- Bitcoin recently achieved a record high but has since declined by 9%, leading other cryptocurrencies to also experience substantial losses.

- The cryptocurrency market downturn has resulted in the liquidation of over 304,930 traders and the loss of US$1.02 billion in market value.

- Despite the recent crash, analysts view the setback as temporary, asserting the strength of the ongoing bull market.

- They suggest that internal dynamics and pro-crypto leadership in the US outweigh the negative impact of recent federal monetary policies.

Bitcoin and Co are on a downtrend which started two days ago when the number one crypto made a new all-time high at US$108,268 (AU$173,651). Since then, BTC has dropped by about 9%, with 3% in the past 24 hours alone. At the time of writing Bitcoin trades for US$97,482 (AU$156,409), as data from CoinMarketCap shows.

Bitcoin (BTC), weekly chart, source: CoinMarketCap

Bitcoin (BTC), weekly chart, source: CoinMarketCap

The drop was even more marked in other cryptocurrencies like Ethereum (ETH), which has dropped 6% in the past day, and Dogecoin (DOGE), which plunged by almost 13%.

Crash Liquidates Traders, Drops Market Cap

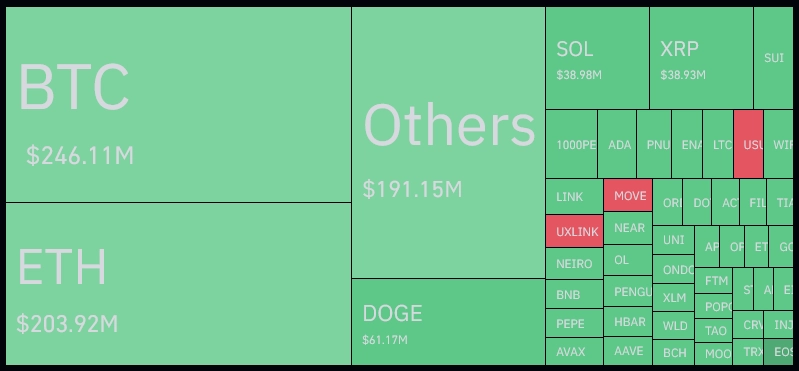

The crash has wiped out US$1.02 billion (AU$1.63 billion) from the crypto market, with 304,930 traders liquidated as per data from Coinglass.

Related: Solana Blockchain Hits New Records After PENGU Token Launch

Advertisement

US$856.67 million (AU$1.37 billion) in long positions have been liquidated with a total of US$246.11 million Bitcoin liquidations, including US$188.85 million (AU$302.98) in longs and US$57.26 million (AU$91.87) in shorts.

Liquidation heatmap, source: Coinglass

Liquidation heatmap, source: Coinglass

The carnage has dropped the global crypto market cap by 3.55%, which currently sits at US$3.36 trillion (AU$5.39 trillion).

The crash comes after a rally that has lasted since Donald Trump won the US presidential election in November 2024. Yesterday’s announcement by Fed Chair Jerome Powell has very likely contributed to the sell-off.

The US Federal Reserve lowered interest rates, but is now likely to do so only twice next year. Powell also said the Fed is in no position to hold Bitcoin as a reserve asset. Many observers hold high hopes that Trump will install a strategic Bitcoin reserve on day one.

Analyst Says Multi-Year Bull Market to Continue

Bitwise Chief Investment Officer Matt Hougan believes the recent crash does not change the bullish narrative.

He said while the Fed announcement is indeed “bad for risk assets”, Hougan thinks the pullback is a mere “hiccup”.

According to the CIO, the Fed doesn’t have the influence over crypto it used to have and the “internal momentum” of crypto carries far more weight now.

Related: BitMEX Co-Founder Hayes Predicts ‘Harrowing Dump’ Post-Trump Inauguration

Therefore, the bullish narrative for crypto continues: pro-crypto leadership in the US, institutional adoption through exchange-traded funds (ETFs), governments buying Bitcoin and breakthroughs in blockchain tech.

Ultimately, Hougan says crypto is in a “multi-year bull market”, never mind the Fed. He also shared a technical indicator which hints at a continuation of the bull market:

Bitcoin’s 10-day exponential moving average (~$102k) is still above its 20-day exponential moving average (~$99k).

Matt Hougan, Bitwise CIO

Matt Hougan, Bitwise CIO