Animoca Brands is planning to list on the New York Stock Exchange, with an announcement expected soon. Executive Chairman Yat Siu said the listing is motivated by U.S. President Donald Trump’s favorable regulatory stance on digital assets.

Trump’s Light-Touch Regulation

Hong Kong-based Animoca Brands, a leading blockchain gaming and crypto investment firm, is eyeing a listing on the New York Stock Exchange. While no specific date has been set, and the listing is not dependent on market conditions, Executive Chairman Yat Siu said an announcement would be made soon.

Animoca Brands is reportedly pursuing the listing in part to take advantage of U.S. President Donald Trump’s “light-touch” regulation of digital assets. In an interview with the Financial Times, Siu described Trump’s approach as a “unique moment” for the industry.

Since taking office in January, the Trump administration has moved swiftly to dismantle Biden-era policies, which critics say discouraged innovation and pushed crypto firms out of the U.S. Under Trump, the U.S. Securities and Exchange Commission (SEC) has dropped or paused lawsuits against digital asset companies. These steps, along with Trump’s enthusiastic embrace of cryptocurrency, have attracted key players such as the cryptocurrency options exchange Deribit.

According to Siu, a U.S. listing was not even under discussion a year ago, but Trump’s approach to crypto regulation has made it a central part of Animoca’s roadmap.

“If the U.S. didn’t do what they did with the regulators [under Biden], we probably would have competitors in the U.S. Normally, we’d be fighting with some giant or something. It’s the biggest market, so we should go there, right? It’s a unique moment in time. I feel like it would be one heck of a wasted opportunity if we didn’t at least try,” Siu said.

Animoca Brands, which raised nearly $6 billion in private funding, has steadily built an investment portfolio spanning Opensea, Kraken, and Consensys. The company anticipates gaming firms integrating crypto payments into upcoming releases like Grand Theft Auto 6, potentially boosting revenues.

Some Animoca-backed firms, including crypto exchange Kraken, are also exploring U.S. listings in late 2025 or early 2026, further underscoring the Trump administration’s regulatory shift as a catalyst for crypto industry expansion.

The company’s revenue surged to $314 million last year, with earnings before taxes and depreciation rising to $97 million. With $300 million in cash and stablecoins and $538 million in digital assets, Animoca believes it is well-positioned to enter U.S. public markets.

“We think we’re the biggest non-financial services crypto firm,” Siu said.

Pi Network Token Rockets into Top 20 After Massive Price Surge

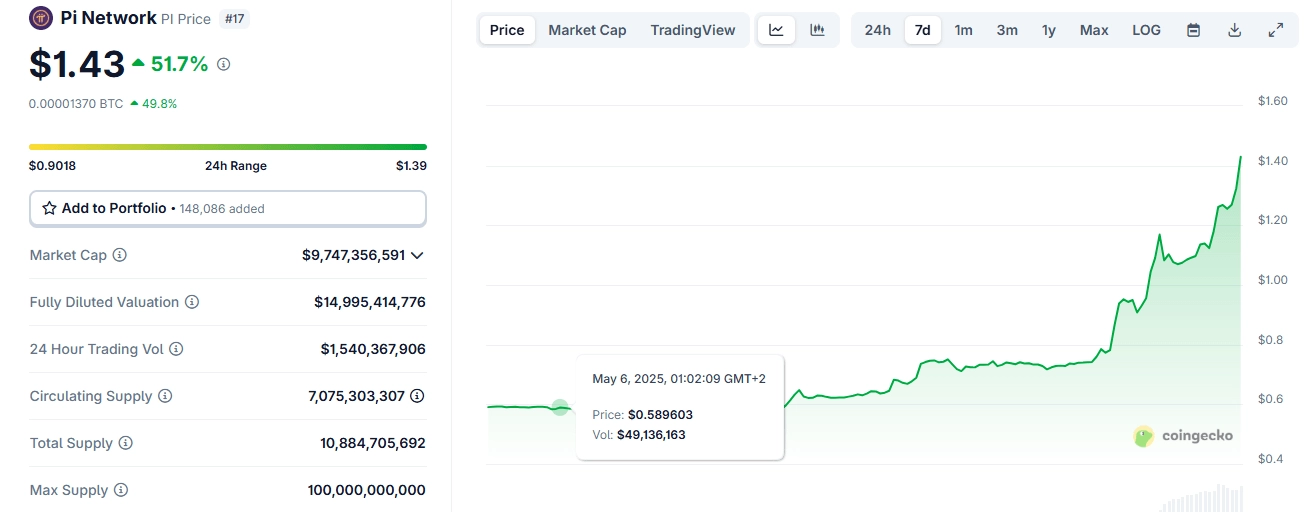

Pi Network’s token experienced a significant surge, briefly entering the top 20 digital assets after rising over 72% in less than 48 hours. This rally occurred just before a major ecosystem announcement scheduled for May 14.

Upcoming Pi Network Ecosystem Announcement Fuels Rally

On May 12, Pi Network, a social cryptocurrency and developer platform, briefly saw its token break into the top 20 digital assets by market capitalization after a more than 50% surge in 24 hours. In fact, at the time of writing ( May 12, 2:00 a.m. EST), the token had risen by over 72% in under 48 hours, making Pi the best-performing top 20 digital asset over seven days.

The token’s rally comes just a few days before Pi Network’s promised May 14 ecosystem announcement. While the May 8 post on X shared few details about the pending announcement, the token’s run since this teaser suggests users are anticipating major news that has a bearing on Pi Network’s growth trajectory.

Prior to the May 8 post, Pi Network had also introduced new features to enhance inclusivity and accessibility to its Mainnet ecosystem. It said this decoupling of wallet activation from migration would enable millions more to engage with the Pi Mainnet. According to Pi Network, these changes aim to grow the Pi Mainnet ecosystem by enabling more users to own and use Pi on the blockchain, benefiting developers and the overall utility of Pi.

Besides the ecosystem announcement, speculation that Binance might finally list the token is also believed to be fueling the surge. Despite breaking into the top 20, Pi is still not listed on Binance, a top cryptocurrency exchange platform, due to issues around the distribution of Pi tokens. Some reports suggest the token’s relatively low trading volumes and liquidity are other key factors why Binance has not listed it.

Meanwhile, as shown by Coinegcko data, Pi had largely trended downward since its Feb. 27 peak of $2.93, with the token appearing to bottom at just under $0.50 on April 5. However, after flatlining for the rest of April and the first week of May, Pi began a rally that saw it peak at $1.43, its highest point since March 16. At the time of writing, Pi was up 118% over seven days and ranked 17 with a market capitalization of just over $9 billion.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons