Mining Grid Revolutionizes Bitcoin Mining With Cores Racing: A Competitive, Rewarding New Model

This content is provided by a sponsor.

PRESS RELEASE.

As Bitcoin continues to dominate financial markets globally, Mining Grid, a pioneer in blockchain innovation, has successfully launched Cores Racing—a groundbreaking program that transforms Bitcoin mining into a more fair, competitive, and community-driven experience.

Building on the success of its Mining Race platform, which boasts over 50,000 users from 140 countries, this initiative marks a new era in Bitcoin mining. With its introduction of Mining Cores, Cores Racing provides users with a cost-effective and accessible product that offers 1 TH/s of mining power and flexible activation options of one or three years. This streamlined, approachable product aims to lower barriers and invite a broader audience into the world of Bitcoin mining.

Reviving Bitcoin’s Original Vision

Cores Racing draws inspiration from Bitcoin’s early principles, where solo miners could actively compete for block rewards in a truly decentralized environment. Over time, the rise of institutional mining has made it increasingly difficult for individual miners to succeed. Cores Racing addresses this by leveling the playing field with a revolutionary Block Races Rewards system, offering a chance for miners to collaborate, compete, and win rewards in a decentralized and transparent manner.

Unlike traditional mining models, where rewards are fragmented and payouts are often overshadowed by larger players, Cores Racing transforms mining into an exciting, competitive race format. Through this innovative structure, miners earn rewards based on their contributions while enjoying a far more inclusive and engaging experience.

Designed for Accessibility and Global Connection

The platform is designed with accessibility in mind, offering intuitive tools and a streamlined interface that allows individual miners—regardless of technical expertise—to participate with ease. This makes Cores Racing an ideal entry point for newcomers while also providing seasoned miners with a thrilling, competitive dimension to their earnings.

One of the defining characteristics of Cores Racing is its ability to unite miners from across the globe into a single, decentralized network, fostering collaboration and friendly competition across borders. With users spanning 140 countries, the platform creates a diverse and inclusive community of miners who share the vision of reviving Bitcoin’s original ethos. Its flexible connectivity options further ensure seamless participation regardless of location.

Driving Sustainability and Community Growth

The impact of Cores Racing extends beyond the mining community, introducing a new standard for sustainability and fairness in the blockchain industry. By maximizing contributions through pooled mining structures, the platform reduces energy waste and improves mining outcomes. This approach aligns with Mining Grid’s commitment to eco-friendly practices and positions Cores Racing as a leader in creating a more sustainable blockchain ecosystem.

Additionally, the platform provides users with an innovative earning strategy that eliminates the isolation often associated with solo mining. Participants not only enjoy higher rewards but also gain access to a thriving network where collaboration and innovation go hand in hand. The Grid Link system, a unique referral and rewards model, further enhances community engagement by incentivizing participants to expand their networks and invite others to join the race.

Rami Alsridi, Founder and CEO of Mining Grid, states: “Cores Racing brings back the excitement of early Bitcoin mining—empowering individuals to compete and win meaningful rewards. Our mission is to make mining fair, inclusive, and accessible for everyone.”

Solaiman Al-Rifai, Founder and Board Member of Mining Grid, adds: “This launch is a game-changer. By combining innovation with decentralization, Cores Racing enhances mining efficiency, rewards, and community growth. It’s about more than just mining—it’s about reshaping the future of Bitcoin.”

As Bitcoin’s mining difficulty continues to rise and institutional players dominate the landscape, Cores Racing represents a pivotal shift in making mining more inclusive and rewarding. Mining Grid’s vision for the future is rooted in empowering individuals, fostering collaboration, and ensuring that Bitcoin’s founding principles of transparency, fairness, and decentralization remain intact.

About Mining Grid Mining Grid is a leading provider of sustainable blockchain solutions, revolutionizing the global mining industry. With a strong focus on eco-friendly practices and innovative technology, Mining Grid empowers individuals across the MENA region and beyond to embrace blockchain with confidence and responsibility.

For more information, visit: www.miningrid.com

_________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Mad Money’s Jim Cramer Warns of 1987-Style Market Crash Amid Tariff-Driven Volatility

Jim Cramer, CNBC’s “Mad Money” host, has warned investors of a potential stock market crash mirroring 1987’s Black Monday, citing escalating Trump tariffs and recent market turbulence as catalysts for renewed economic uncertainty.

Cramer Cites Black Monday Parallels—But Crowd Bets on ‘Inverse’ Strategy

Jim Cramer, the volatile host of CNBC’s “Mad Money,” has sparked alarm with his prediction of a market crash reminiscent of 1987’s Black Monday, when the Dow Jones Industrial Average (DJIA) plummeted 22% in a single day. His warnings follow a brutal two-day sell-off on April 3–4, 2025, which saw the Dow plunge 2,231 points amid fears that Trump’s tariffs on imports could exacerbate inflation and stall economic growth.

Cramer, a former hedge fund manager turned media personality, attributed the recent downturn to President Trump’s refusal to scale back tariffs targeting foreign goods, particularly Mexican beer and auto parts. He singled out companies like Constellation Brands—the distributor of Grupo Modelo’s Corona beer—as vulnerable to tariff-driven cost spikes, noting, “The last thing it needs is tariffs. This dog played my child trust until we finally jettisoned it at a big loss.” Cramer also criticized Trump’s inaction, arguing that without intervention, markets could face a “man-made obliteration” akin to Black Monday.

Cramer said:

We could be in for the rips of a quick bear market, following the Covid-2020 model. We could be in for a 2000-style bear market where tech was laid to waste for a very long time, or it might be the Big Kahuna—the one in October 1987.

