Crypto Is Not Communism BIS Report Sparks Outrage from Industry Leaders

You are here: Home / News / Crypto Is Not Communism BIS Report Sparks Outrage from Industry Leaders

- The BIS’s recent report advocates for isolating digital assets from traditional finance, sparking backlash from industry leaders who argue it could destabilize the financial system.

- Christopher Perkins criticizes the BIS’s approach, claiming it misunderstands innovation and could create systemic risks rather than mitigate them.

- Perkins defends crypto, stating it provides access to financial services globally, likening it to the internet rather than communism.

The Bank for International Settlements (BIS), after its latest report, advocated for the isolation of digital asset markets from traditional finance, with top industry figures warning that the proposals could destabilize rather than safeguard the global financial system.

Christopher Perkins, president of blockchain investment firm CoinFund, slammed the BIS’s April 15 report, “Cryptocurrencies and Decentralized Finance: Functions and Financial Stability Implications,” calling its recommendations “dangerous” and “uninformed.”

“Many of their conclusions, perhaps fueled by fear, arrogance, or ignorance, completely miss the mark,” Perkins posted on X on April 19. “This is not about preventing risk; this is about misunderstanding innovation.”

The @BIS_org just published a new paper, “Cryptocurrencies and decentralised finance: functions and financial stability implication.” The good news is that the authors finally realize that advancements in crypto (including the growth of ETFs, stablecoins and tokenized real world…— Christopher Perkins 🦅🌎⚓️NYC (@perkinscr97) April 19, 2025

The BIS report urges policymakers to adopt a “containment” strategy, effectively walling off digital assets and decentralized finance (DeFi) from traditional banking and the broader economy. Perkins warns such a strategy would do the opposite of what’s intended: create systemic vulnerabilities rather than reduce them.

He points out the mismatch in operational tempo between legacy finance and blockchain-based systems: “When one market runs 24/7 in real-time and the other sleeps at night and on weekends, any artificial separation creates massive liquidity risk of unimaginable scale.”

Perkins adds, “If these proposals are implemented, they will not mitigate the systemic risk they seek to prevent.”

BIS Pushes Back as Crypto Grows in Developing Economies

The BIS’s view appears rooted in skepticism toward the anonymity of DeFi developers, the volatility of digital assets, and the growth of USD-backed stablecoins. But Perkins argues the digital asset space is a step forward, not backward.

“Crypto is not communism,” he wrote. “It’s the new internet that gives anyone with a connection access to financial services. You cannot control it any more than you can control the internet.”

As for concerns about anonymous development teams, Perkins fired back, “When was the last time a TradFi firm published a full list of its developers? Public companies disclose, yes, but those are becoming rare. Private markets now dominate.”

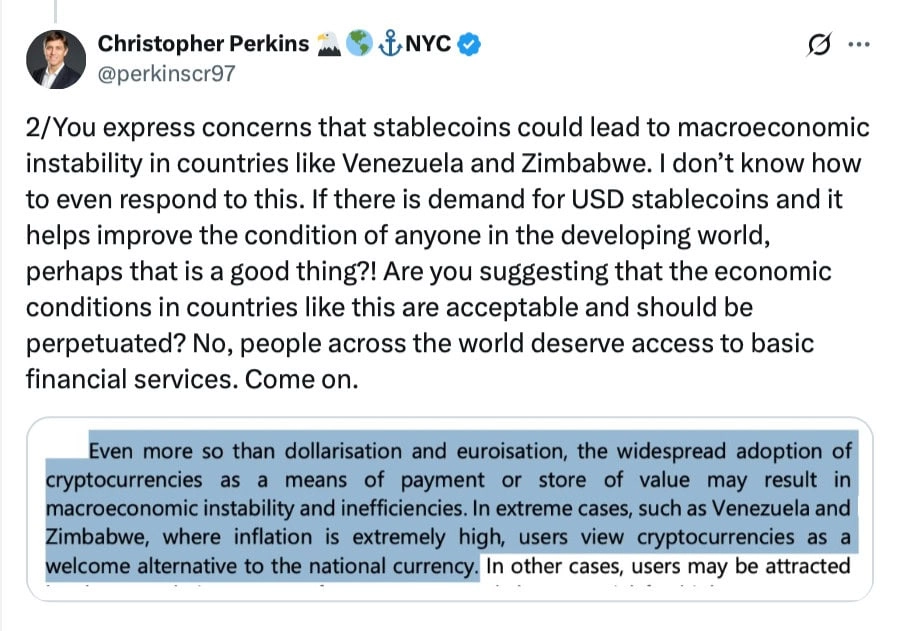

The BIS report also warns of potential macroeconomic instability caused by stablecoins and crypto, particularly in countries like Venezuela and Zimbabwe. But Perkins flips that argument on its head.

“If there is demand for USD stablecoins and they help improve conditions for those in developing economies, maybe just maybe that’s a good thing,” he said.

Catalini and Perkins Call Out BIS Report

Perkins wasn’t the only one raising red flags. Christian Catalini, co-founder of Lightspark and an MIT-trained economist, offered a biting critique of the BIS’s framework.

He likened the report to “writing parking regulations for a fleet of self-driving drones earnest work, two technological leaps behind.”

1/ The @BIS_org just published a blueprint for “containing” crypto and DeFi. Think: writing parking regulations for a fleet of self‑driving drones — earnest work, two technological leaps behind. pic.twitter.com/11C8UaDuJM — Christian Catalini (@ccatalini) April 19, 2025

Catalini and Perkins both argue that instead of containing innovation, regulators should focus on understanding and modernizing frameworks to fit a rapidly evolving financial architecture, including developments in crypto.

As policymakers scramble to keep pace with innovation, the BIS report highlights a growing ideological divide: one side seeking control through isolation, the other urging integration through modernization.

With digital assets reaching what the BIS itself called “critical mass,” how global institutions respond now could shape the financial landscape for decades to come. Whether they opt for walls or bridges may determine who benefits and who is left behind.

Related | Bitcoin’s Battle at $84,260: Will Support Hold or Signal a Bearish Trend?