The Ethereum price has most recently witnessed a sharp pullback from its all-time high of $4792, scaring many investors, which is influenced by ETF flow shifts and macroeconomic pressure built by a recent report by the US.

Despite this correction, some major institutional players and whales continue to show their optimism for ETH crypto as they keep accumulating on every dip possible, signaling confidence in the assets long-term trajectory.

Therefore, the current ETH price chart now reflects both cautious short-term sentiment and bullish long-term positioning.

As per daily chart, the Ethereum price today is exchanging hands at $4,422, down more than 8% from its recent all-time high of $4,792.

This correction has trimmed its market capitalization to $529.21 billion, with daily trading volumes at $49.28 billion. The decline coincided with a U.S. Producer Price Index (PPI) report showing a 0.9% month-over-month rise in July, the highest in three years.

This inflationary data fueled risk-off sentiment across financial markets, pulling down the ETH price USD alongside equities.

Following weeks of strong inflows into Ethereum ETF products, the first signs of outflows appeared. A net $59.3 million outflow was reported, though not all issuers were equally impacted.

As per the Farside investors data, BlackRocks ETHA ETF recorded consistent inflows of $338 million, while other products, including Fidelitys FETH, faced outflows.

Moreover, while retail participants showed signs of panic selling, the institutional players and whales have used the dip as an opportunity to accumulate.

Data from Arkham revealed that Bitmine has kept on purchasing ETH and most recently added another 106,485 ETH worth $470.5 million, bringing its total holdings to 1.29 million ETH, valued at $5.75 billion.

Similarly, reports indicate that even high-profile investors, including former U.S. President Donald Trump, have been buying ETH, with purchases worth $8.6 million alongside $10 million in BTC.

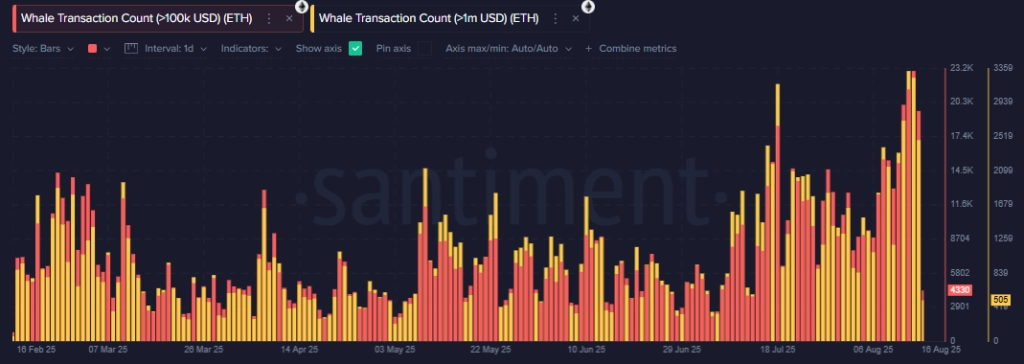

Adding to this, Santiment data reveals that the whale transactions from addresses holding more than $100,000 and $1 million in ETH have risen sharply, reinforcing accumulation trends.

The ETH price chart reflects a clear uptrend structure, despite the recent decline. Even though analysts are bullish, witnessing the August price action, the experts highlight that the Ethereum price continues to follow an upward trendline, with a possible retest acting as the next springboard.

Based on this technical setup, an Ethereum price prediction of $6,000 before the end of August has been projected if momentum holds.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

What is the ETH price prediction for 2025?As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $5,925.

Is ETH a good investment?As the altcoin season begins, the short-term gains make Ethereum a lucrative buying option. However, the long-term promises of this programmable blockchain make it a viable long-term crypto investment.

How much would the price of Ethereum be in 2040?As per our Ethereum price prediction 2040, Ethereum could reach a maximum price of $123,678.

How much will the ETH coin price be in 2050?By 2050, a single Ethereum price could go as high as $255,282.