Ethereums price took a 2.6% dip against the U.S. dollar on Friday, hot on the heels of bitcoins overnight tumble. While bitcoins weekly loss clocks in at a modest 0.7%, ethers price showed some spunk, boasting a more lively 2% gain over the past seven days.

Jamie Redman

Jamie Redman

Ethereum Holds Steady at $3,650 After Recent Dip

As of press time, bitcoin commands a hefty 60.8% of the $3.82 trillion crypto market, while ether struts its stuff at 11.6%. Ethers market share slipped just a tad but still shines brighter than its 11.1% stake from a week ago, Jan. 18.

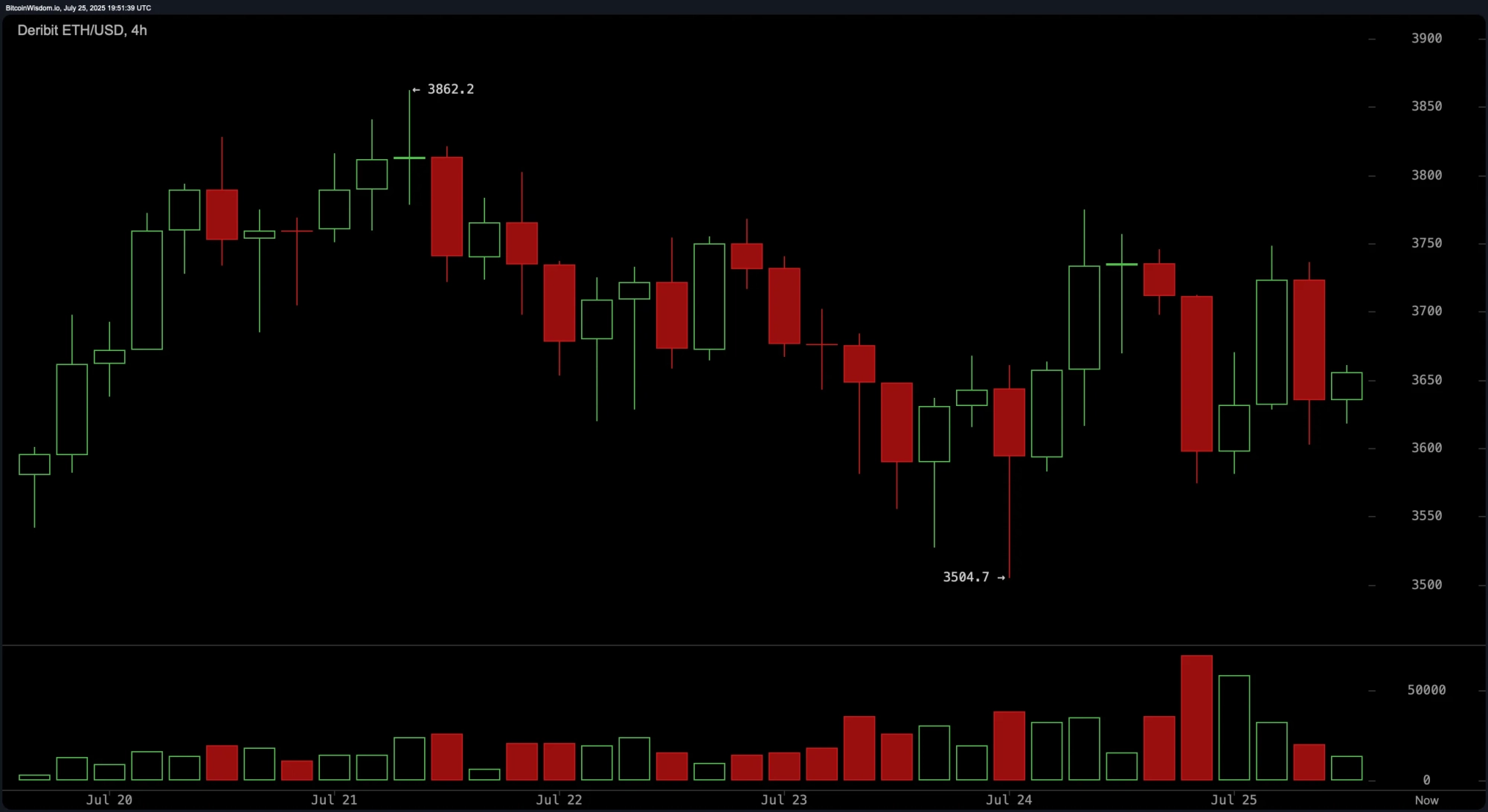

ETH/USD Deribit on July 25, 2025, 4-hour chart.

ETH/USD Deribit on July 25, 2025, 4-hour chart.

With a $441 billion market cap, the second-largest crypto asset danced between $3,585 and $3,750 in the last 24 hours. Ethers 24-hour trading volume held strong at $90.55 billion, trailing bitcoins $103.78 billion in global trades.

Last night, after hitting a high of $3,750, ETH swooped down to a $3,585 low before rebounding to $3,602 in a snappy ten-minute recovery. By 3:45 p.m. ET on Friday, Jan. 24, ether was swapping hands at a cool $3,653 per coin. Binance reigned supreme as ETHs top exchange for trading activity today.

In the wild world of crypto derivatives, $114.14 million in ETH positions got liquidated over the past day, with $82.18 million of those being short positions. ETH nabbed the silver medal for daily liquidations, trailing bitcoin but outpacing SOLs $40 million in leveraged losses. Just moments ago, an ETH/USD long position on Binance took a $30,000 hit in a dramatic liquidation at 3:36 p.m. ET.

Despite recent market turbulence, ethereums resilience has shined through, maintaining a modest weekly gain. As crypto traders navigate the volatile crypto landscape, ethers market presence these days and active trading volume still suggests a promising future, potentially challenging bitcoins dominance in the evolving digital economy.