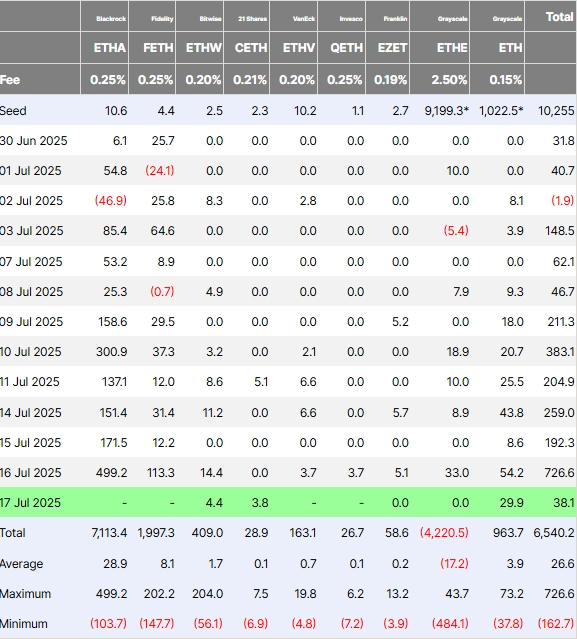

- US Ethereum ETFs saw record inflows of US$727M on Wednesday, led by BlackRocks US$499M and Fidelitys US$113M, pushing total ETF holdings past 5M ETH.

- ETF demand outpaced Ethereums daily issuance by 107x, creating major buy pressure as ETH surged 17.2% to US$3,475 and extended its two-week rally to 34.2%.

- BlackRock also seeks to integrate staking to its ETH ETF, as per a new filing submitted by the Nasdaq.

Demand for Ethereum ETFs exploded on Wednesday, with US funds hauling in nearly US$727M (AU$1.1B), shattering their previous single-day record.

BlackRocks ETHA fund alone attracted US$499M (AU$767M), its largest daily intake to date, while Fidelitys FETH followed with US$113M (AU$173.8M). The buying spree pushed total holdings across Ether ETFs past 5 million ETH, now representing over 4/% of the assets circulating supply.

Related: US CPI Rise Spurs TariffDriven Price Shiftsand Crypto Wobbles

Source: Farside Investors

Source: Farside Investors ETF appetite even dwarfed Ethereums daily issuance. With just US$6.74 million (AU$10.36 million) worth of new ETH minted on the network, ETF demand outstripped supply by a factor of 107, data from Ultra Sound Money shows.

Advertisement

ETH surged to nearly US$3,475 (AU$5,345) after the inflows, posting a 17.2% gain on the day and extending its two-week rally to 34.2%. Bitcoin, by contrast, moved just 0.7/%.

Other large-cap tokens followed Ethereums lead: XRP rose 7.6/%, hitting a new all-time high, Dogecoin was up 6.9/%, Solana 5.2/%, Cardano 3.5/%, BNB 3.4/%, and Tron 3.2/%. Market watchers are now eyeing Bitcoin dominance, which sits at 61/%, as a potential inflection point. Analyst Matthew Hyland suggested the broader altcoin cycle could accelerate if dominance slips toward 45/%.

Recently, the Nasdaq submitted a new filing to the US Securities and Exchange Commission (SEC) on behalf of BlackRock, requesting permission to incorporate staking into the iShares Ethereum ETF.

If approved, the fund would not only track Ethers price but also allow it to generate staking yields from Ethereums proof-of-stake network. That means ETF shareholders could indirectly benefit from rewards earned by locking ETH into validator nodes, which help secure the blockchain.

Related: Standard Chartered Breaks New Ground with Institutional Crypto Trading