![]()

Journalist

Posted: December 16, 2024

Share this article

- BTC price could hit $103K, driven by liquidity sweep.

- A likely uptick in global longs could mark a potential BTC reversal and bull trap.

For the past few days, Bitcoin [BTC] has stayed above $100K, but its next direction could be triggered by the Fed rate cut decision.

After last week’s U.S. inflation and labor data, the market was pricing a 96% chance of another 25bps interest cut during the next Fed rate decision on the 18th of December.

Next BTC moves

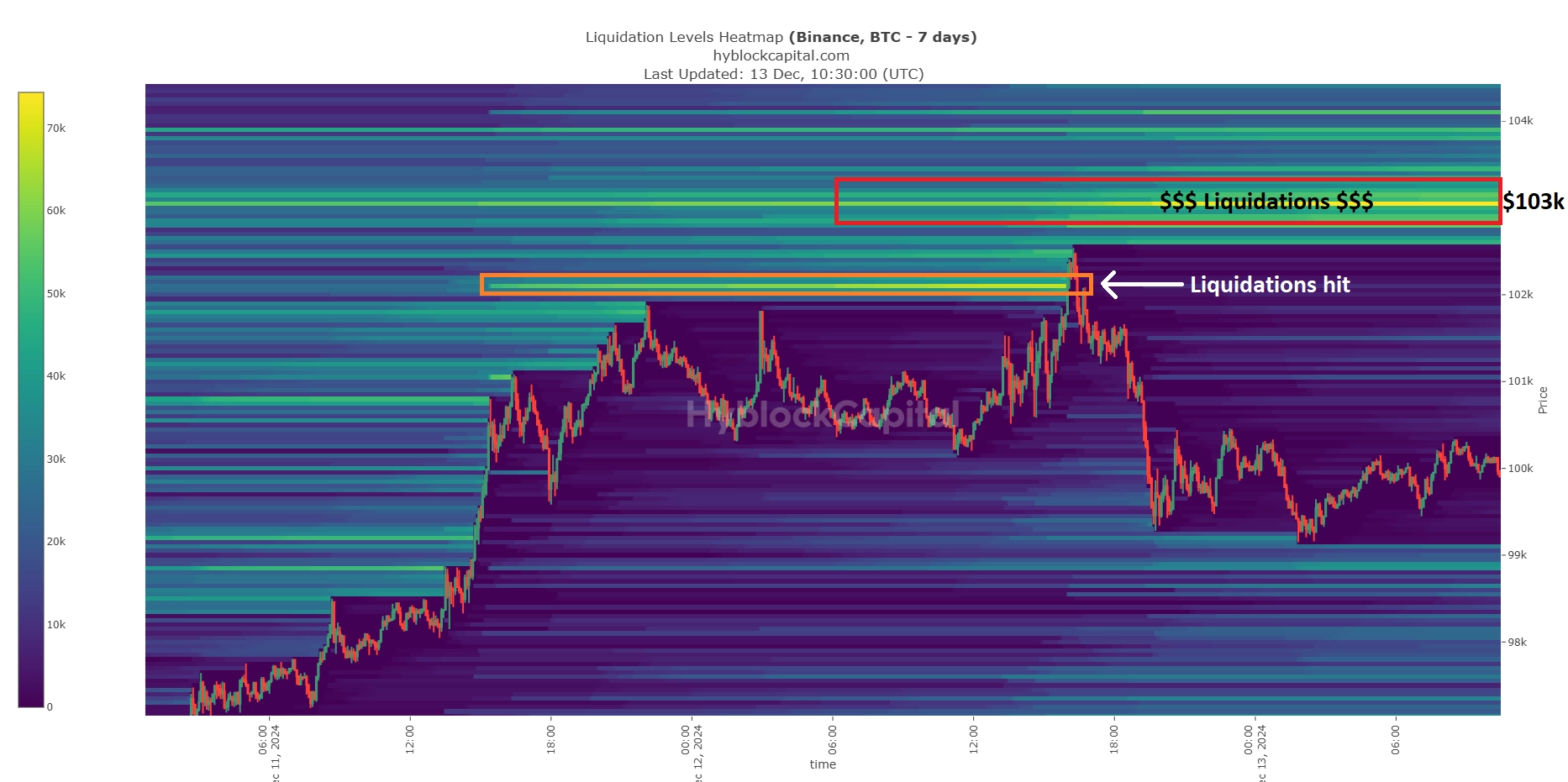

So, which way will BTC go? According to BTC trader CrypNuevo, the most likely move was a liquidity hunt at $103K/104K, citing recent trends. Part of his analysis on X read ,

“A lot of short liquidations at $103k. It might be the right time to hunt them…We can see how they’ve been consistently targetting these liquidation clusters in the past days.”

Source: Hyblock

At press time, there were still considerable leveraged short positions at $103K-$104K, which reinforced CrypNuevo’s projection.

On the 12-hour chart, BTC has been tightly consolidating around its ascending channel’s mid-range. The $103K/$104K target sat about 2% from the mid-range.

The upper channel target of $107K was 5% from the mid-range level, but had less liquidity and might not strongly attract price action as the $103K level.

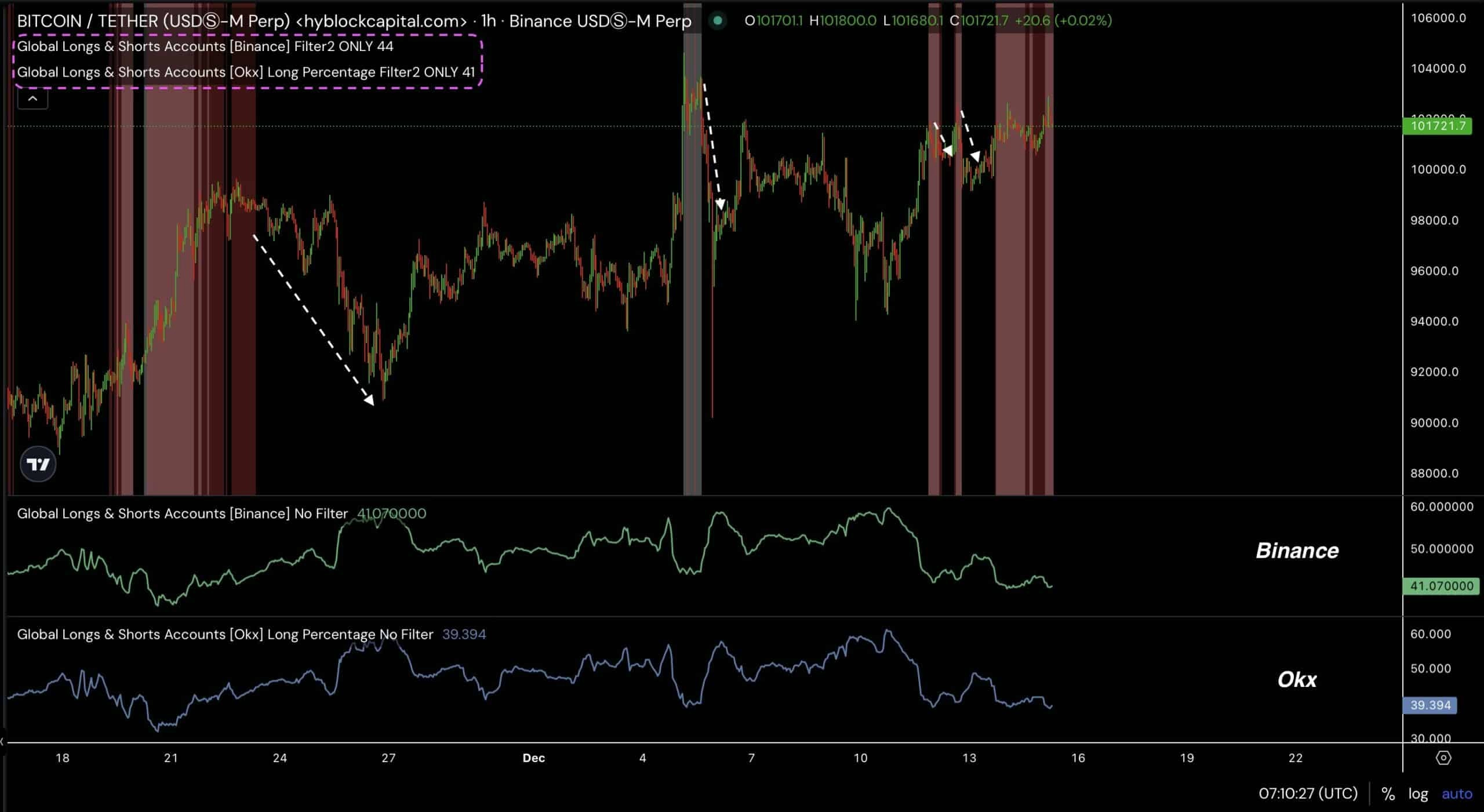

Source: BTC/USDT, TradingView

If that’s the case, BTC could hit $103K/$104K targets, driven by liquidity sweep, and then retreat lower.

The channel’s range-low has stopped previous retracements, and the potential pullback could ease at $97K. Afterward, BTC could continue its range-bound movement.

Hyblock’s retreating global longs indicator supported the likely slip to range-low after tapping $103K. The oscillator always rises when BTC falls and drops when BTC pumps.

At press time, the indicator was heading to its bottom and could reverse, marking a likely BTC retracement and bull trap.

Source: Hyblock

Read Bitcoin [BTC] Price Prediction 2024-2025

In short, BTC could push slightly above the mid-range to liquidate short positions at $103K/$104K levels before going for leveraged longs at the channel’s range-lows near $97K.

However, a breakout on either side would invalidate the above range-bound outlook.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion