Bitcoin gets an early macro tailwind as the US seals trade deals, but plenty of BTC price volatility catalysts are waiting in the wings into August.

COINTELEGRAPH IN YOUR SOCIAL FEEDBitcoin heads into the July monthly close eyeing $120,000 as a BTC price rebound holds firm.

-

BTC price action is giving market participants cause to expect all-time highs again, but the threat of a $113,000 comedown remains.

-

A giant week of US macro data combines with the Fed meeting on interest rates amid pressure on Chair Jerome Powell.

-

The US-EU trade deal provides an instant boost for risk assets, including a record open for S&P 500 futures.

-

Bitcoins performance in July 2025 may feel impressive, but it still has a way to go to stand out against historical norms.

-

Stablecoin liquidity suggests that bulls may need to wait before getting the momentum necessary to reenter price discovery.

Bitcoin bulls running at $120,000

A late-week surge placed Bitcoin price action within striking distance of $120,000, but momentum ultimately failed to follow through.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView Despite that, BTC/USD managed to hold the area around $119,000, per data from Cointelegraph Markets Pro and TradingView, emboldening market participants to expect further upside next.

If Bitcoin can tighten up and hold over $117,000 then i think we are good for new ATHs very soon, trader Crypto Tony forecast in a post on X Monday.

BTC/USDT perpetual contract 1-week chart. Source: Crypto Tony/X

BTC/USDT perpetual contract 1-week chart. Source: Crypto Tony/X Trader and analyst Rekt Capital said that Bitcoin had kickstarted a bull flag with its $119,450 weekly close.

In which case turning ~$119200 into support via a retest could occur next week (maybe even via a wick), he told X followers alongside an explanatory chart.

However, for the moment BTC needs to avoid an upside wick beyond the Bull Flag Top resistance otherwise price would stay in the Range.

BTC/USD 1-week chart. Source: Rekt Capital/X

BTC/USD 1-week chart. Source: Rekt Capital/X On Sunday, Cointelegraph reported on traders liquidity expectations for the coming days. Exchange order books showed two key zones above and below the price, with analysis seeing the potential for a return toward $113,000.

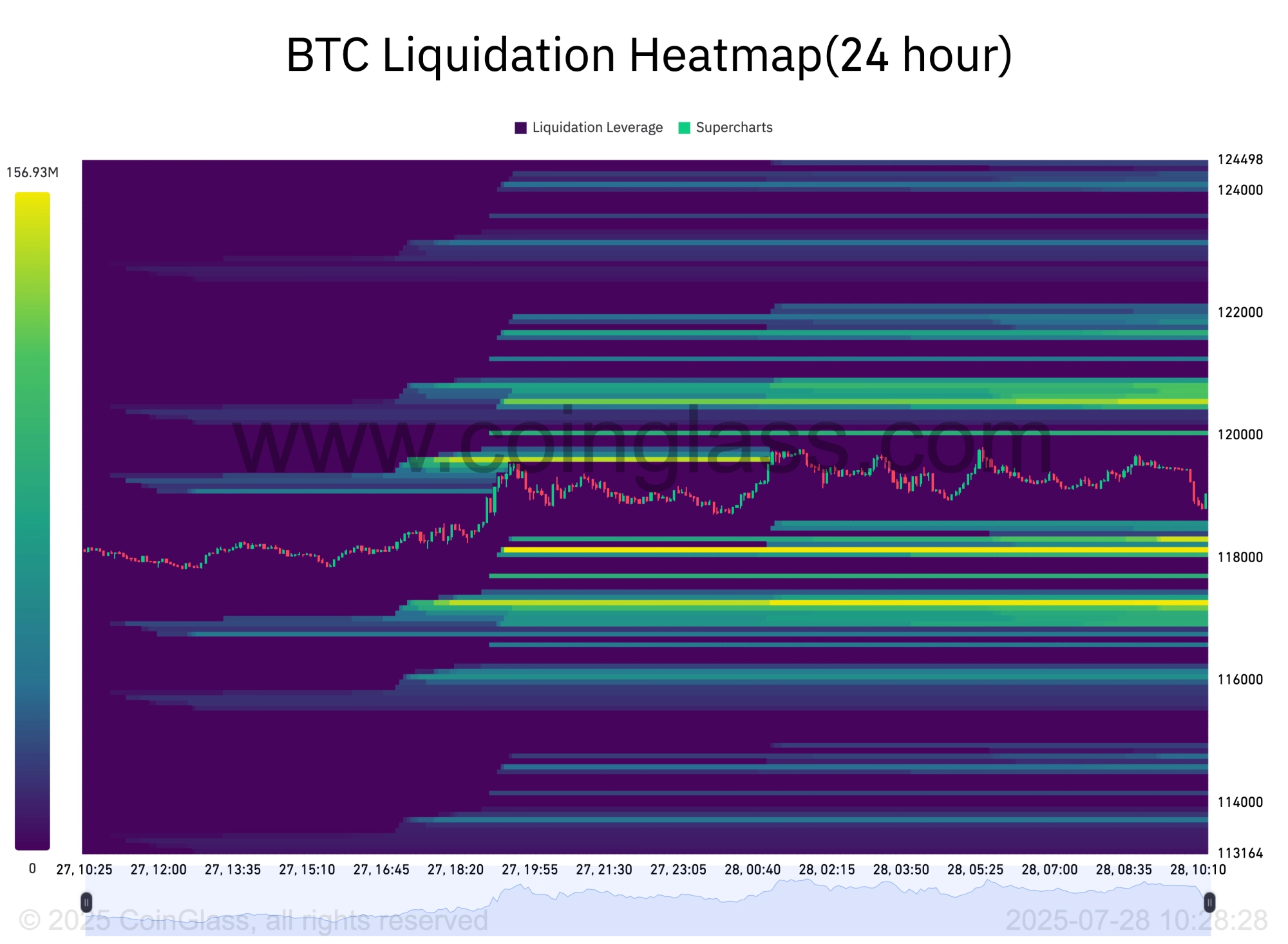

For $BTC, were sitting at about 58.7% longs stacked against 41.3% shorts. That means theres a decent amount of fuel for a move up if shorts get flushed, but not an overwhelming amount that screams squeeze incoming, analyst TheKingfisher argued while examining liquidations.

It's balanced enough that we could see more chop until one side really commits.

BTC liquidation heatmap. Source: CoinGlass

BTC liquidation heatmap. Source: CoinGlass The latest data from monitoring resource CoinGlass shows bid liquidity laddered between $116,800 and $118,300.

FOMC week begins with Powell in focus

If much of July was relatively quiet in terms of US macroeconomic data, the tables are about to turn.

The Federal Reserve interest-rate decision forms the highlight of the coming days, but this is far from the only point of interest for risk-asset traders.

Q2 GDP is due just hours before the Federal Open Market Committee (FOMC) meeting on Wednesday. The day after, the Feds preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, will be released.

We have a massive week ahead of us, trading resource The Kobeissi Letter summarized on X.

Kobeissi added that corporate earnings will continue to pour in, creating the most data-packed week of the year.

That data comes at a crucial time for markets. The ongoing divide between government expectations and Fed policy continues to boil over into the public eye, with President Donald Trump actively calling on Fed Chair Jerome Powell to cut interest rates.