps since October, aligned with the channel lows. This made the $98K-$100K a strong short-term support for BTC.

The mid-range of $104K and upper level of $108K-$109K could be feasible if the support holds.

On the flipside, a breach below the support could escalate further carnage and embolden bears. In such a case, $90K and $85K could become reachable for bears.

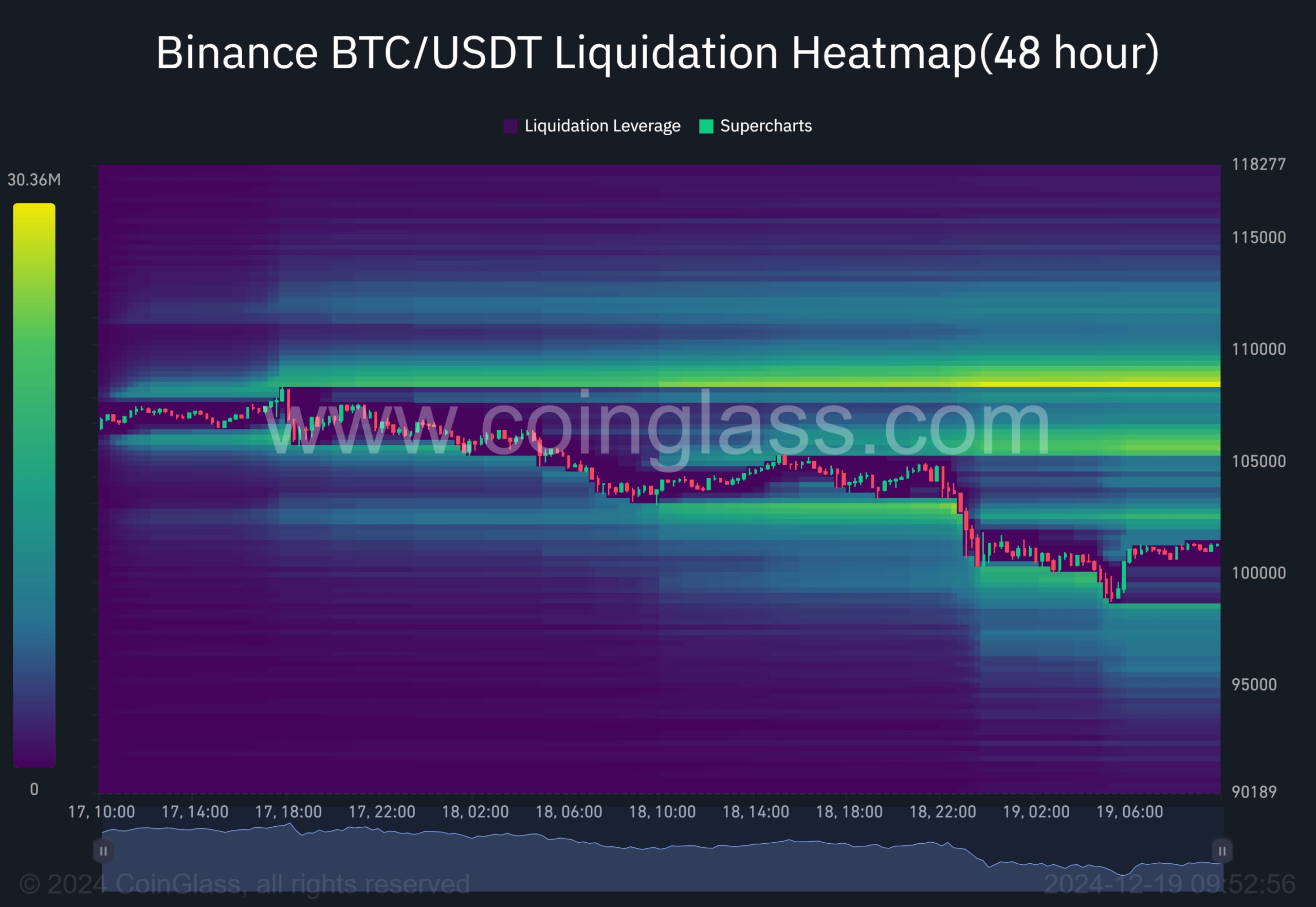

That said, the recent decline was also driven by a liquidity hunt, which was currently concentrated at $102.5K, $105K and $108K levels (bright yellow lines).

Source: Coinglass

The upside liquidity made a BTC rebound the most likely unless low trading volume during the Christmas holiday triggered more sell-offs.

How will ETH and XRP react to the above BTC’s price scenarios?

ETH, XRP price prediction

For ETH, the king altcoin has consolidated between $3.5K and $4K since the beginning of December. Like BTC, it dropped from $4.1K but bounced at the $3.5K range-lows as of this writing.

Source: ETH/USDT, TradingView

A move higher to $3.7K and $4K could be feasible if the range-low holds. A decisive move above the trendline support (white), could confirm a reclaim of the uptrend that began in November.

That said, if the channel’s support cracked, ETH bears could drag the altcoin to $3.3K or $3.1K.

Interestingly, XRP’s chart looked solid amongst the big 3. Despite the 10% drop, XRP held above its Q4 trendline support and could be the key level to watch for the rest of 2024.

Source: XRP/USDT, TradingView

Bulls could eye a $2.8 level or push higher to the 2021 cycle high of $3.3 using the support as a springboard. The bullish leaning was supported by the recent stablecoin RLUSD launch and ETF expectations in 2025.

Read Bitcoin [BTC] Price Prediction 2024-2025

However, a crack below it could empower short sellers to push XRP lower to $2 or $1.6.

In conclusion, the top cryptocurrencies, BTC, ETH, and XRP defended key levels, suggesting a potential market trend reversal to the upside. But will a likely low trading volume during the Christmas period affect the recovery?