- Can Ethereum break out without fresh capital entering the market?

- Sentiment outpaced participation, hinting that ETH may struggle to move higher without trader commitment.

Ethereum [ETH] is back in the spotlight as signs of renewed enthusiasm begin to build across social and market channels.

From chatter surges to early shifts in trader positioning, the signals suggest rising anticipation, but whether this momentum has the backing to carry forward remains to be seen.

Social buzz rises, but are traders ready to act?

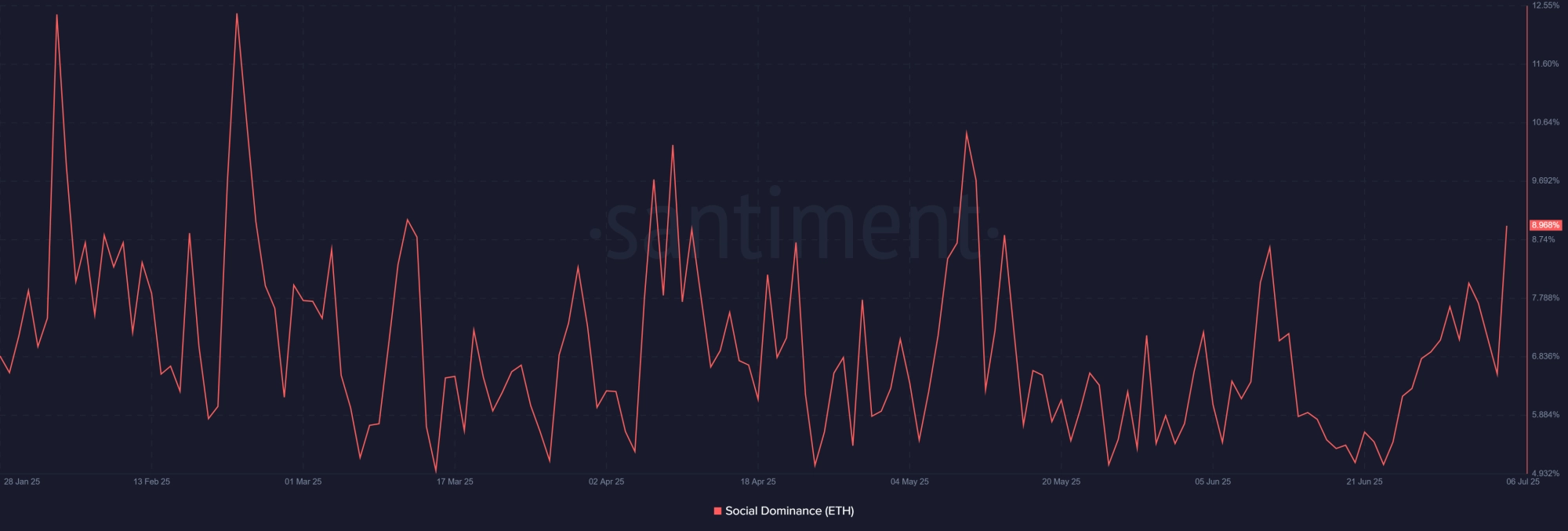

Ethereums Social Dominance spiked to 8.96%, its highest reading since May, suggesting a surge in public interest.

This uptick aligns with climbing Exchange Reserves, raising eyebrows about whats brewing behind the scenes.

Is the crowd front-running a move? Or are institutions quietly circling?

Naturally, when social volume spikes alongside Exchange Reserves, it often foreshadows a major pivotbullish or not. So, whats fueling this tension?

Source: Santiment

Can THIS sustain Ethereums bullish bias?

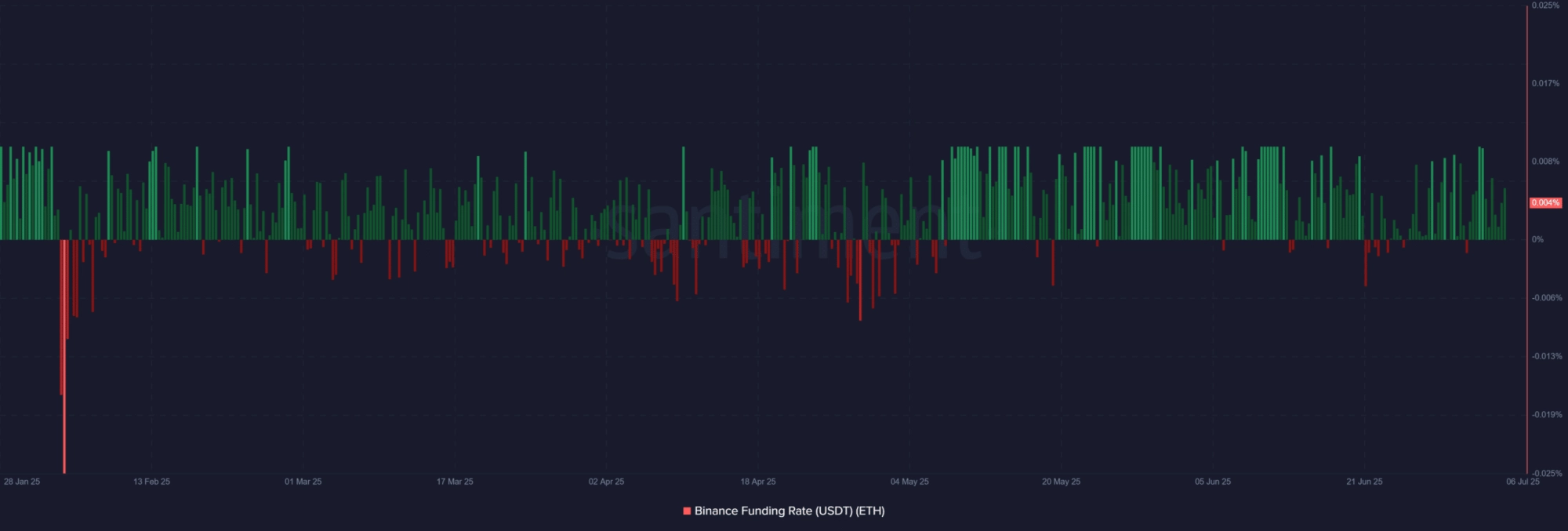

Despite growing on-chain uncertainty, ETHs Funding Rates remained in slightly positive territory at +0.004%, suggesting traders continue to lean bullish.

This consistent bias toward long positions implies underlying confidence among derivatives participants, even as on-chain reserve metrics raise red flags.

Positive Funding Rates reflect that traders are paying a premium to hold longs, which could amplify gains if upward momentum resumes.

However, if prices begin to falter while funding remains elevated, it may trigger a rapid unwinding of leveraged positions.

Source: Santiment

Short-term holders re-enter

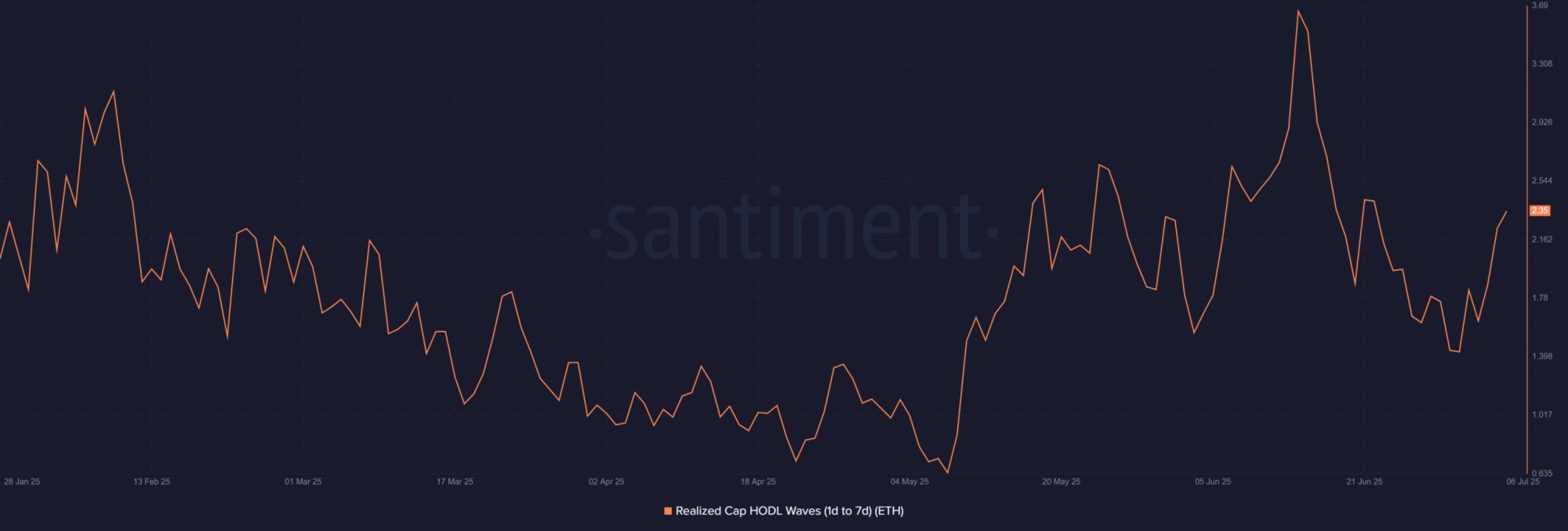

Meanwhile, short-term holders are stepping back into the ring. Realized Cap for 17 day holders climbed to 2.35, recovering from its previous low. Its a small, but telling, move.

This category often acts as a leading indicator of speculative sentiment, and its rise suggests that traders may be positioning ahead of a potential price swing.

Interestingly, this uptick comes as social buzz intensifies and exchange balances rise, hinting at growing conviction.

Still, this metric remains well below its early June peak, showing that while momentum is returning, it has yet to reach a fully overheated state.

Source: Santiment

Cooling trader participation

ETHs derivatives data revealed a sharp 58.9% drop in trading volume and a 1.05% decline in Open Interest, highlighting fading engagement from active market participants.

Meanwhile, Options Volume also fell by 58.2%, showing that speculative appetite has thinned across both spot and options markets.

But since Open Interest only dipped slightly, its not a full exodusjust fewer new entrants.

In fact, this combination suggests traders are still holding on, just with less aggression. Thats not capitulation, but it isnt conviction either.

Will sentiment and leverage be enough to drive ETH forward?

Optimism is clearly building across social, sentiment, and Funding Rates. But whether it translates into price action depends on one thing: capital.

Until then, sentiment alone may struggle to translate into a decisive price move.