Current metrics place the total value locked into decentralized finance (DeFi) at approximately $117.856 billion. Ethereum, once commanding more than 56% of that figure at the close of 2024, has since dipped to 51.24% in May, marking a notable decline in its share.

Battle for DeFi Dominance Heats up: Ethereum Slides, Solana and Bitcoin Advance

Ethereum still leads in several categories, including total value locked in DeFi, non-fungible token (NFT) sales, and a large portion of the value of tokenized U.S. Treasuries and stablecoins built atop its smart contract infrastructure. Yet in recent years, that lead has narrowed, as rival blockchains have gained ground and chipped away at its dominance across all of these sectors.

Source: Defillama.com

Source: Defillama.com

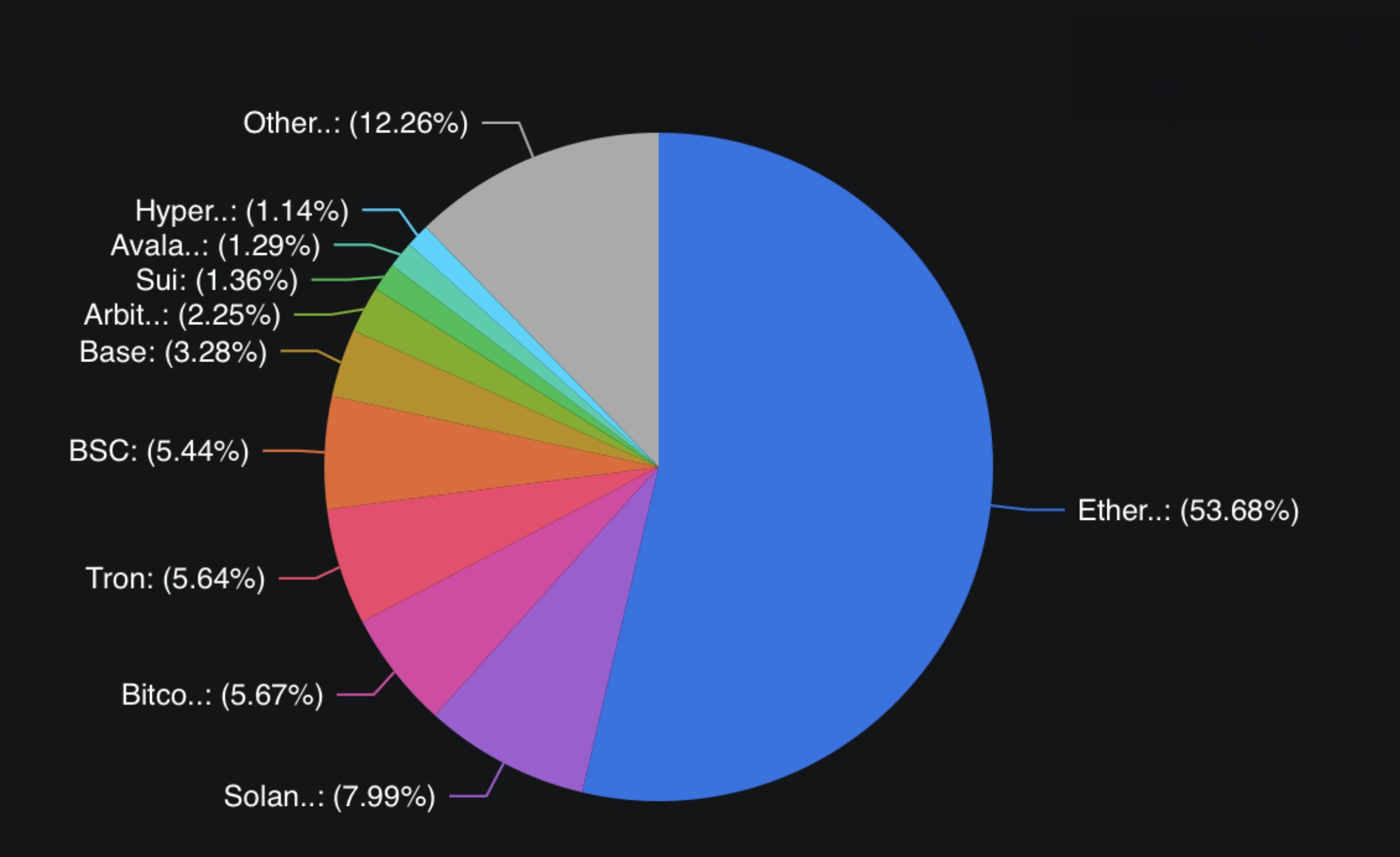

Zooming in on decentralized finance (defi) total value locked (TVL) back in February 2021, Ethereum held an impressive 91%-plus share of the DeFi pie. Fast forward 51 months, and that figure has tapered down to 53.68%, reflecting a 37.32% drop. At the beginning of 2025, Ethereum’s grip on DeFi TVL stood at 56.38%, but it has since shed 2.7%, dipping as low as 51.24% earlier this month.

DeFi challengers have emerged from blockchains like Solana, Bitcoin, Tron, and Binance Smart Chain (BSC). Based on defillama.com’s chain statistics, Solana holds 7.99% of the total value locked (TVL), followed by Bitcoin at 5.67%, Tron close behind at 5.64%, and BSC rounding out the top five with 5.44%. Other DeFi networks such as Base, Arbitrum, Sui, Avalanche, Hyperliquid, and Berachain are steadily climbing the ranks.

Lately, the data paints a picture of a maturing DeFi ecosystem where Ethereum’s early advantage is being gradually eroded by a wave of competitors. While Ethereum still remains at the forefront, the shifting balance suggests a more pluralistic future. Alongside this, another dominant chain could very well rise to prominence and dethrone ETH’s current position at the helm.

The current trend implies that innovation and adoption are no longer confined to a single chain but are dispersing across a growing field of contenders.

13599 views

XRP Key in SEC Filing as Webus Builds Treasury Engine

XRP roars into the institutional spotlight as Webus unveils a $300 million digital asset framework, unlocking next-level treasury infrastructure with regulatory clarity and elite execution.

Webus Files With SEC to Establish XRP Treasury Engine

Webus International Ltd. (Nasdaq: WETO) disclosed key details of its Delegated Digital-Asset Management Agreement with Samara Alpha Management LLC through a Form 6-K filing submitted to the U.S. Securities and Exchange Commission (SEC) on June 3. The SEC filing also includes the company’s announcements regarding its XRP treasury plan on May 29 and June 2.

The agreement, executed on May 28, grants Samara Alpha discretionary authority over a potential $300 million portfolio of digital assets, principally XRP, pending activation upon the transfer of assets to designated custody wallets. This filing marks a significant step in Webus’s strategic positioning around digital asset treasury infrastructure while affirming regulatory transparency. The company emphasized the institutional rigor of the partnership, stating:

This strategic framework … is designed to provide Webus with institutional-grade infrastructure and expertise for potential future digital asset treasury operations, specifically focused on XRP management.

Webus confirmed that no funds or assets have yet been transferred, and that Samara Alpha’s obligations begin only upon asset delivery. Critically, the agreement also limits exposure: “The aggregate value of the managed assets under this Agreement shall not exceed US$300,000,000 unless otherwise agreed in writing by both parties.”

Custody arrangements will be executed via multi-signature wallets, with Webus retaining key access and Samara Alpha lacking unilateral withdrawal authority. Fee terms include a 2% annual management fee, a 20% performance fee on net profits above a high-water mark, and an 80/20 staking reward split favoring Webus. The contract, governed by New York law, is set for a three-year term following activation and allows termination with cause or notice. By structuring this digital asset initiative through an SEC-registered investment adviser and codifying protections such as custody controls and risk-defined discretion, Webus signals its intention to cautiously enter the digital asset space without compromising institutional governance.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons