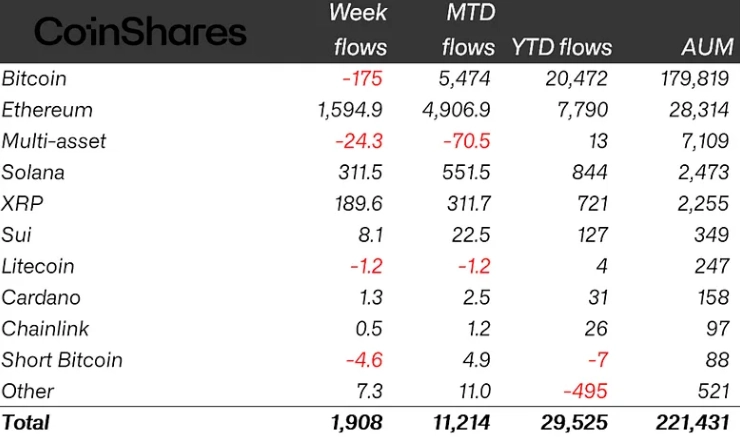

Cryptocurrency investment products ended last week in the green, marking 15 consecutive weeks of inflows, even as Bitcoin funds saw minor outflows.

Global crypto exchange-traded products (ETPs) recorded $1.9 billion of inflows during the trading week ending Friday, according to a Monday report from European crypto asset manager CoinShares.

The latest inflows came despite heightened market volatility as Bitcoin tumbled to as low as $115,000 by the end of the week, while Ether briefly dropped below $3,600 on Thursday, according to CoinGecko.

The new gains brought the year-to-date (YTD) inflows to a new high of $29.5 billion, while total assets under management (AUM) for the first time reached $221.4 billion. Month-to-date inflows also set a record of $11.2 billion, surpassing the previous record of $7.6 billion seen in December 2024 following the US election.

Ether ETPs see second-largest inflows on record

The majority of last weeks gains were driven by Ether investment products, which saw $1.59 billion in inflows. According to CoinShares head of research, James Butterfill, the figure represents the second-largest weekly inflow ever recorded for Ether ETPs.

Solana and XRP followed Ether ETPs in recorded gains last week, with inflows totaling $311.5 million and $189.6 million, respectively.

On the other hand, Bitcoin ETPs saw minor outflows of $175 million as BTC investment products ended a 12-day inflow streak on July 21.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

According to Butterfill, the divergence in the flows between Bitcoin and altcoins highlights potential anticipation of altcoin ETFs rather than a broader altcoin season.

These altcoin inflows may be driven less by broad-based enthusiasm and more by anticipation surrounding potential US ETF launches, Butterfill said.

He added that several altcoin ETPs saw minor outflows, including Litecoin and Bitcoin Cash , $1.2 million and $0.7 million, respectively.

Inflows drop 57% week-over-week

Last weeks $1.9 billion in inflows marked a 57% decline from the previous weeks $4.4 billion, the largest weekly inflows on record.

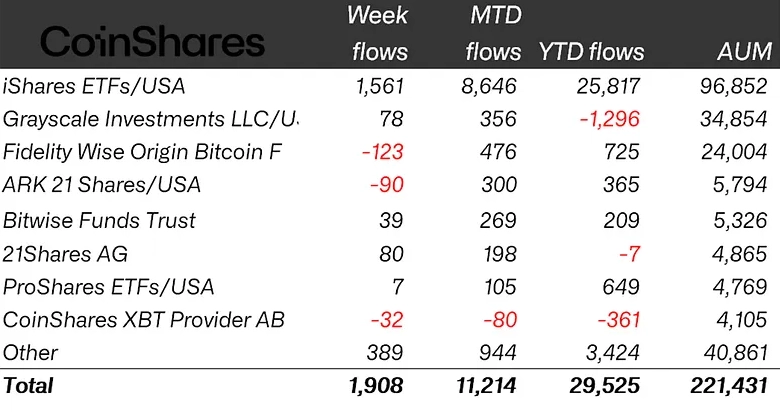

BlackRocks iShares crypto ETFs led last weeks gains with $1.56 billion inflows, down nearly 64% from the previous weeks $4.3 billion.

Fidelity Investments extended outflows to $123 million, while Cathie Woods ARK Invest slowed down outflows from $120 million to $90 million.

Crypto ETP flows by issuer as of last Friday (in millions of US dollars). Source: CoinShares

Crypto ETP flows by issuer as of last Friday (in millions of US dollars). Source: CoinShares European issuer 21Shares saw the largest inflows among issuers after iShares, with modest inflows of $80 million. Grayscale Investments followed with $78 million in inflows.

Although Grayscale now sees $356 million in inflows, its YTD flows are red with nearly $1.3 billion of outflows. BlackRocks YTD inflows stand at $25.8 billion, or 87.5% of total inflows in crypto ETPs in 2025.

Magazine: Robinhoods tokenized stocks have stirred up a legal hornets nest