If you want to own a full bitcoin through dollar-cost averaging (DCA), 2025 may be your last realistic chance.

Jamie Redman

Jamie Redman

DCA Strategy Faces Diminishing Returns, But Bear Markets Could Be a Blessing for Late Bitcoin Stackers

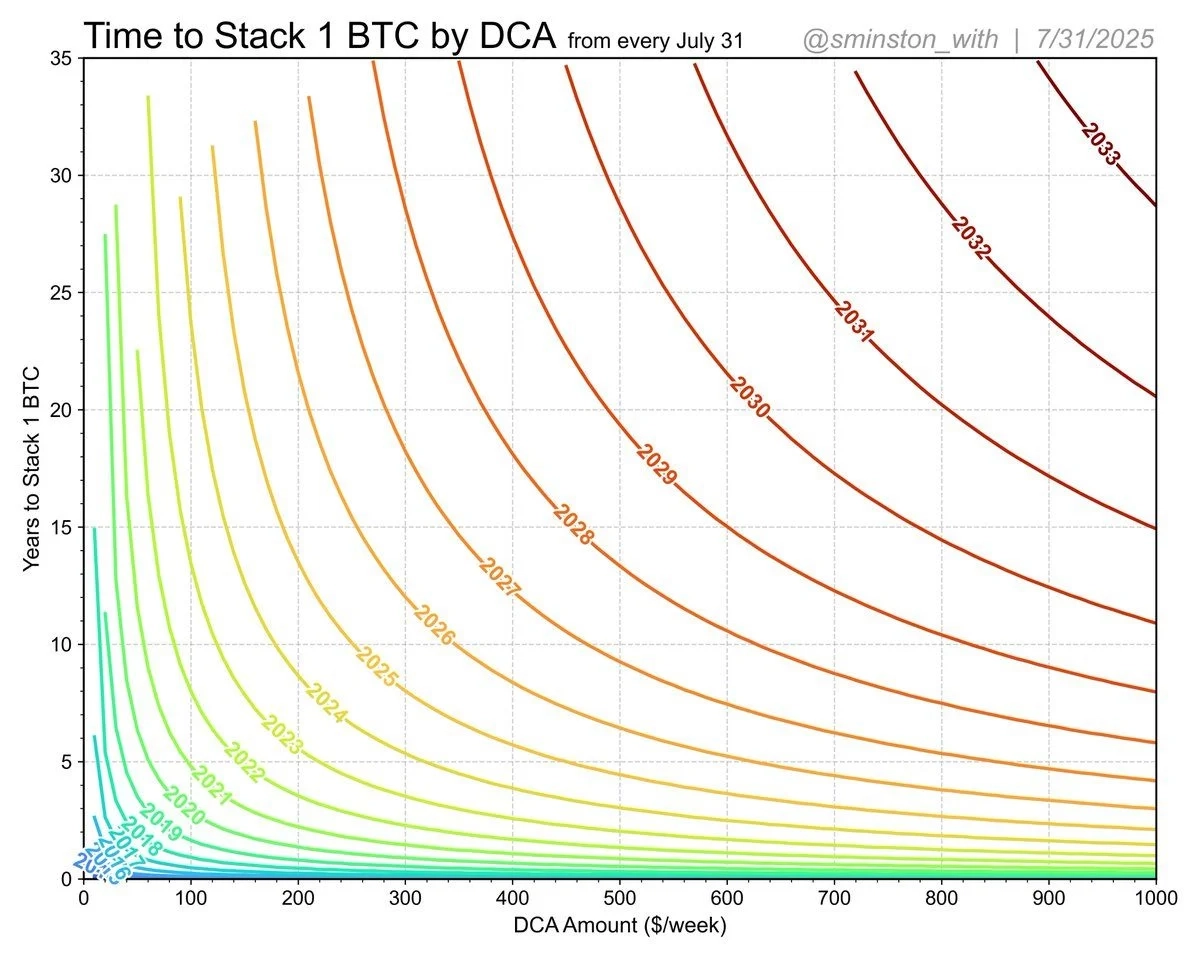

According to a recent analysis from anonymous bitcoin ( BTC) researcher Sminston With, individuals who begin a dollar-cost averaging (DCA) strategy of $250 per week in 2025 can still reasonably expect to accumulate a full bitcoin in ten years. However, starting in 2026, that same effort will likely require 15 years or more.

Sminston With, who holds a PhD in Materials Science and Engineering, is well-known in the BTC community for his rigorous, data-heavy models. Using a power law-based projection, his latest chart maps how long it would take to accumulate 1 bitcoin starting on July 31 each year, depending on how much is invested weekly. The findings illustrate a narrowing window for average investors.

Chart shared by the X account @sminston_with on July 31, 2025.

Chart shared by the X account @sminston_with on July 31, 2025.

Essentially, dollar-cost averaging, DCA for short, is an investment strategy that involves purchasing a fixed dollar amount of an asset at regular intervals, regardless of its price. In the context of bitcoin, this means consistently buying small amountseven fractionsover time. Because bitcoin is divisible into 100 million units known as satoshis, investors can stack partial amounts without needing to purchase a whole coin at once.

This strategy is particularly important as bitcoin trades around $115,000 on July 31, 2025. For many, that price tag makes whole coin ownership seem unattainable. DCA offers a long-term, disciplined approach that removes the need for market timing and reduces emotional decision-making.

The chart produced by Sminston With shows that in 2020, a DCA of just $100 per week would have stacked 1 BTC in roughly three years. But as bitcoins price increased, the time horizon has stretched. In 2025, a $250 weekly DCA will get you there in 10 years. Starting in 2026, itll take 15 years or more. By 2033, stacking a full bitcoin in 10 years would require $1,000 per week.

The analysis relies on a power law model, a mathematical framework often used to describe exponential growth. In bitcoins case, this model tracks long-term price appreciation based on historical data and projected adoption rates. The shape of the curve steepens over time, reflecting bitcoins diminishing issuance and increasing demand.

Using the model, implied future bitcoin prices emerge. In 2026, the price is projected around $208,000. By 2029, it is estimated to climb past $390,000 per bitcoin. Come 2033, the model anticipates bitcoin reaching $520,000making even partial ownership increasingly difficult without high-frequency accumulation.

For context, heres how DCA breaks down post-2025:

- In 2026, a $250/week DCA takes 15 years.

- By 2028, it will take nearly 20 years.

- In 2030, $500/week wont even get you 1 BTC in a decade.

- By 2033, only a $1,000/week strategy crosses the 10-year threshold.

While these projections assume a continuation of bitcoins long-term growth trend, they dont account for short-term volatility. Thats where bear markets enter the conversation.

If bitcoin enters a bear market, DCA strategies become significantly more effective. During price drawdowns, each dollar buys more satoshis. For instance, if bitcoin fell to $60,000, a $250/week DCA could accumulate 1 BTC in just under 5 years. Essentially, downturns accelerate accumulationa silver lining for patient investors.

On the flip side, bull markets slow down stacking progress, as higher prices reduce the buying power of each DCA installment.

Basically, to some observers, the math behind Sminston Withs model presents a stark message: For those aiming to own a full bitcoin through steady contributions, 2025 could be a critical inflection point. As prices rise, only higher weekly contributions or longer time horizons will keep that goal within reach.

For many, DCA remains the most approachable strategybut time may no longer be on their side.