BlackRock, Fidelity Combined Hold Almost 2.5% of Total BTC Supply in Their ETFs

- BlackRock’s IBIT and Fidelity’s FBTC funds combined account for 2.5% of the total Bitcoin supply, representing over US$30 billion.

- IBIT holds 347,766.96 BTC worth US$20.32 billion, doubling the BTC count of Fidelity’s FBTC.

- Institutional investors like governments, public and private companies, and funds now hold a substantial and increasing share in the global Bitcoin market.

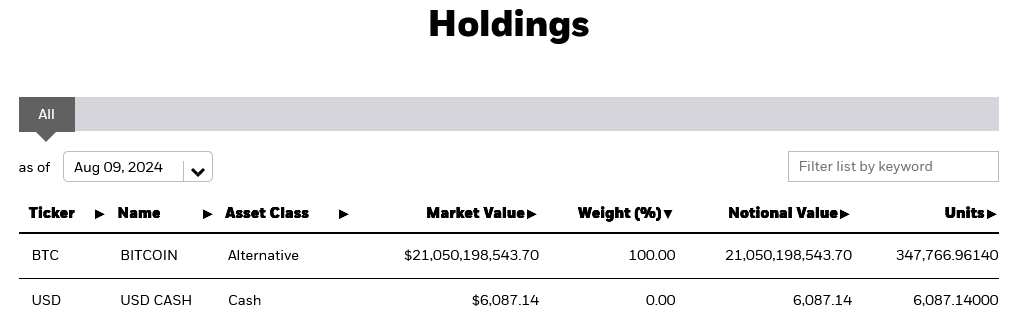

BlackRock’s iShares with its IBIT and Fidelity’s Wise Origin Bitcoin FBTC funds now account for a massive 2.5% of total Bitcoin. IBIT, which holds 347,766.9614 of BTC worth US$20.32 billion (AU$30.85 bn) doubles FBTC’s holdings. The Fidelity fund currently holds 176,950.95 BTC worth US$10.93 billion (AU$15.77 bn).

IBIT’s BTC holdings, source: BlackRock

IBIT’s BTC holdings, source: BlackRock

While this means that IBIT represents close to 1.7% of total BTC supply, FBTC accounts for over 0.8% – the total of both funds is 524,717.9114 BTC.

Related: Celsius Sues Tether for US$3.5 Billion in Bitcoin Dispute, Alleges Misappropriation Amid Bankruptcy

Together the funds hold a whopping US$30.66 billion (AU$46.47 bn) or 2.4986% of all Bitcoin – which has a maximum supply of 21,000,000.

Advertisement

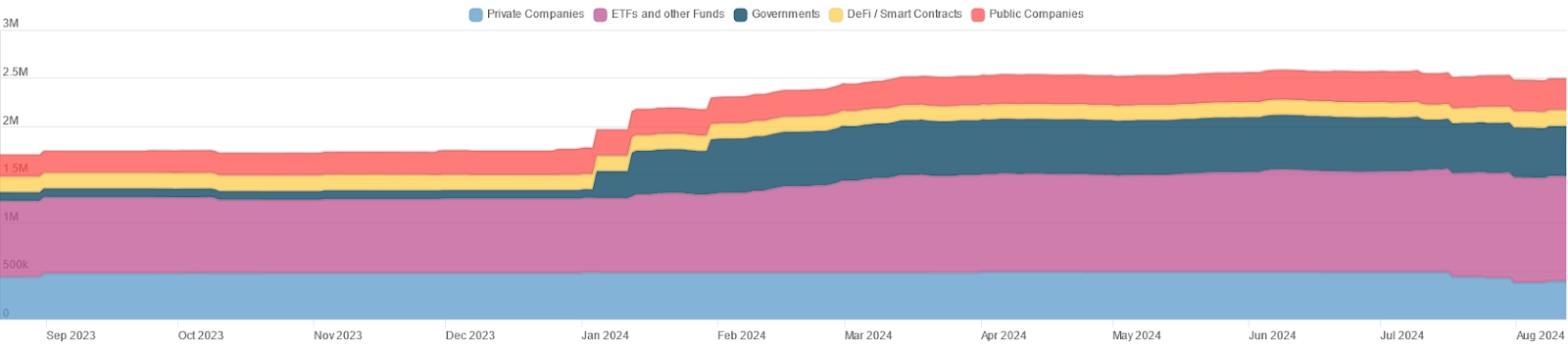

Data from Bitcoin Treasuries shows that private companies currently hold 396,278 BTC, governments hold 517,414 BTC, DeFi and smart contracts (i.e. wrapped BTC etc.) hold 167,566 BTC, while public companies hold 327,430 BTC.

However, the ETFs and other funds hold a combined 1,089,481 BTC, which means all in, institutions now hold 10% of all supply.

Funds, companies, DeFi/ smart contracts, governments BTC holdings, source:bitcointreasuries.com

Funds, companies, DeFi/ smart contracts, governments BTC holdings, source:bitcointreasuries.com

Notable Individual BTC Holdings

While it’s difficult to pinpoint exact numbers, individuals currently own the majority of Bitcoin, but institutions are rapidly increasing their share.

Of course, there are several individuals that have publicly stated how much Bitcoin they hold.

After settling with Mark Zuckerberg in 2008, the Winklevoss twins invested US$11 million (AU$16.7 million) in Bitcoin, amassing ~70,000 BTC. The Winklevoss twins co-founded the Gemini exchange and are key figures in the crypto world.

Venture capitalist Tim Draper lost 40,000 BTC in the Mt. Gox hack but later acquired 29,656 BTC in 2014 through a US Marshals auction.

MicroStrategy’s Michael Saylor revealed holding 17,732 BTC in 2020, making him a notable Bitcoin advocate.

And don’t forget Satoshi Nakamoto: Bitcoin’s creator is believed to hold ~1.1 million BTC.

How Do You Compare?

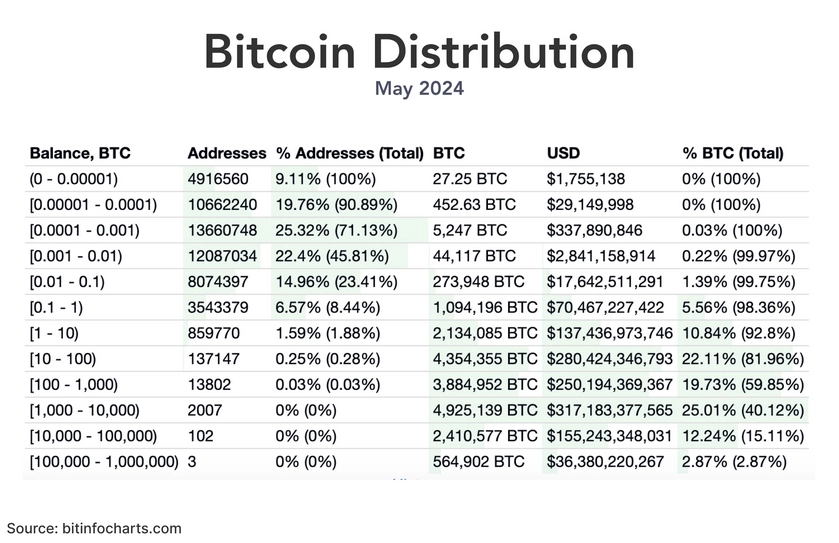

So, where does that leave the average investor? The below chart shows that a small number of addresses controls a large portion of the total supply.

Source: river.com/ bitinfocharts

Source: river.com/ bitinfocharts

And the contrasts are quite stark: Addresses holding less than 0.00001 BTC comprise over 9% of all addresses but contain almost no Bitcoin in terms of value.

There are only 3 addresses holding between 100,000 to 1,000,000 BTC, representing a significant 2.87% of all BTC in circulation.

Related: Ripple Starts Testing of Stablecoin RLUSD on Ethereum and XRP Ledger

There is a vast majority of wallets holding anywhere from 0.00001 BTC to 0.01 BTC, but collectively holding only a small fraction of the total Bitcoin value.

Of course, using wallet address counts to measure Bitcoin distribution can be a flawed metric. There could be many inactive wallets, whales may distribute assets across wallets and exchanges also hold large amounts in custody which doesn’t say much about the actual holders.