XRP Tracker Fund Unleashed in Asia With Ripple Driving Capital and Strategy

The cryptocurrency whipsawed right after Federal Reserve Chairman Jerome Powell delivered a damning indictment of President Donald Trump’s tariffs in a Wednesday speech.

BTC Shakes Off Early Losses Despite Powell’s Dire Speech

Federal Reserve Chairman Jerome Powell told attendees at a Wednesday Economic Club of Chicago event that “the level of the tariff increases announced so far is significantly larger than anticipated,” and that President Donald Trump’s aggressive trade policies will result in “higher inflation and slower growth.”

Powell’s ominous outlook triggered a precipitous drop in bitcoin’s price, but the digital asset recovered from the $83K level during after-hours trading.

“Bitcoin ( BTC) dropped roughly 2%, from $85,300 to $83,300, within 30 minutes of Fed Chair Jerome Powell’s 1:30 PM EST remarks,” Dylan Bane told Bitcoin.com. Bane is an analyst at crypto data intelligence firm Messari. “Equities followed a similar pattern. The Dow Jones, S&P 500, and Nasdaq fell between 1.5% and 4% over the course of the day, suggesting a broad-based risk-off reaction to Powell’s comments,” Bane added.

Overview of Market Metrics

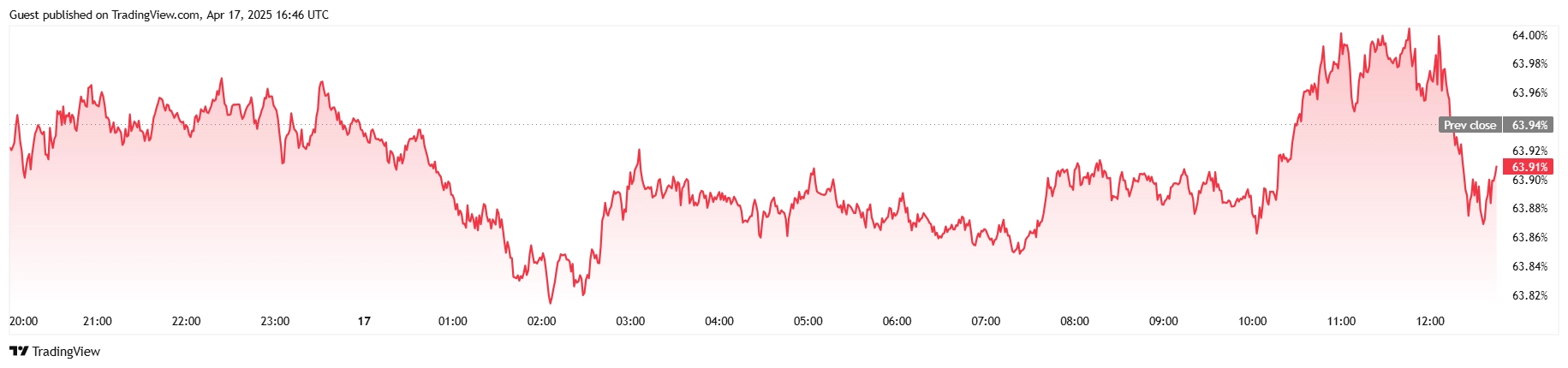

Bitcoin is currently trading at $84,891.80, continuing its upward momentum with a modest 0.12% gain since yesterday and reflecting a strong 7.09% increase over the past week. The asset fluctuated between $83,314.85 and $85,428.28 during the past 24 hours, indicating a relatively stable trading session despite some broader market hesitation.

( BTC price / Trading View)

( BTC price / Trading View)

Trading volume dipped by 7.13% to $24.59 billion, and market capitalization stands at $1.68 trillion, down by a marginal 0.11% since Wednesday. Bitcoin dominance slipped slightly by 0.02% to 63.92%, a subtle indication that altcoins are beginning to regain minor footing following recent underperformance.

( BTC dominance / Trading View)

( BTC dominance / Trading View)

Meanwhile, futures activity showed a modest decline, with total BTC open interest falling 0.54% to $54.36 billion. According to Coinglass, total liquidations reached $3.96 million over the past day, with short sellers getting hit the hardest and accounting for $3.92 million of that figure. Long positions, in contrast, remained relatively untouched at just $37,970, signaling strong market confidence and a continued short squeeze environment.

Powell Warns Trump About Negative Impact of Tariffs

The Fed Chair issued a clear warning about the impact of Trump’s tariffs on Wednesday afternoon as he spoke about the U.S. economy at the Economic Club of Chicago.

“The new administration is in the process of implementing substantial policy changes,” Powell explained. “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension.” That mandate is to maintain price stability and maximum sustainable employment, a feat that will prove increasingly difficult in a protectionist environment.

What Powell is alluding to is a conundrum economists refer to as “stagflation,” where economic growth stagnates while inflation rises, putting central bankers in a pickle because they can’t rein in one metric without adversely impacting the other.

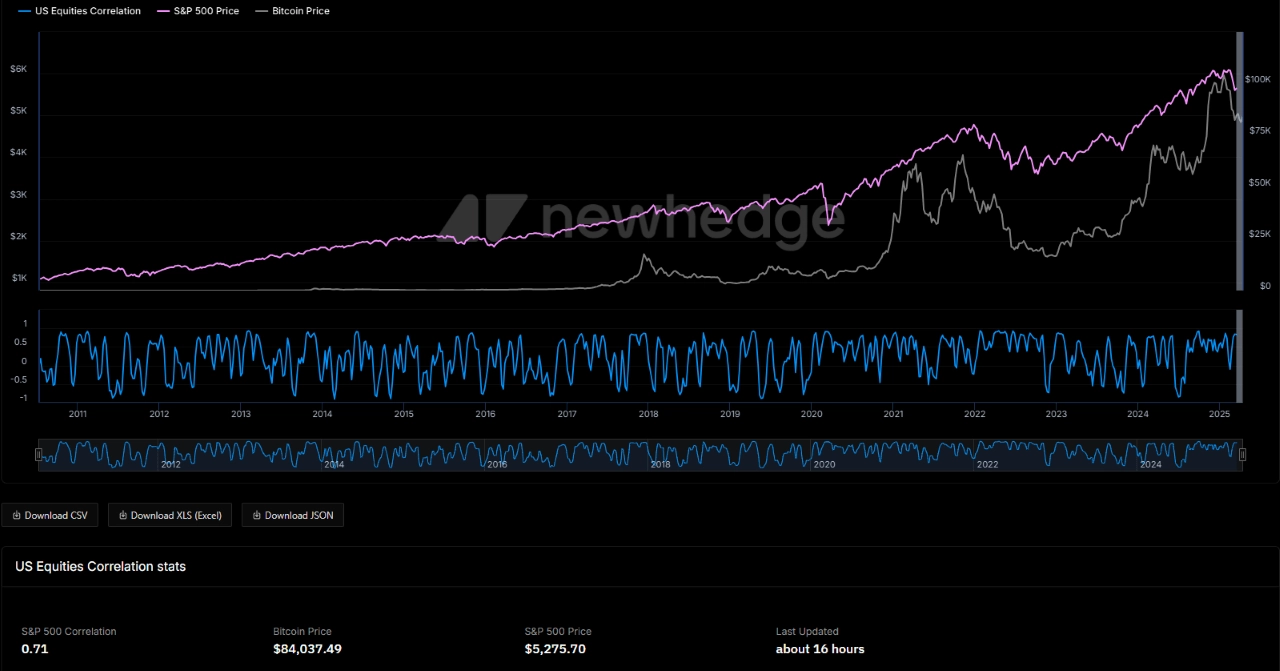

Both bitcoin and traditional assets reacted with a selloff, but going forward, Bane suggests the cryptocurrency could eventually reduce its correlation with stock markets, which, according to Newhedge, currently stands at 71%.

(BTC-S&P 500 correlation / Newhedge)

(BTC-S&P 500 correlation / Newhedge)

“Until the full impact of tariffs and inflation dynamics plays out, we expect BTC to continue moving broadly in tandem with equities,” Bane explained. “A true decoupling likely hinges on a fundamental restructuring of the international economic order that could see the U.S. dollar losing its status as the world’s reserve currency.”