Current metrics place the total value locked into decentralized finance (DeFi) at approximately $117.856 billion. Ethereum, once commanding more than 56% of that figure at the close of 2024, has since dipped to 51.24% in May, marking a notable decline in its share.

Battle for DeFi Dominance Heats up: Ethereum Slides, Solana and Bitcoin Advance

Ethereum still leads in several categories, including total value locked in DeFi, non-fungible token (NFT) sales, and a large portion of the value of tokenized U.S. Treasuries and stablecoins built atop its smart contract infrastructure. Yet in recent years, that lead has narrowed, as rival blockchains have gained ground and chipped away at its dominance across all of these sectors.

Source: Defillama.com

Source: Defillama.com

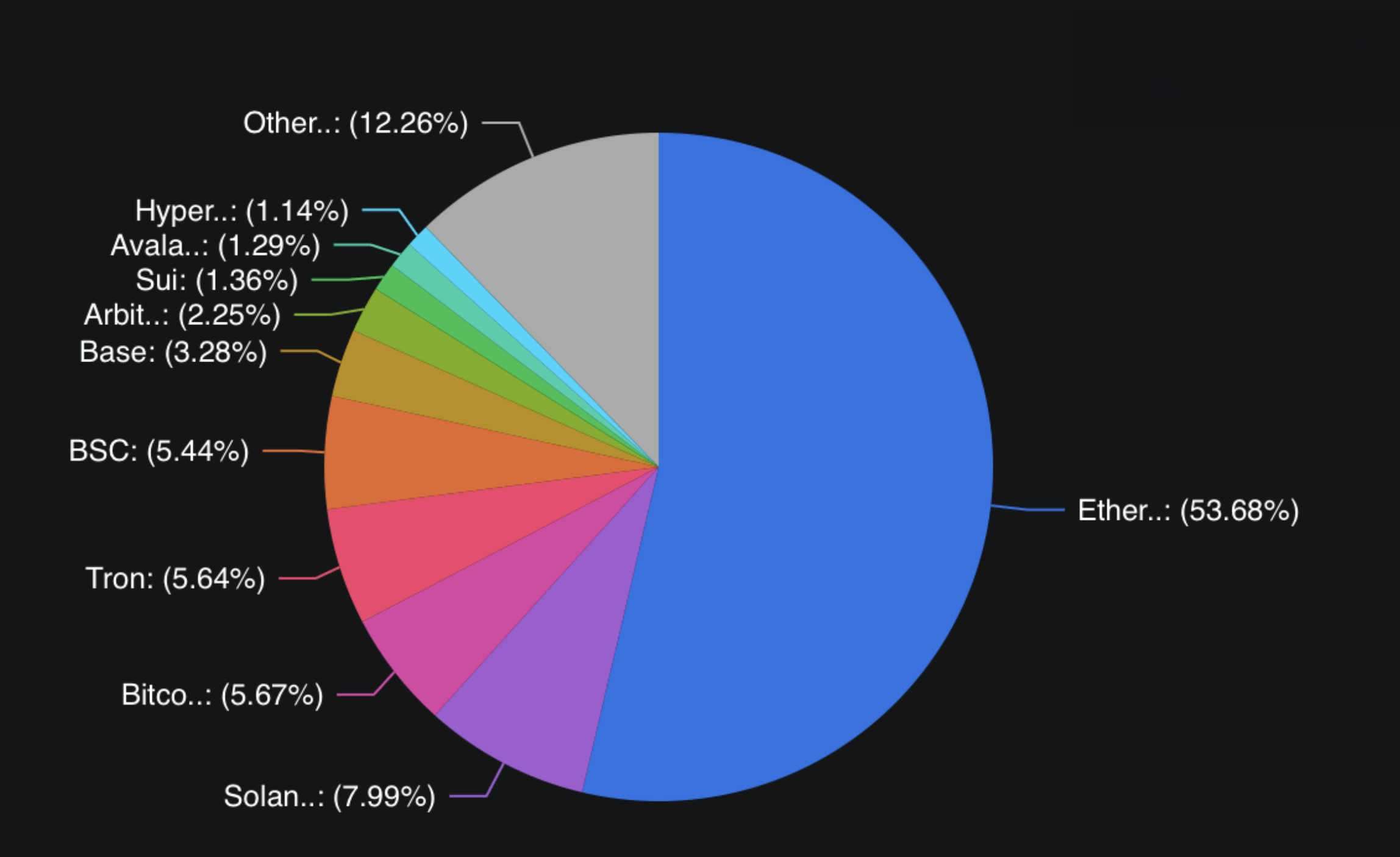

Zooming in on decentralized finance (defi) total value locked (TVL) back in February 2021, Ethereum held an impressive 91%-plus share of the DeFi pie. Fast forward 51 months, and that figure has tapered down to 53.68%, reflecting a 37.32% drop. At the beginning of 2025, Ethereum’s grip on DeFi TVL stood at 56.38%, but it has since shed 2.7%, dipping as low as 51.24% earlier this month.

DeFi challengers have emerged from blockchains like Solana, Bitcoin, Tron, and Binance Smart Chain (BSC). Based on defillama.com’s chain statistics, Solana holds 7.99% of the total value locked (TVL), followed by Bitcoin at 5.67%, Tron close behind at 5.64%, and BSC rounding out the top five with 5.44%. Other DeFi networks such as Base, Arbitrum, Sui, Avalanche, Hyperliquid, and Berachain are steadily climbing the ranks.

Lately, the data paints a picture of a maturing DeFi ecosystem where Ethereum’s early advantage is being gradually eroded by a wave of competitors. While Ethereum still remains at the forefront, the shifting balance suggests a more pluralistic future. Alongside this, another dominant chain could very well rise to prominence and dethrone ETH’s current position at the helm.

The current trend implies that innovation and adoption are no longer confined to a single chain but are dispersing across a growing field of contenders.

13095 views

Russia Intensifies Drive to Replace US Dollar in Global Trade

Russia accelerates the global de-dollarization drive with bold new push for national currencies and economic sovereignty in trade.

Russia Ramps up Exit From Dollar-Dominated Trade System

The global shift toward settling trade in national currencies instead of the U.S. dollar is gaining traction, with Russia positioning itself at the forefront of this movement. During the seventh Moscow Academic Economic Forum on June 2, Russian Foreign Minister Sergey Lavrov stressed the importance of creating independent mechanisms for foreign trade as a way to reinforce the country’s economic autonomy. He was quoted by Tass as saying:

The tasks of further strengthening of Russia’s economic and technological sovereignty, including through the creation of mechanisms for servicing foreign trade independent of external pressure, and the transfer of international settlements into national currencies, are coming to the fore now.

Lavrov argued that the international landscape—characterized by heightened sanctions and what he described as “persisting attempts by a number of Western countries to curb the development of our country”—necessitates urgent action to build a resilient economic model. He called for a unified effort among government bodies, the business sector, academia, and civil society to support this transformation. According to Lavrov, such coordinated engagement is essential to establishing what he called a more just, multipolar economic architecture, in contrast to the Western-dominated global order.

The remarks follow a rising global interest in alternatives to the dollar for cross-border transactions, driven by efforts to reduce the impact of sanctions and reliance on centralized financial systems. Major economic groups such as BRICS, the Shanghai Cooperation Organization, and ASEAN are pursuing these alternatives. In Russia, this movement includes growing interest in decentralized technologies like blockchain and digital assets. Advocates say tools such as Bitcoin could support national economies by facilitating transactions outside conventional financial networks, contributing to de-dollarization and economic autonomy.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons