Synopsis

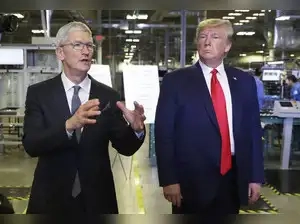

Apples $600 billion U.S. manufacturing investment, announced by CEO Tim Cook and President Donald Trump, is a game-changer for the tech industry and American jobs. The new $100 billion boost through the American Manufacturing Program focuses on reshoring supply chains, expanding partnerships with key U.S. companies, and creating 20,000 new jobs in innovation-driven fields. Apples stock soared as investors applauded the move, seeing it as a smart step against global trade risks.

AP Apple has announced a massive $100 billion boost to its U.S. manufacturing investment, pushing its total commitment to $600 billion. This bold move has sparked a sharp rise in Apples stock as the company strengthens its American supply chain and creates thousands of new jobs.

AP Apple has announced a massive $100 billion boost to its U.S. manufacturing investment, pushing its total commitment to $600 billion. This bold move has sparked a sharp rise in Apples stock as the company strengthens its American supply chain and creates thousands of new jobs.

Apple plans to work with many American companies such as Corning, Coherent, Applied Materials, Texas Instruments, and Broadcom to build key parts and materials domestically. One standout deal is the $2.5 billion investment with Corning to produce 100% of iPhone and Apple Watch glass in Kentucky. This facility will feature the worlds largest and most advanced smartphone glass production line and an Apple-Corning Innovation Center. This massive U.S. investment isnt just about products; its about people and jobs. Apple is set to hire around 20,000 new employees in the U.S. over the next four years. These hires will be focused on research and development, silicon engineering, software development, and artificial intelligenceall cutting-edge areas. This move is expected to give a real boost to the American economy, particularly in manufacturing sectors that have seen decline over the years. With more advanced manufacturing happening domestically, Apple hopes to build a resilient supply chain that can withstand global disruptions. The initiative also aligns closely with President Trumps America First economic policies, which emphasize growing U.S.-based production and reducing dependence on foreign suppliers.

There are several reasons behind Apples big investment push in the U.S. For one, global trade tensions and tariffs have made overseas manufacturing more complicated and expensive. By increasing production in the U.S., Apple can avoid some of these trade-related costs and risks. Moreover, customers and governments worldwide are paying more attention to supply chain security and sustainability. Bringing manufacturing closer to home helps Apple improve oversight and reduce its environmental footprint. Finally, investing in American manufacturing supports innovation, as close collaboration between engineers and factory workers accelerates new product development. Wall Street responded enthusiastically to Apples news. The companys stock price jumped nearly 5%, adding roughly $140 billion to its market value in just one day. Investors see Apples plan as a smart way to secure its supply chain, avoid tariffs, and tap into the growing push for domestic production. This stock surge reflects confidence in Apples leadership and long-term strategy. It also shows that the market values companies willing to invest big in U.S. manufacturing and innovation, especially amid ongoing global economic uncertainties. While Apple is ramping up its U.S. manufacturing, its not abandoning its global supply chain. Instead, the company aims to balance production across different regions. By diversifying where products and components are made, Apple can better handle disruptions like those caused by the pandemic or geopolitical tensions. The new American Manufacturing Program adds an important layer of resilience to Apples operations, making the supply chain more flexible and secure. This strategy keeps Apple competitive in a world where manufacturing agility is more important than ever. Q: What is Apples American Manufacturing Program? A: Its Apples $600 billion plan to expand manufacturing and supply chains in the U.S., creating jobs and building advanced facilities.

Q: How did Apples stock react to the investment announcement?

A: Apples stock jumped nearly 5%, reflecting strong investor confidence in the companys U.S. growth plans.