The host’s dire outlook has reignited debate over his stock-picking track record. Critics often label Cramer a contrarian indicator, citing data showing that betting against his recommendations—via strategies like the Inverse Cramer ETF (SJIM)—has historically outperformed the market. The SJIM ETF, launched in 2023, reportedly delivered a 48% return in 2024 by shorting Cramer’s picks. Analysts argue his tendency to hype overvalued, media-driven stocks creates short-term volatility ripe for exploitation.

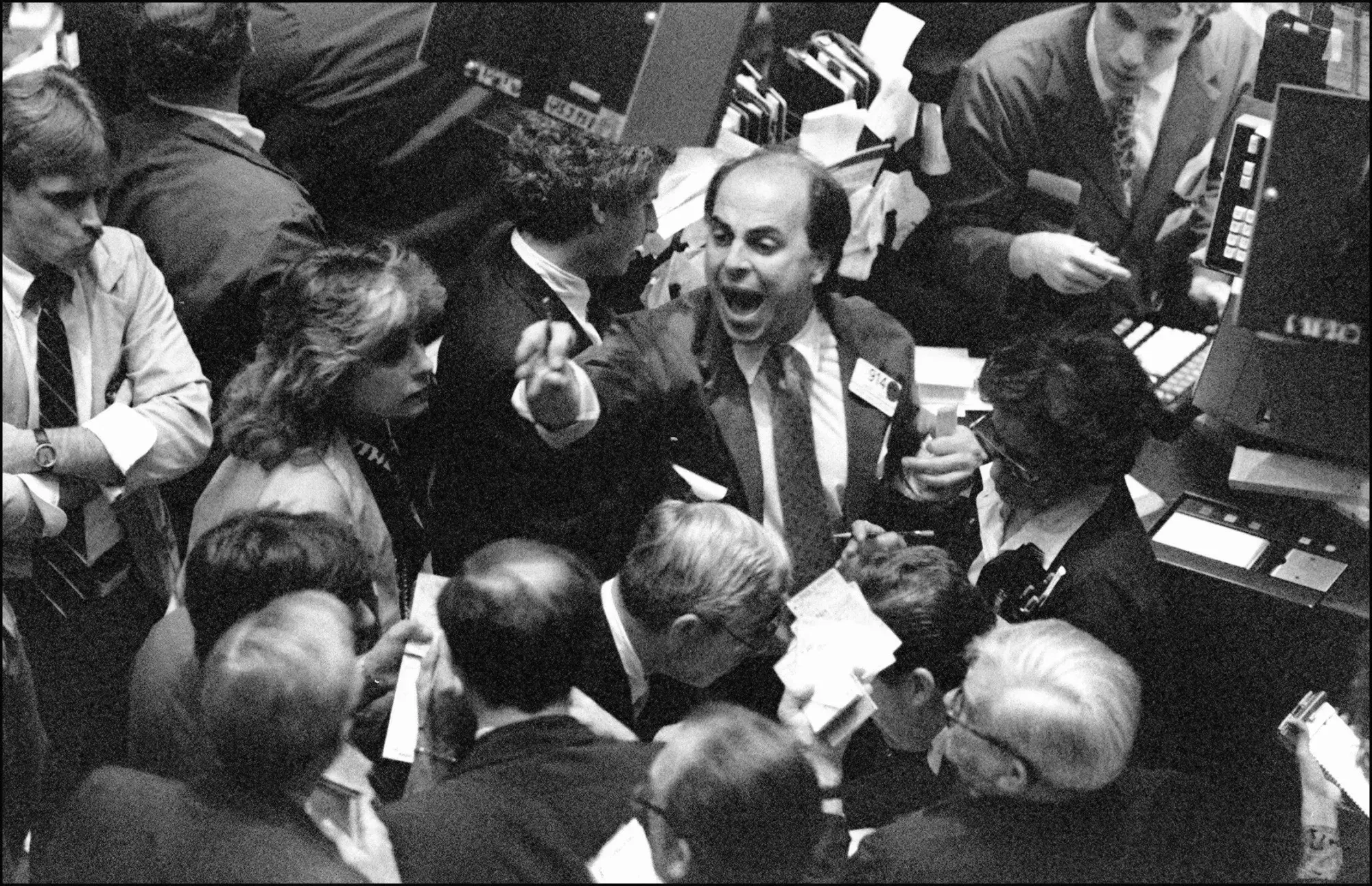

Oct. 19, 1987, otherwise known as ‘Black Monday.’ Photo source: Bloomberg.

Oct. 19, 1987, otherwise known as ‘Black Monday.’ Photo source: Bloomberg.

Cramer’s Black Monday comparison references the Oct. 19, 1987, crash, triggered by program trading, overvaluation, and global contagion. While swift central bank action averted a depression, the crash exposed risks of automated trading and herd mentality—factors Cramer claims are resurfacing. “It feels like one of those pre-crash moments in October ’87,” he said, recalling his decision to sell holdings before the collapse.

Despite his polarizing reputation, Cramer urged investors to avoid panic, noting that post-1987 markets rebounded within a year. He advised focusing on recession-resistant sectors like auto parts and discounted financial stocks, though he cautioned, “In a recession, you don’t wanna own anything connected to autos.”

The Inverse Cramer movement, amplified by social media trackers like @Cramertracker, showcases deepening skepticism toward his advice. Yet Cramer’s latest warnings highlight tangible risks: Trump’s tariffs have already disrupted supply chains, while sticky inflation complicates the Federal Reserve’s ability to cut rates.

Whether Cramer’s prediction proves prescient or merely hyperbolic, his commentary reflects broader anxieties over policy-driven market instability—a lesson Black Monday taught all too well.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons