While Bitcoin (BTC) has previously shown significant momentum in this market cycle, recent insights suggest that liquidity sources beyond Coinbase may be driving the trend.

A CryptoQuant analyst, Mignolet, specifically provided a detailed analysis of Bitcoin’s market, shedding light on the role of major exchanges like Coinbase and Binance in the ongoing bull cycle.

Shifting Liquidity Dynamics And Exchange Roles

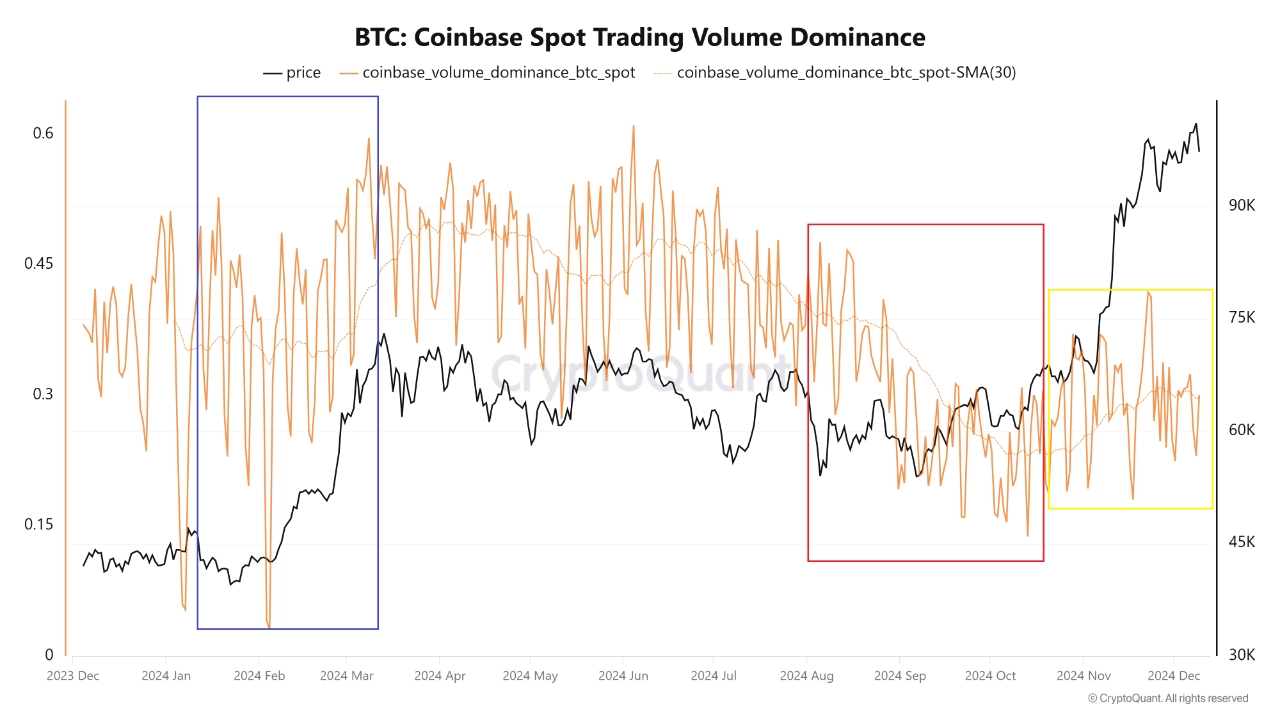

In a recent post on the CryptoQuant QuickTake platform titled “Coinbase Dominance Remains Low,” Mignolet examined the trajectory of Coinbase’s influence on Bitcoin’s price movements.

The analyst highlighted that while Coinbase played a crucial role in the initial stages of this year’s Bitcoin rally, its dominance has since diminished. This shift indicates a broader distribution of liquidity across the market, with Binance emerging as a significant player in sustaining the bullish momentum.

Coinbase dominance remains low

“However, just before the rise in September-October, Coinbase dominance actually declined and has not significantly increased even now (red box).” – By @mignoletkr

More details 👇https://t.co/nmnPGuz3WK pic.twitter.com/mBSImH8MwD

— CryptoQuant.com (@cryptoquant_com) December 11, 2024

Mignolet’s analysis points to a critical observation: Coinbase’s dominance in spot trading has notably declined during the second phase of Bitcoin’s current rally.

His analysis revealed that Bitcoin exchange-traded funds (ETFs) were approved earlier this year, spurring a surge in Coinbase’s trading activity.

Coinbase Bitcoin spot trading volume dominance. | Source: CryptoQuant

Coinbase Bitcoin spot trading volume dominance. | Source: CryptoQuant

This influx of liquidity was instrumental in driving Bitcoin prices upward and disrupting the traditional halving cycle expectations. However, as the rally progressed, Coinbase’s influence waned.

The analyst emphasized that while Coinbase remains a pivotal source of liquidity, Binance has assumed a more prominent role in the current market phase. Mignolet wrote:

Let me reiterate: I’m not saying that Coinbase liquidity is unimportant or insignificant. It’s incredibly important. What I am highlighting is that there’s an even more critical source of liquidity at play. = Binance

Notably, Binance’s growing dominance suggests that liquidity flows from a wider array of participants, contributing to a somewhat decentralized and strong market structure.

This redistribution could indicate broader institutional and retail interest in Bitcoin as traders and investors diversify their platforms.

Bitcoin Sees Sharp Rebound

Following a few days of correction dropping below the $95,000 price mark, Bitcoin has now seen a sudden rebound.

Particularly, at the time of writing, the asset has reclaimed the $100,000 price mark with a current trading price of $100,625, marking a 4% increase in its price.

BTC price is moving upwards on the 1-hour chart. Source: BTC/USDT on TradingView.com

This increase in Bitcoin’s price has now brought the asset to a mere 3.6% decrease away from its all-time high above $103,000 established earlier this month.

Featured image created with DALL-E, Chart from TradingView

Samuel Edyme

Meet Samuel Edyme, Nickname - HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.