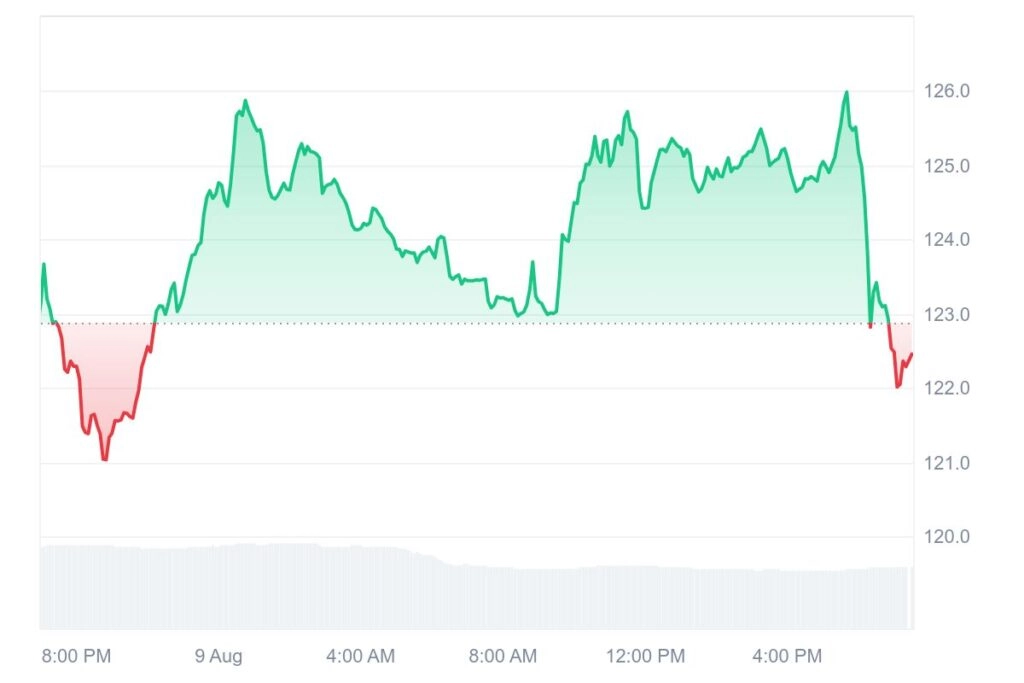

- Litecoin is trading at $123.32, up 14.08% in a week, with $2.41B volume and $9.39B market cap.

- MEI Pharma buys 929,548 LTC at $107.58 each, marking the first public company to add Litecoin to its treasury.

- Analysts eye a potential $250 target if LTC breaks key resistance and holds above the $64 support.

Litecoin (LTC) has surged 14.08% in the past week to $126.13, boosted by MEI Pharmas landmark $100M purchase, the first public company to add LTC to its treasury, as it approaches a key technical breakout zone.

At the time of writing, Litecoin is trading at $122.45, supported by a decisive 24-hour volume of $2.41 billion and a market capitalization of $9.39 billion.

Source: CoinMarketCap

Source: CoinMarketCap The recent price jump seems driven by a major corporate buy. According to on-chain and market coverage, crypto analyst Santolita shared that MEI Pharma has purchased 929,548 LTC, averaging out at a rate of $107.58 per coin, a stunning $100 million treasury buy.

Santolita (@SantoXBT) August 8, 2025MEI Pharma acquired 929,548 $LTC at $107.58 per coin, a $100M treasury move

This makes MEI Pharma the first public company to adopt Litecoin as a strategic reserve pic.twitter.com/vReOstiDQt

The acquisition is the first public company to legally utilize Litecoin under its strategic reserve, a first-time indicator reflecting a growing institutional backing for the cryptocurrency.

Technically, More Crypto Online emphasized the LTCs pricing structure. The analysts point out that LTC is seeking to breach a significant resistance barrier. As long as purchasing remains strong and the figure is retained above $64, a principal support region, LTC can climb towards $250 in the medium term.

Source: X

Source: X However, analysts caution that Litecoins rise since 2018 has tended to be non-impulsive and, as a result, the current configuration is weak. A significant Bitcoin top could nonetheless cause a reversal of LTCs momentum, and ongoing observation will be needed by Investors.

Currently, the combination of corporate adoption, technological superiority, and steady demand from investors is standing its ground for the bulls, and the market will be eager to find out if this surge can keep up its momentum.

Also Read | Litecoin Surges Over 11% in a Week, Analysts Eye $350 Breakout Target

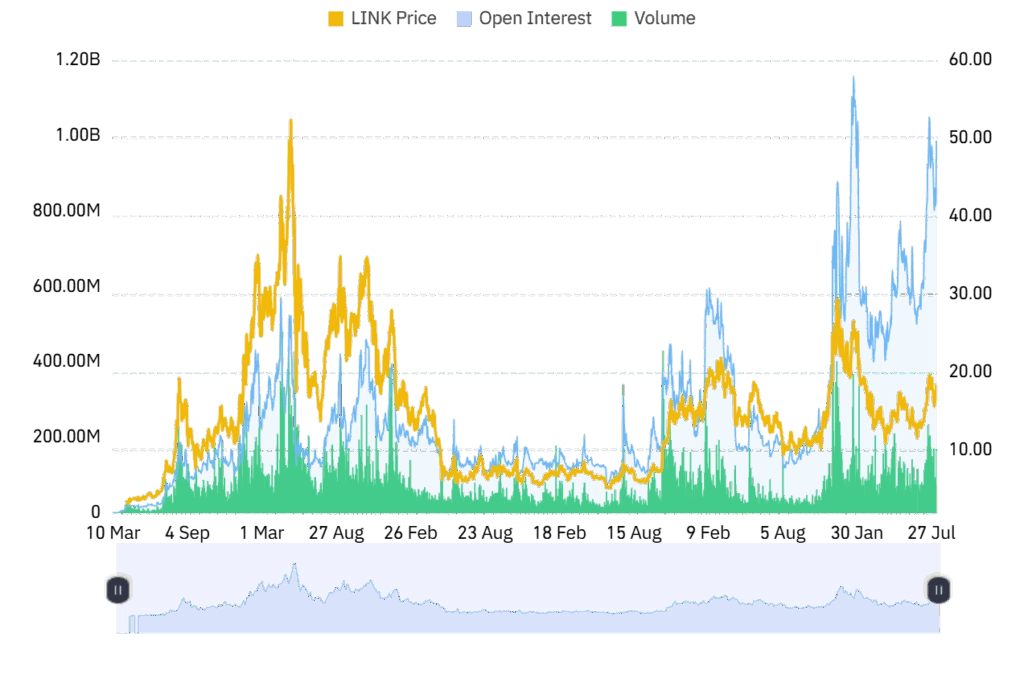

Open interest has increased by +1.05% to $1.11B, and the increased positions entering the market make sense. Trading volume fell -16.54% to $1.86B, showing declining spot activity. The two together indicate that the traders are adding leverage quietly even when market activity is thin. It is a likely setup for a larger move when momentum arises.

Source: Coinglass

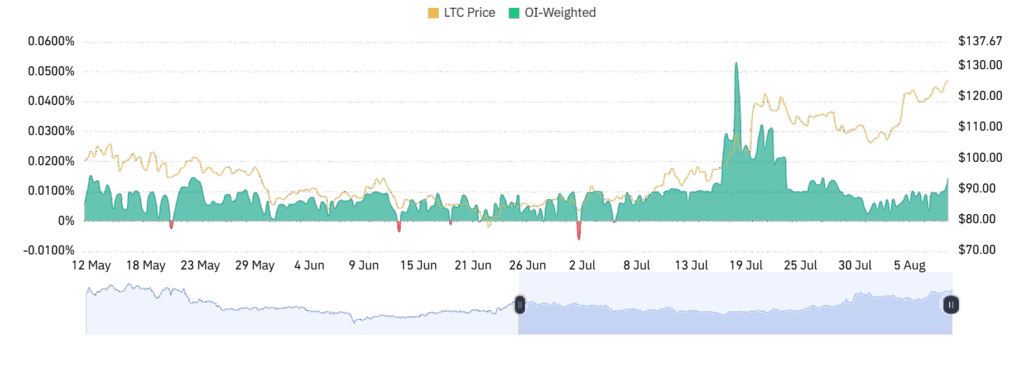

Source: Coinglass OI-weighted funding rate is 0.0142%, showing evenly matched positioning. LTC funding rate has been overall positive, hinting at gentle bullish pressure. Short dips below the zero level are brief moments of bearish dominance. The market is bullish on the whole without overheating signs.

Source: Coinglass

Source: Coinglass Also Read | Litecoin Surges 14% as ETF Buzz, Market Momentum Push LTC Toward $140

Zagham Abbas is a crypto journalist at TronWeekly, focusing on market trends, blockchain innovation, and emerging developments in the digital asset space. He previously contributed to CoinCult and BTC Politan, where he covered key events shaping the crypto industry. With over three years of writing experience, he brings a research-driven and timely approach to crypto reporting.