Today in crypto, Arkham Intelligence claims to have retroactively uncovered the biggest crypto hack in history, Bitcoin ETFs saw $812 million in outflows, while Ether ETFs ended their longest inflow streak with $152 million in losses. Meanwhile, exchange Gate has launched spot trading services in the United States.

Arkham Intelligence says it retroactively uncovered the biggest crypto heist in history

Blockchain analytics platform Arkham Intelligence claims to have retroactively discovered a $3.5 billion hack of a Chinese Bitcoin mining pool dating back to 2020.

LuBian, a mining pool operator that emerged in May 2020, was hacked on December 28, 2020, and suffered the loss of 127,426 Bitcoin, valued at about $14.5 billion using current market prices, according to Arkham.

A portion of the stolen funds from the LuBian hack. Source: Arkham Intelligence

A portion of the stolen funds from the LuBian hack. Source: Arkham Intelligence The mining pool was able to save 11,886 BTC by moving the funds to different addresses, which it still holds.

The blockchain intelligence platform said that the hack is suspected to have occurred through a brute-force attack, which revealed private keys that were generated by an algorithm and were insecure.

Spot Bitcoin ETFs see second-largest outflow, Ether ETFs end 20-day streak

Spot Bitcoin exchange-traded funds (ETFs) saw $812.25 million in net outflows on Friday, marking the second-largest single-day loss in the history of these products.

The drawdown erased a week of steady gains and pushed cumulative net inflows down to $54.18 billion. Total assets under management slid to $146.48 billion, representing 6.46% of Bitcoins market capitalization, according to SoSoValue.

Fidelitys FBTC led the exodus with $331.42 million in redemptions, followed by ARK Invests ARKB, which saw a substantial pullback of $327.93 million. Grayscales GBTC also lost $66.79 million. BlackRocks IBIT posted a relatively minor loss of $2.58 million.

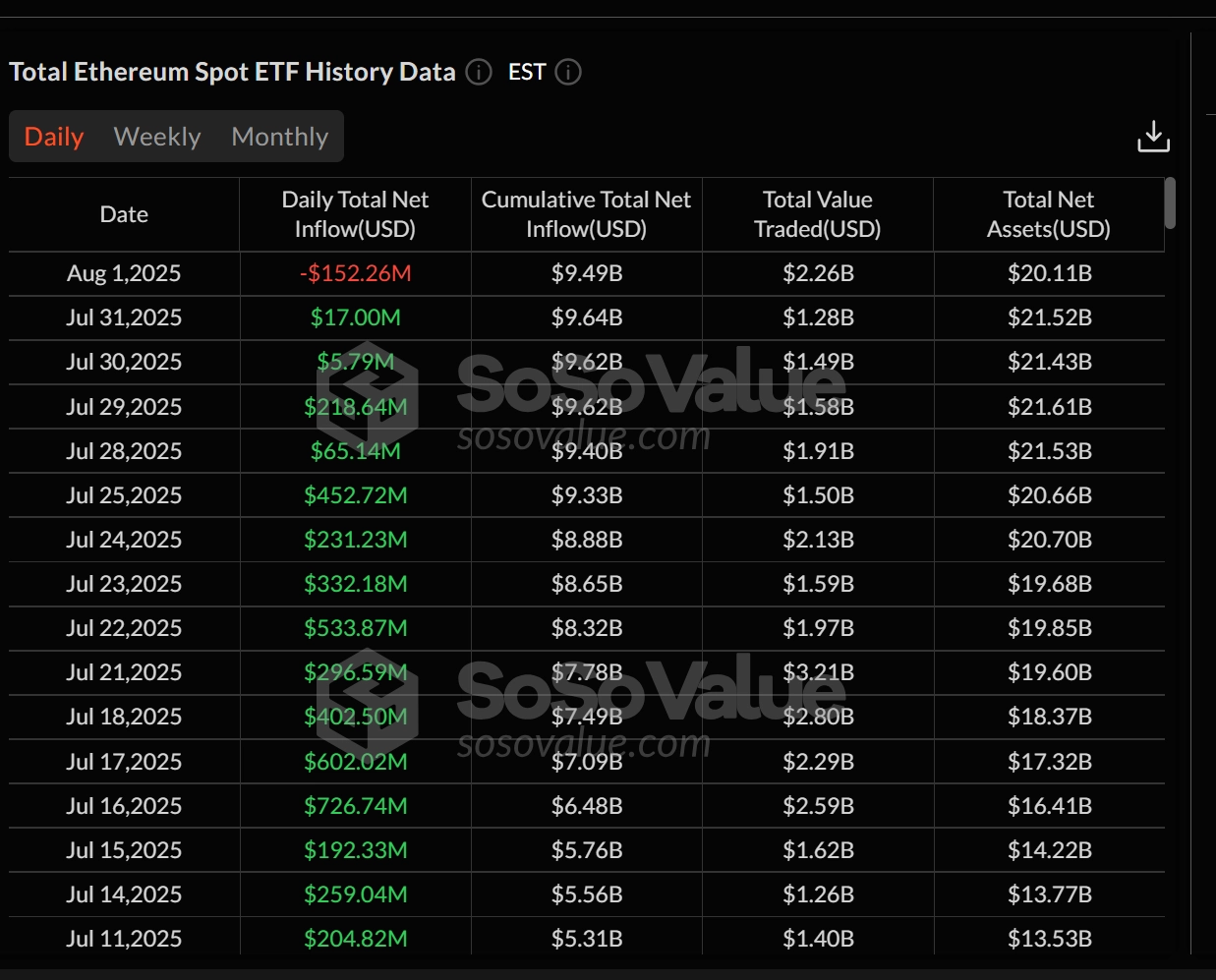

Meanwhile, Ether ETFs ended their longest inflow streak to date. After 20 consecutive trading days of net inflows, the sector recorded a $152.26 million outflow on Friday. Total assets under management now stand at $20.11 billion, or 4.70% of Ethers market cap.

Ether ETFs end 20-day inflow streak. Source: SoSoValue

Ether ETFs end 20-day inflow streak. Source: SoSoValue Crypto exchange Gate launches spot trading services in the US

Crypto exchange Gate is launching in the United States, offering spot trading services to US customers for the first time. Founded in 2013 by Chinese scientist Lin Han, the company cited improved regulatory clarity in the country as the reason behind the move.

According to Gate, it will initially offer crypto trading pairs for US customers, with upcoming services for fiat on- and off-ramps and support for custodial wallets. As of July 24, the exchange offered over 3,800 trading pairs on its platform, one of the largest asset varieties in the market.

Spot trading volume on Gate reached $6.8 billion in the past 24-hours, according to CoinMarketCap.

The move comes as crypto exchanges are reentering the United States amid increased regulatory clarity.