This content is provided by a sponsor.

PRESS RELEASE.

Dubai, United Arab Emirates, 14th May – The landmark 30th edition of HODL (formerly known as the World Blockchain Summit), the world’s longest-running Crypto & Web3 Summit series, returns to Dubai today, 14 May 2025, at Madinat Jumeirah, continuing through 15 May 2025.

HODL will bring together over 5,000 attendees, including policymakers, regulators, institutional investors, technological innovators, and entrepreneurs to drive critical conversations and partnerships shaping the future of decentralised finance, asset tokenisation, and AI-powered infrastructure.

Organised by Trescon and building on the legacy of the World Blockchain Summit, HODL has hosted 29 editions across key global hubs, including Dubai, Singapore, and Bangkok. This milestone event in Dubai cements its position as a leading global platform for blockchain innovation and strategic collaboration.

“HODL has become the definitive platform for blockchain innovation in the Middle East and beyond. This 30th edition marks a turning point as institutional adoption meets breakthrough tech. We’re proud to drive the conversations shaping the future of decentralisation ,” said Mohammed Saleem, Founder & Chairman of Trescon.

HODL will spotlight cutting-edge developments driving the crypto and Web3 ecosystem — including real-world asset tokenization, advancements in modular blockchain infrastructure, the next wave of DeFi innovation, evolving regulatory frameworks, and enhanced security protocols for digital assets. These trends are accelerating global momentum toward institutional and enterprise blockchain adoption.

Featuring a powerhouse line-up of speakers including:

- Corbin Fraser, Chief Executive Officer, Bitcoin.com

- Nils Andersen-Röed, Global Head of FIU, Binance

- Gracy Chen, Chief Executive Officer, Bitget

- Rifad Mahasneh, Chief Executive Officer MENA, OKX

- Robert Crossley, Global Head of Industry and Digital Advisory Services, Franklin Templeton

- Joseph Ziolkowski, Chief Executive officer, Relm Insurance

- Viktor Fischer, Managing Partner, RockawayX

- Vivien Lin, Chief Product Officer, BingX

- Luther Maday, Global Head of Payments, Algorand Foundation

- Dyma Budorin, Co-Founder and Chief Executive Officer, Hacken

“HODL 2025 is where the future of Web3 and crypto innovation takes shape. I am thrilled to collaborate with pioneers shaping this exciting digital revolution ,” stated Corbin Fraser, CEO of Bitcoin.com.

Talking about the opportunity, Nils Andersen-Röed, Global Head of FIU at Binance remarked, “Excited to share insights on blockchain and connect with leaders driving GameFi, NFTs, and Web3 advancements at HODL 2025 .”

In a significant development for the region’s innovation landscape, HODL has partnered with Pegasus Tech Ventures to host the UAE Regional Round of the Startup World Cup, offering emerging blockchain ventures a chance to pitch for a place at the global finals and compete for a $1 million investment. Pegasus has invested in over 260 companies, with 71 exits and 22 IPOs, providing a formidable launchpad for start up growth.

HODL 2025 provides its attendees unprecedented access to more than 500 institutional investors, creating opportunities for strategic collaborations with industry leaders, regulatory authorities, enterprise organisations, and government officials. This environment is optimally structured for capital formation, strategic insight development, and institutional partnerships.

Reflecting the growing influence of blockchain in global finance, HODL is backed by leading sponsors and ecosystem partners including:

- Platinum Sponsor – Liquid Loans

- After Party Sponsor- Coinvoyage

- Gold Sponsors – Tata Consultancy Services | Gofaizen & Sherle

- Silver Sponsor – Facephi

- Bronze Sponsors – Skygate Network | FMCPAY | Pays.Solutions | P2P

With the strategic support of over 60 global media and listing partners, participating organisations will achieve significant visibility across international platforms. CNN Business Arabic serves as the Official Media Partner, with Khaleej Times as Exclusive Media Partner, and ZEX PR WIRE as the Official Digital PR Distribution Partner.

For more information, visit: https://hodlsummit.com/dubai2025/ For further enquiries, contact:

Shadi Dawi

Sr. Director – PR, Comms., & Media

M: +971 55 498 4989 | E: [email protected]

———————–END——————

About HODL

HODL, born from the legacy of the iconic World Blockchain Summit (WBS) and organised by Trescon, is the world’s longest-running blockchain event series with 29 global editions across cities like Dubai, Singapore, and Bangkok. Since 2017, HODL has served as a platform for blockchain deal-making, innovation, and connecting disruptive projects with investors, enterprises, and governments.

Join HODL Dubai on May 14-15, 2025, to engage with industry leaders, explore cutting-edge blockchain developments, and secure your place at the forefront of Web3 innovation.

Visit https://hodlsummit.com/dubai2025/ for more details and ticket information.

_________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Bitcoin Price Watch: Double Top or Launchpad? $105K Level Under Fire

Bitcoin trades at $103,581 today with a total market capitalization of $2.057 trillion and a 24-hour trade volume of $35.91 billion. The cryptocurrency experienced an intraday price range of $101,109 to $104,293, signaling elevated activity within a tight but volatile band.

Bitcoin

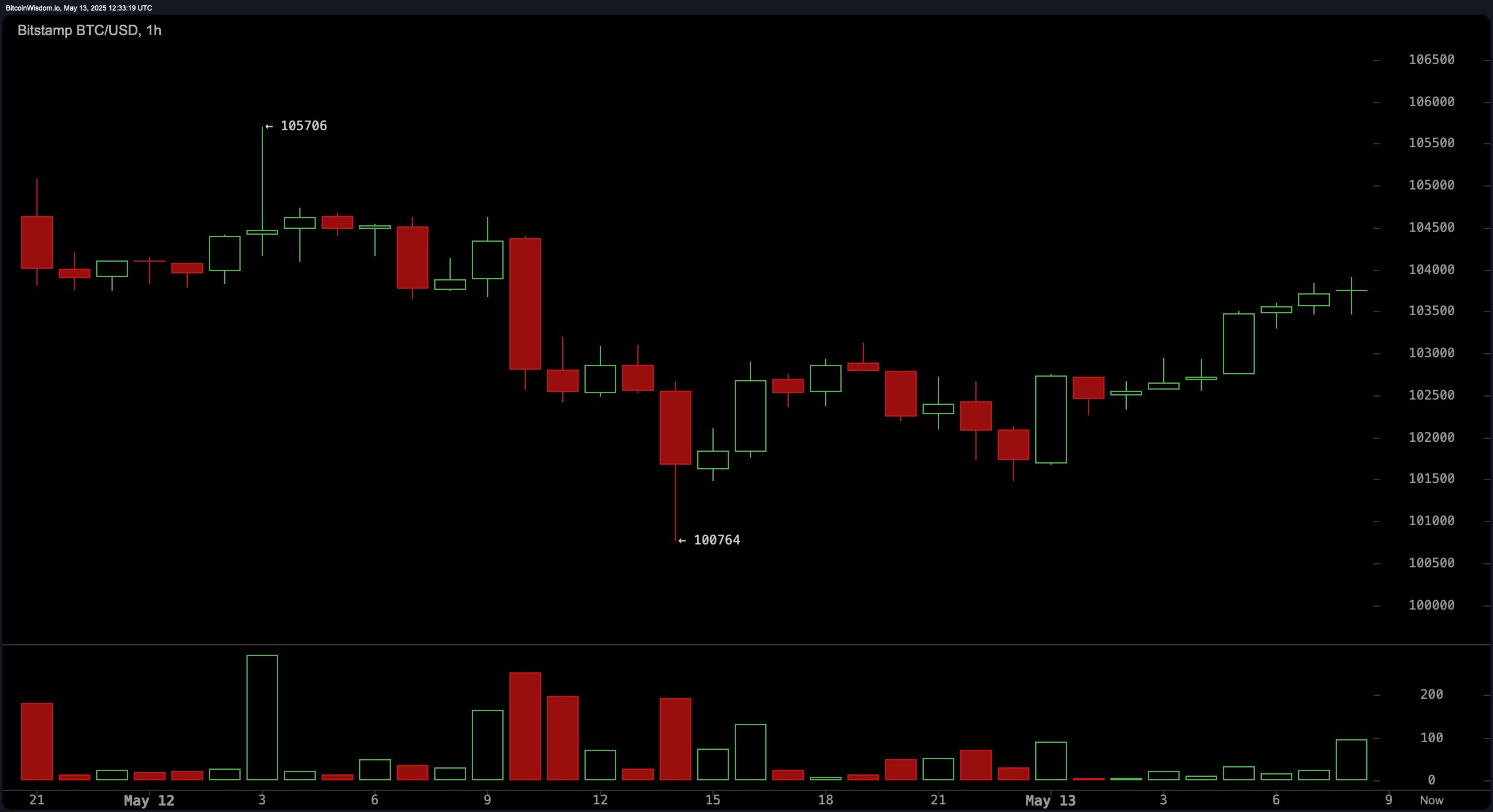

The 1-hour BTC/USD chart highlights a distinct intraday pullback followed by a sharp V-shaped recovery, with price action reclaiming the $103,800 range. The short-term trend is defined by higher lows, suggesting a budding bullish bias. However, the low volume on the recovery warns of cautious sentiment among traders. Entry opportunities are found near $103,000 for quick scalps, while deeper dips to $102,500 may attract aggressive buyers. Resistance stands firm between $104,500 and $105,000, capping immediate upside potential unless a volume-backed breakout occurs.

BTC/USD 1H chart via Bitstamp on May 13, 2025.

BTC/USD 1H chart via Bitstamp on May 13, 2025.

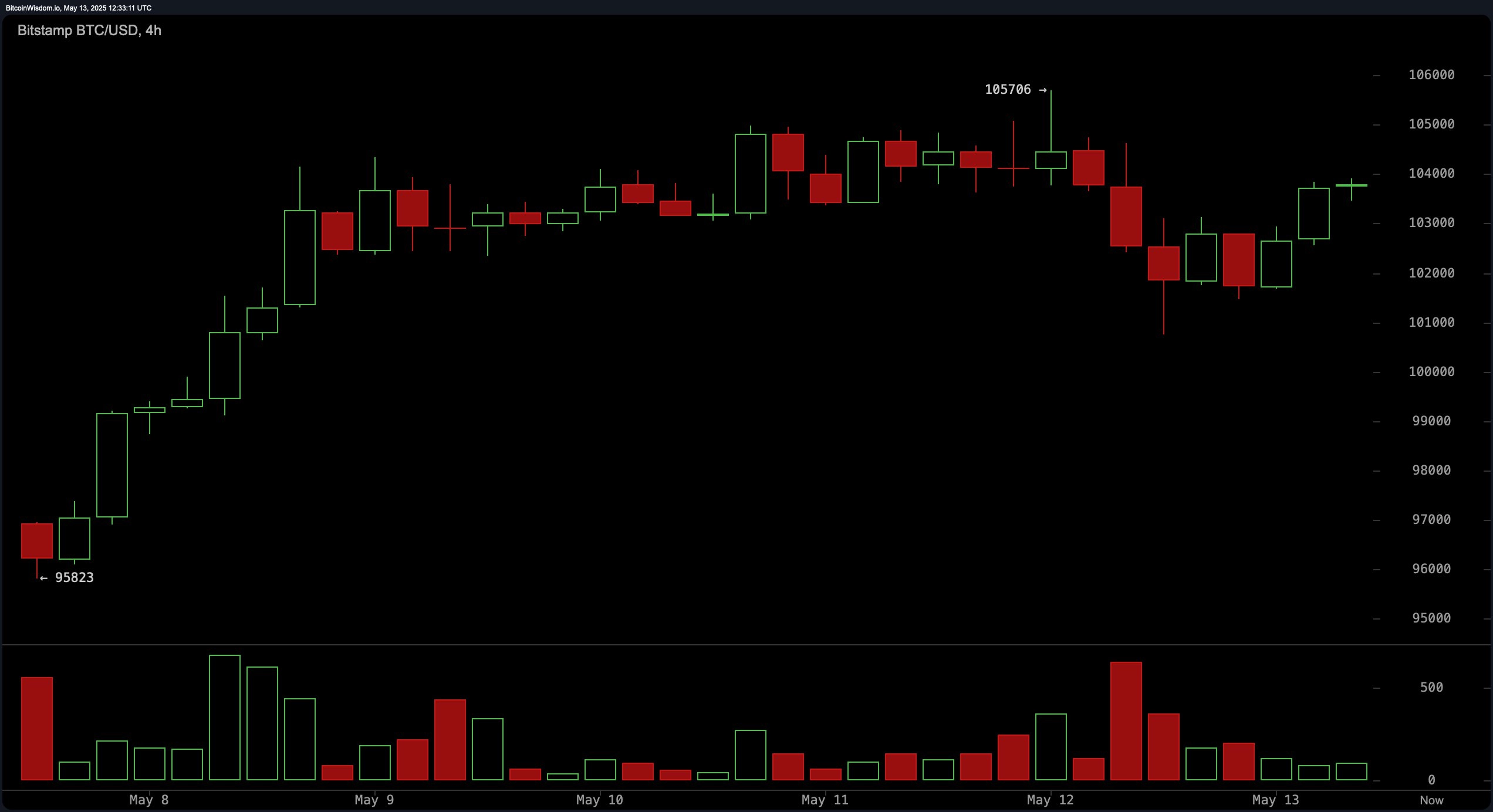

On the 4-hour chart, bitcoin currently exhibits a broader shift from uptrend to sideways consolidation with a subsequent pullback. A localized bottom was established at $100,764, and a gradual recovery has been underway. Yet, low volume during this bounce underscores weak conviction from bulls, casting doubt on the sustainability of the advance. Price confirmation near $102,500 to $103,000 is essential for validating any further upside attempts. Resistance remains entrenched at the $105,000 level, corresponding with the previous high.

BTC/USD 4H chart via Bitstamp on May 13, 2025.

BTC/USD 4H chart via Bitstamp on May 13, 2025.

