BitMine $BMNR has been on fire since Monday after naming Fundstrats Tom Lee as Chairman, the stock skyrocketed. Now, its raising $250M for an Ethereum treasury strategy. Could this be the MicroStrategy of ETH?

BitMine Bets Big on Ethereum

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on July 3, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

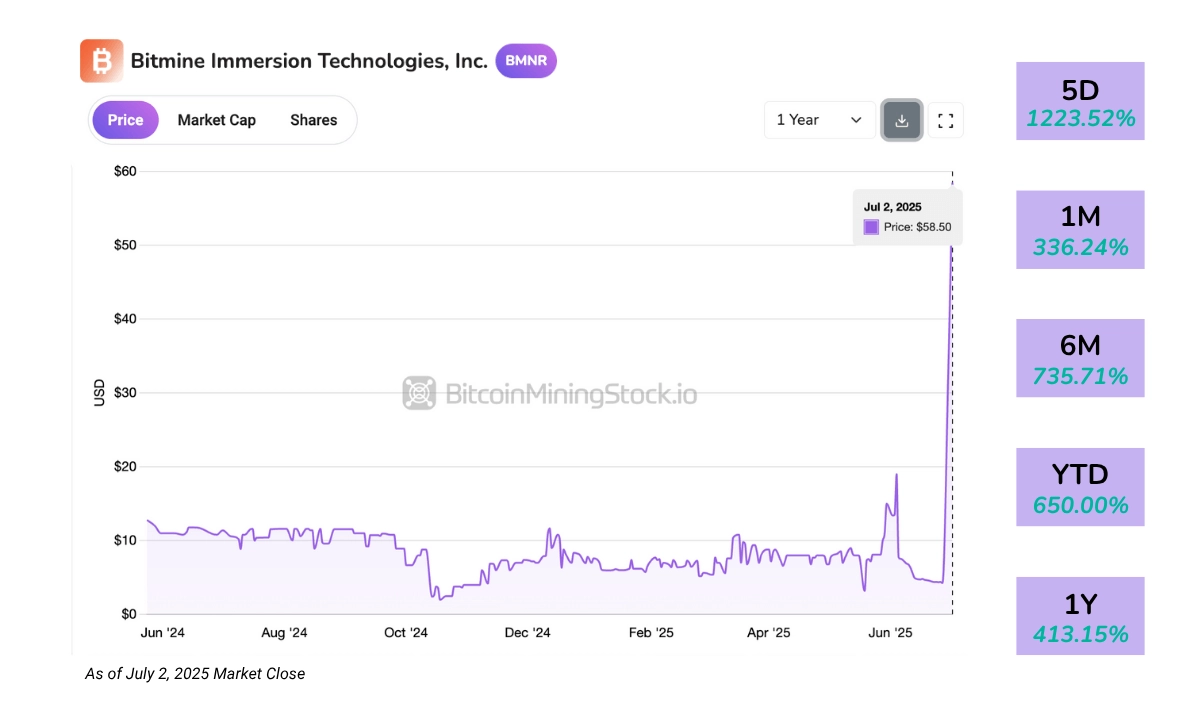

BitMine Immersion Technologies (NYSE American: BMNR) has captured exceptionally large attention after its stock skyrocketed more than 700% in a single day on Monday. The immediate catalyst? The appointment of Fundstrats Tom Lee , a well-known Wall Street strategist, as Chairman of the Board.

BitMines share price has skyrocketed since Monday, June 30

BitMines share price has skyrocketed since Monday, June 30

Meanwhile, BitMine revealed a $250 million private placement to fund a bold Ethereum accumulation strategy , intending to become the largest publicly traded ETH holder.

The timing was particularly interesting. Just a few days earlier, Bit Digital (NASDAQ: BTBT) revealed its own pivot, eventually exiting Bitcoin mining entirely to become a pure-play Ethereum staking and treasury company. BitMine, however, is not walking away from Bitcoin despite shifting gears toward ETH as a core reserve asset.

For a company that was uplisted to the NYSE American only weeks ago, the central question remains: is this the start of a genuine strategic breakthrough, or just a news-fuelled spike?

Company Overview

BitMine calls itself a Bitcoin Network Company, and its ambitions extend far beyond mining. The company is building a financial services platform spanning self-mining, synthetic hash rate contracts, MaaS infrastructure, and crypto treasury advisory.

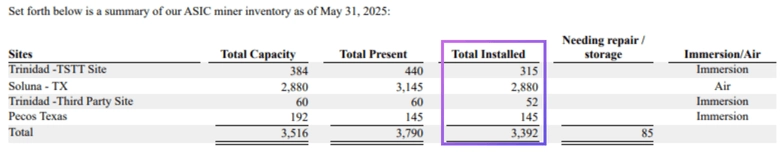

Headquartered in the U.S., BitMines mining operations span across five sites, primarily in Texas (Silverton and Pecos) and Trinidad & Tobago. However, its mining scale is pretty modest, with 3,392 ASIC miners installed as of May 2025, which places the company among the smaller publicly traded miners*.

Screenshot from BitMine Q2 2025 SEC Filing

Screenshot from BitMine Q2 2025 SEC Filing

*BitMine has not disclosed its hash rate. However, based on the number of installed ASIC miners and assuming the use of Antminer S19 or S21 seriescommonly deployed among public minerstheir operational scale is estimated to range between 0.5 and 0.7 EH/s.

Beyond self-mining, BitMine offers Mining-as-a-Service (MaaS) to institutional clients. A $4 million contract signed in early 2025, involving the lease of 3,000 ASIC units to a public company. The company also engages in hash rate trading, allowing counterparties to access Bitcoin production without hardware ownership. This synthetic mining model is more capital-light and mirrors derivative-based strategies used by institutional firms.

More recently, BitMine launched a Bitcoin treasury advisory practice, offering compliance, accounting, and operational consulting to companies seeking BTC-denominated revenues. The move signalled a pivot toward broader crypto financial services.

Management is led by CEO Jonathan Bates, a former JP Morgan managing director with three decades of market experience. The broader team includes former CleanSpark CFO Lori Love and now Tom Lee.

BitMines Management & Board (screenshot from its corporate presentation)

BitMines Management & Board (screenshot from its corporate presentation)

Financial Highlights

BitMines Q2 FY2025 report (quarter ending May 31 , 2025) shows a business still in the growth stage.

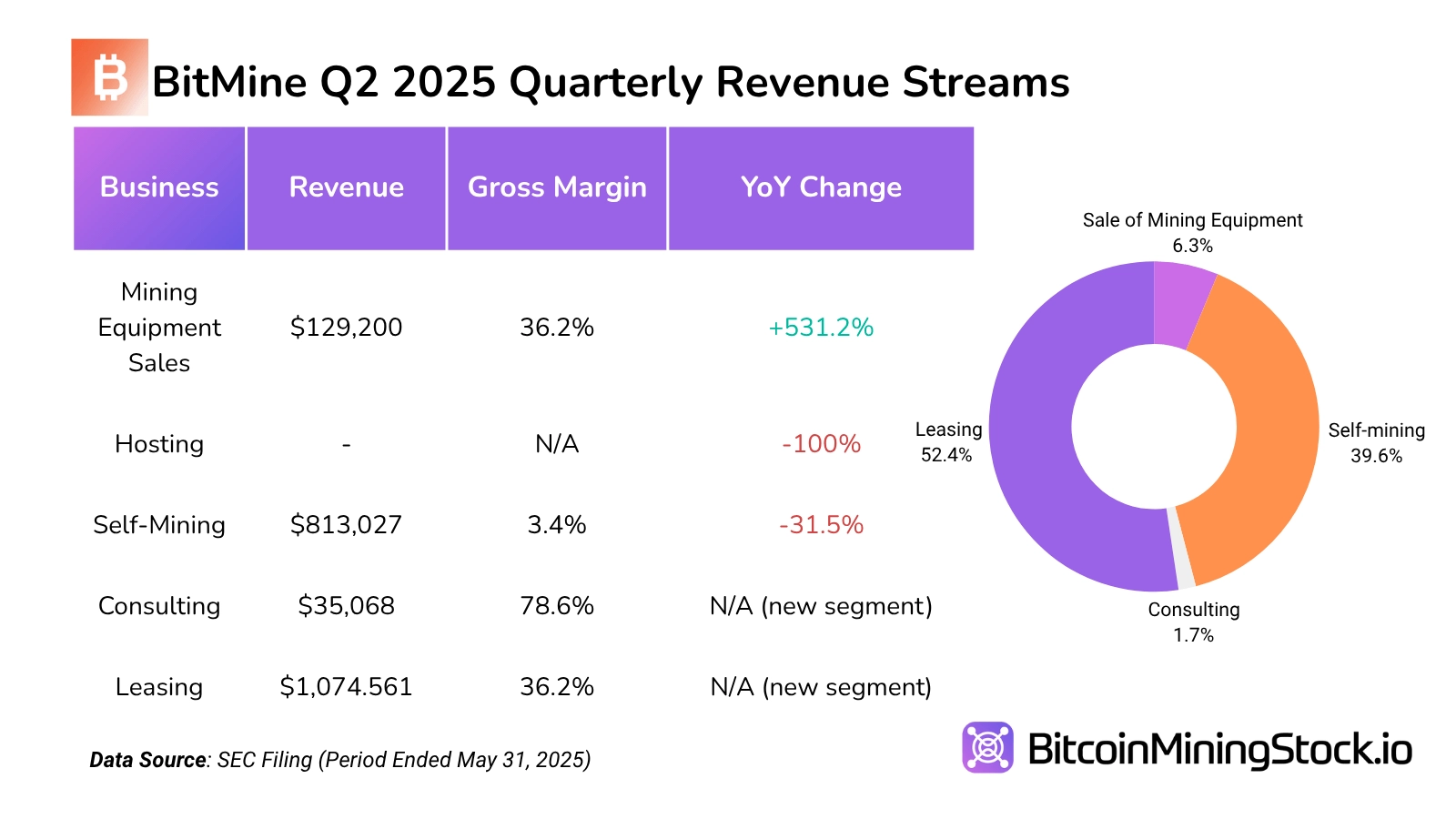

Revenue & Profitability Breakdown

Quarterly revenue came in at $2.05 million, nearly doubling from the $1.22 million in the same quarter last year and up from $1.20 million in the prior quarter. This marks the companys highest quarterly revenue to date. The growth was driven by their leasing business, accounting for over 52% of total revenue. This segment also delivered one of the highest gross profits at $388,637 (gross margin: ~36.2%). This growth supports BitMines move toward a more capital-light and recurring revenue model. If sustained, this model could reduce exposure to mining price volatility and provide steady cash flow.

By contrast, Self-Mining generated $813k in revenue, but with direct costs of $785k the gross margin was just 3.4%**. This razor-thin margin highlights the operational inefficiencies and high input costslikely from energy usage or under-optimized rigs. For comparison, most large-scale public miners target gross margins of 3060% on self-mining. BitMines performance here reinforces that its core mining operations remain sub-scale and cost-heavy.

**According to recent SEC filings, the cost to mine one Bitcoin is reported at $25,182.59 (pure energy costs) or $75,336.43 (all-in cost). The average energy rate was $0.0180 per kWh.

Mining Equipment Sales came in at $129,200, with a moderate 36.2% gross marginnotably similar to leasing, but on a much smaller revenue base. This channel may provide opportunistic revenue but lacks scale or predictability.

Interestingly, Consulting servicesa small but high-margin segmentgenerated $35,068 in revenue with $27,568 in gross profit, delivering an impressive 78.6% margin. Though immaterial in dollar terms, this shows promise for BitMines advisory ambitions, especially if it can position itself as a top treasury consultant as planned.

Meanwhile, Hosting revenue was absent this quarter, suggesting either temporary suspension or reclassification of prior hosting activities.

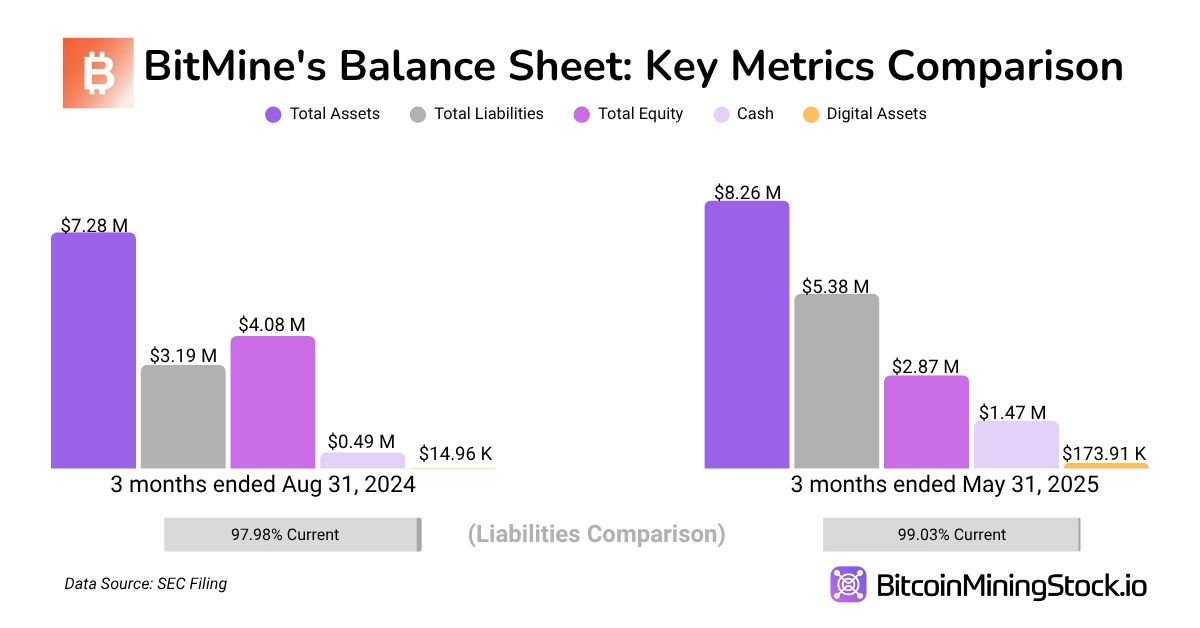

Balance Sheet & Liquidity

The company reported total assets of $8.26 million, marking a 75.3% increase YoY. The growth was driven by a 195% rise in cash and cash equivalents (from $499,270 to $1.47 million) and a tenfold increase in crypto holdings, now at $173,916. While crypto still represents a modest share of assets in the current quarterly report, the increase reflects BitMines changes about treasury strategy.

On the liability side, total liabilities fell 36.6% YoY to $396,349, demonstrating that the company continues to operate with minimal leverage. Some quick calculations: current ratio stands at ~3.99x and a quick ratio is ~3.72x. Both indicate a sufficient liquidity buffer, with minimal leverage or near-term financial pressure.

However, the trend in stockholders equity points to an important dynamic. Equity declined by 29.6% year-over-year, dropping from $4.08 million to $2.87 million. The primary driver was a continued buildup in the accumulated deficit, which grew by more than $5 million over the year. Notably, the increase in paid-in capital during the same period signals investor confidence, but it also indicates that much of the companys financial foundation is still coming from equity financing rather than retained earnings.

Overall, BitMines balance sheet reflects a low-leverage, high-liquidity profile, which is typical of early-stage pivots. Also, while BitMine has bolstered its liquidity and reduced liabilities, it has yet to convert raised capital into sustainable bottom-line performance.

Valuation (as of May 31, 2025)

- Market Cap: ~$397 million

- Enterprise Value (EV): ~$384.5 million

- EV / Revenue (TTM): ~80.6x

- P/S (Price-to-Sales): ~83.2x

- Crypto Holdings / Market Cap: ~0.04%

P.S. While Ive applied standard valuation methods here, the calculations do not yet reflect BitMines recent 154.167 BTC BTC purchases, freshly announced Ethereum treasury strategy or the sharp spike in its share price. I plan to revisit this valuation when new data becomes available.

Ethereum Treasury Strategy

The Ethereum treasury is the most eye-catching narrative of BitMine, especially with its goal of becoming the largest public holder of Ether. Lets decode Tom s long-term ETH thesis based on his interviews and posts.

Tom Lee Interviewed by CNBC

Tom Lee Interviewed by CNBC

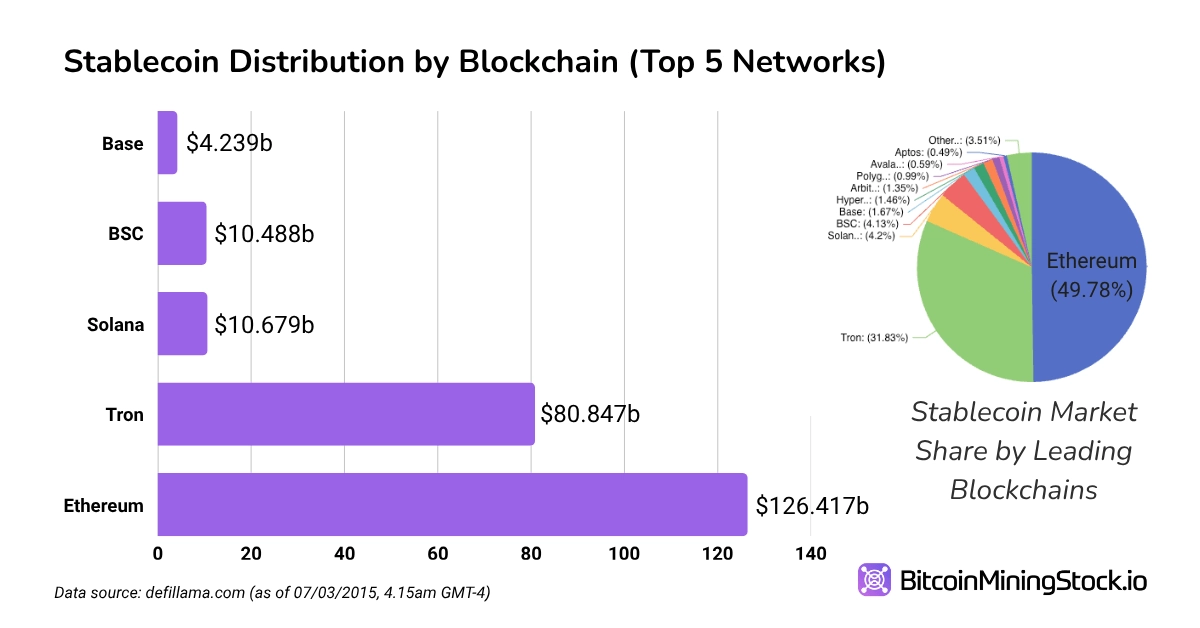

Tom Lees rationale for pivoting BitMine into Ethereum is rooted in the explosive growth of stablecoins and Ethereums unique role in supporting them. Over half of all stablecoins currently operate on the Ethereum network, and these tokens now account for nearly one-third of all transaction fees generated on Ethereum. In Lees view, stablecoins are to crypto what ChatGPT was to AIa breakout application that drives mainstream and institutional adoption.

The U.S. Treasurys own projections suggest stablecoin volume could grow from $250 billion today to as much as $2 trillion. If that forecast plays out, Ethereums fee revenue could expand tenfold. This isnt just a DeFi storyits an infrastructure story. Ethereum would become the settlement layer for a massive portion of global value flow, positioning it as a foundational layer of digital finance.

It looks that BitMine intends to mirror MicroStrategys playbook, but with Ethereum. The $250 million private raise will be used to build ETH reserves, and the company has stated it will track ETH per share as a core performance metric. In theory, if ETH appreciates over time, this reserve accumulation could allow BitMines equity to trade as a proxy for Ethereum exposure.

Other public companies are also aligning with this thesis include SharpLink Gaming (Ethereum Treasury) and DeFi Development Corp (Solana Treasury).

Native tokens of blockchains other than BTC face greater regulatory uncertainty, introducing additional compliance and accounting complexitiesan important factor investors should take into account.

Final Thoughts

The market isnt buying BitMine for its mining operationsits buying the idea of what it could become. The companys current footprint is small, with