Hyperliquid DEXs performance has been solid, but market sentiment meant volume hasnt grown over the past two months. This might need to change for HYPE prices to trend convincingly higher.

Hyperliquid [HYPE], a popular decentralized exchange (DEX), saw steady trading volumes over the past two months, but new user growth slowed.

Combined with muted sentiment and Bitcoins [BTC] failed breakout above $122.8k, HYPE lacked a decisive trend.

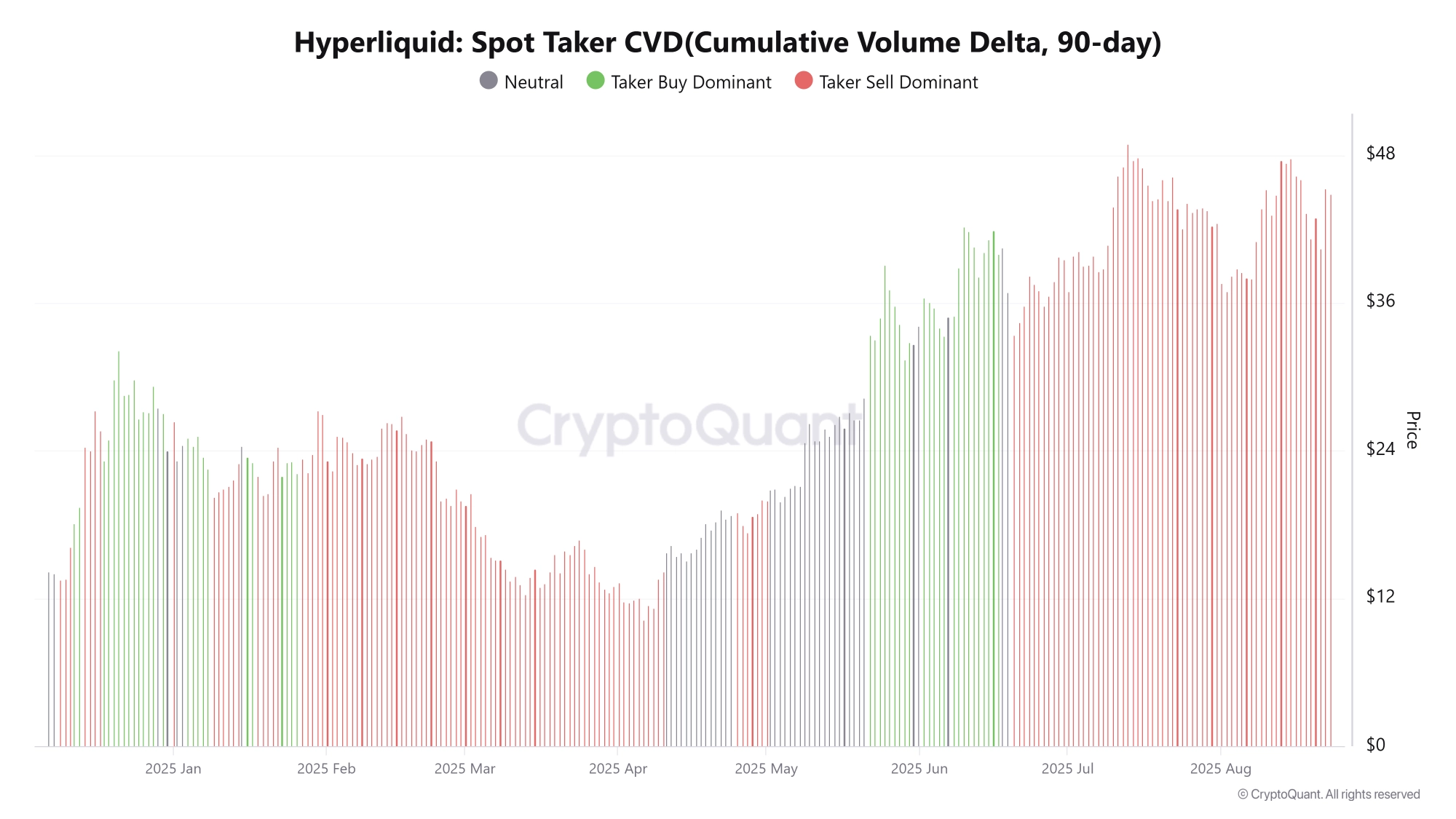

Source: CryptoQuant

CryptoQuant data showed that the HYPEs spot market was seller-dominated since late June.

The Spot Taker CVD exhibited a Taker Sell Dominant phase, using the 90-day cumulative difference in market buy and sell orders.

In other words, market sell orders prevailed in the HYPE spot market. This helped explain why the DEX native token was unable to climb past the $45-$50 supply zone.

Over the past week, HYPE lost 8.4%, reinforcing the slight edge that the bears hold. When can this dynamic change?

Sentiment, Bitcoin, hype, and HYPE

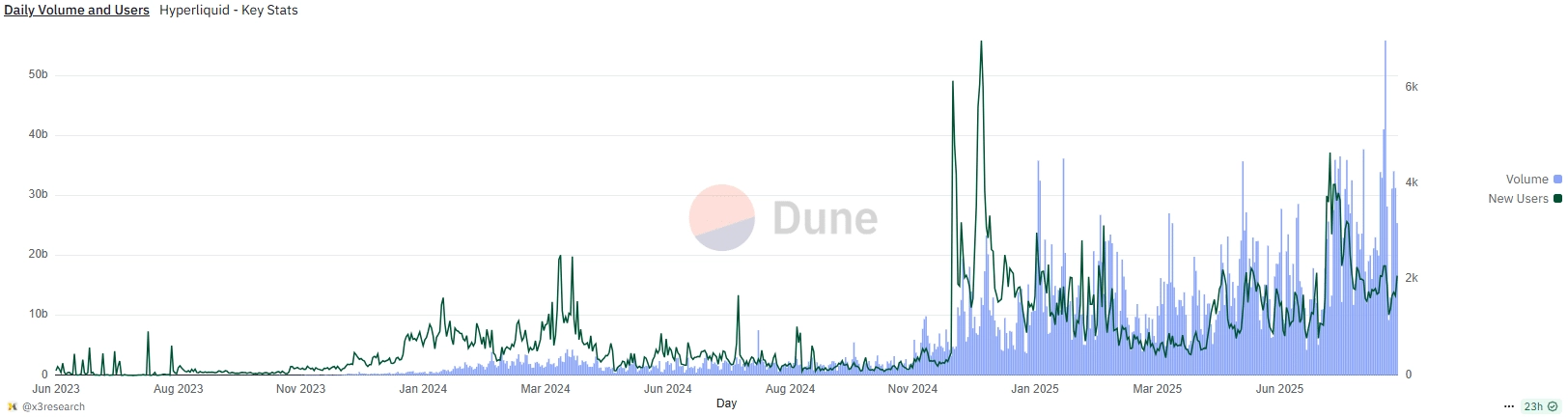

Source: Dune Analytics

The daily trading volume stayed steady over six weeks, but new user growth dropped sharply.

This could be a result of muted market sentiment, even though Bitcoin [BTC] was near all-time highs, and the altcoin market cap expanded 25% since the 10th of July.

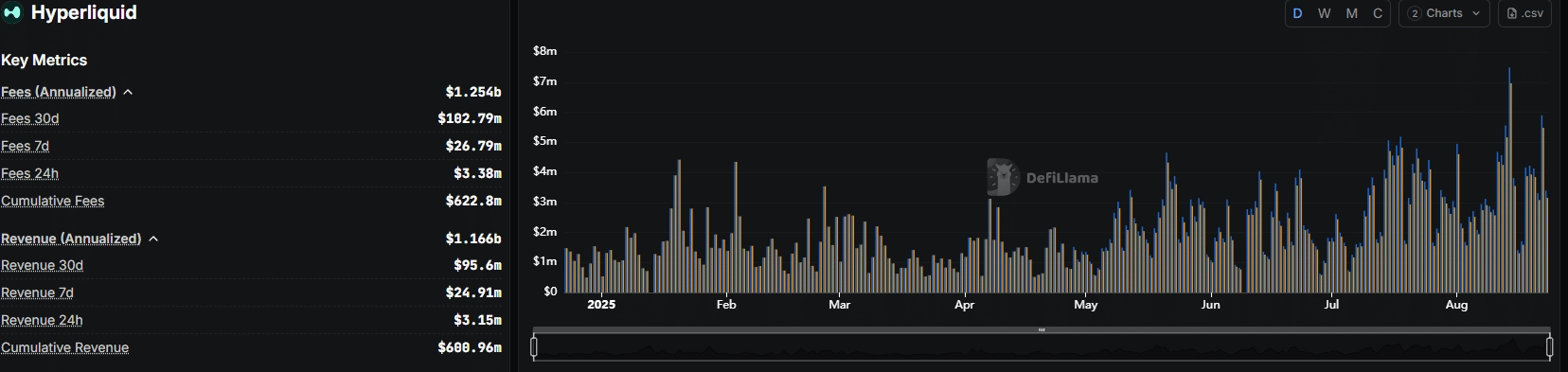

Source: DefiLlama

Fees also remained relatively steady in recent weeks, but have not expanded. These two factors could be why the HYPE token has struggled to establish a strong uptrend, like it did in April and May.

Structure holds, but trend weakens

Source: HYPE/USDT on TradingView

That is not to say that HYPE was bearish.

On the 1-day chart, its market structure remained bullish. In fact, this was evidenced by the higher lows the token formed since May.

The swing structure remained bullish since that rally, although there were internal breakdowns and pullbacks.

The DMI showcased the lack of a strong trend behind the token, highlighting the original point. A Bitcoin bullish spark could ignite the altcoin markets and drive increased volume across exchanges, including Hyperliquid.

Market-wide bullish conviction and heightened participation could be important factors in the coming weeks for HYPE investors.