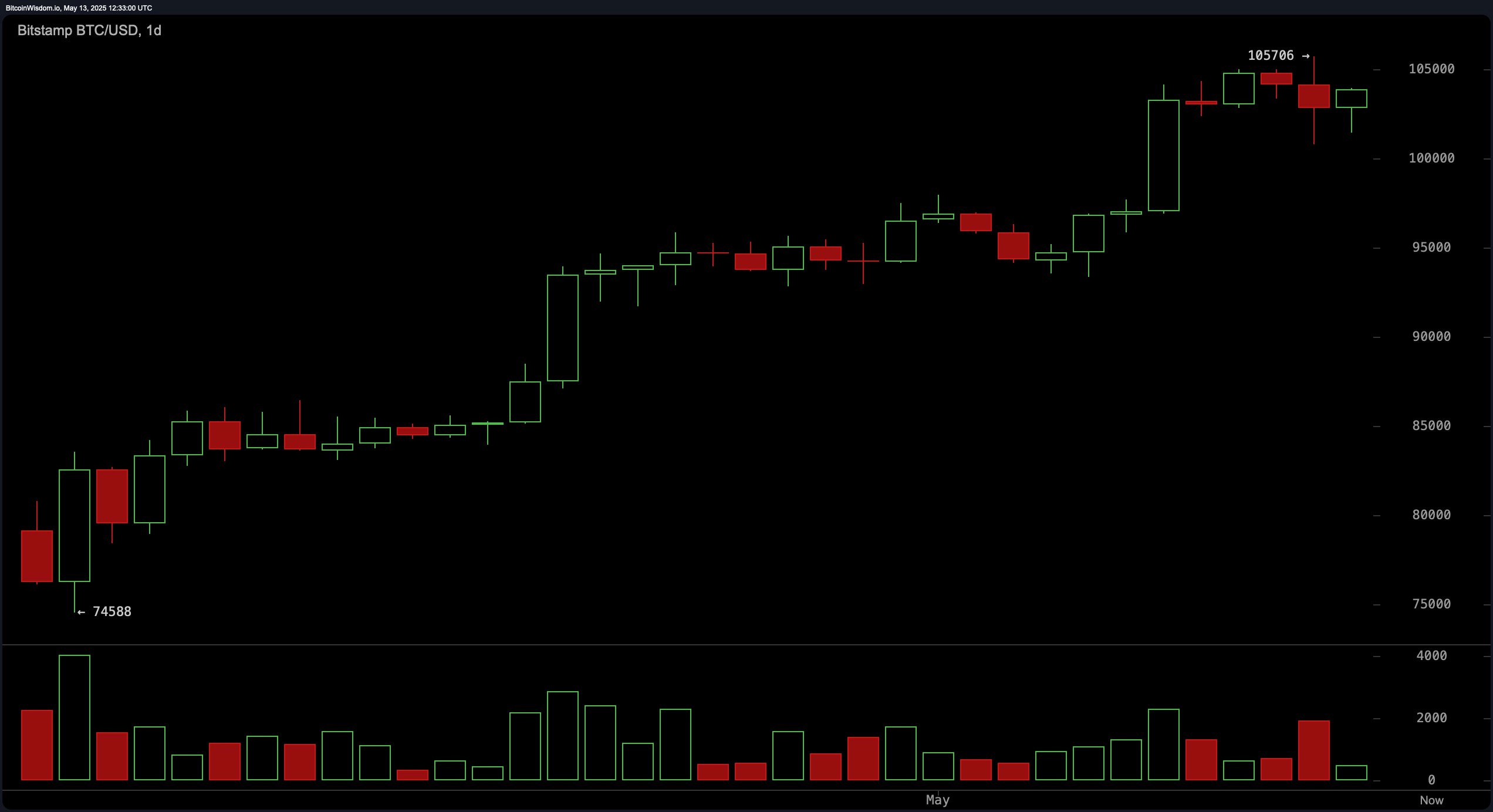

The daily timeframe reveals a pretty strong uptrend followed by signs of momentum exhaustion. Price action topped out at $105,706, potentially forming a double top or temporary ceiling. Red candles with diminishing body size and a slight dip in volume during the rally indicate waning buyer interest. A retracement into the $98,000 to $100,000 range may offer a favorable buy-the-dip scenario, particularly if reversal candlesticks like bullish engulfing patterns emerge. Resistance near $105,000 to $106,000 could limit advances absent significant volume support.

BTC/USD 1D chart via Bitstamp on May 13, 2025.

BTC/USD 1D chart via Bitstamp on May 13, 2025.

Oscillators for the 1-day timeframe present a mixed picture: the relative strength index (RSI) at 71 and Stochastic at 85 both sit in neutral zones, while the commodity channel index (CCI) at 109 signals a sell. Conversely, momentum at 7,970 and the moving average convergence divergence (MACD) at 4,090 both indicate a buy, reflecting underlying strength in the trend despite near-term volatility. The average directional index (ADX) at 36 and the awesome oscillator at 11,033 further support the neutral to mildly bullish sentiment.

The daily moving averages provide unanimous confirmation of a bullish market structure. All short- to long-term averages, including the 10-period exponential moving average (EMA) at 101,151 and simple moving average (SMA) at 100,482, up to the 200-period EMA at 87,512 and SMA at 91,783, are in buy territory. This consistent alignment of upward-trending averages lends significant weight to the broader positive outlook, though price retracements within trend-support zones are increasingly likely in the short term.

Bull Verdict:

Despite recent consolidation and lower volume on recoveries, bitcoin remains technically strong across all key timeframes, supported by consistent buy signals from all major moving averages. As long as the price holds above key support zones and volume confirms breakouts, the broader bullish trend remains intact with the potential to retest or surpass recent highs.

Bear Verdict:

While the prevailing trend is upward, warning signs such as overbought oscillators, declining volume, and resistance near $105,000 suggest vulnerability to a correction. A break below $100,000 would invalidate the current structure and may trigger a deeper retracement toward the $96,000–$97,000 range, weakening the bullish case.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons