- PUMP token crashed 12-20% after cofounder Alon Cohen confirmed the anticipated airdrop wont happen anytime soon

- The token has fallen over 50% from its post-ICO peak of $0.0067 and is now trading below its $0.004 ICO price

- Large holders dumped 1.25 billion PUMP tokens worth $3.8 million, losing $1.19 million in the process

- Legal pressure is mounting with expanded lawsuits targeting Solana Foundation, Solana Labs, and Jito team members under RICO law

- Cohen said the team wants the airdrop to be meaningful and executed well while focusing on ecosystem growth first

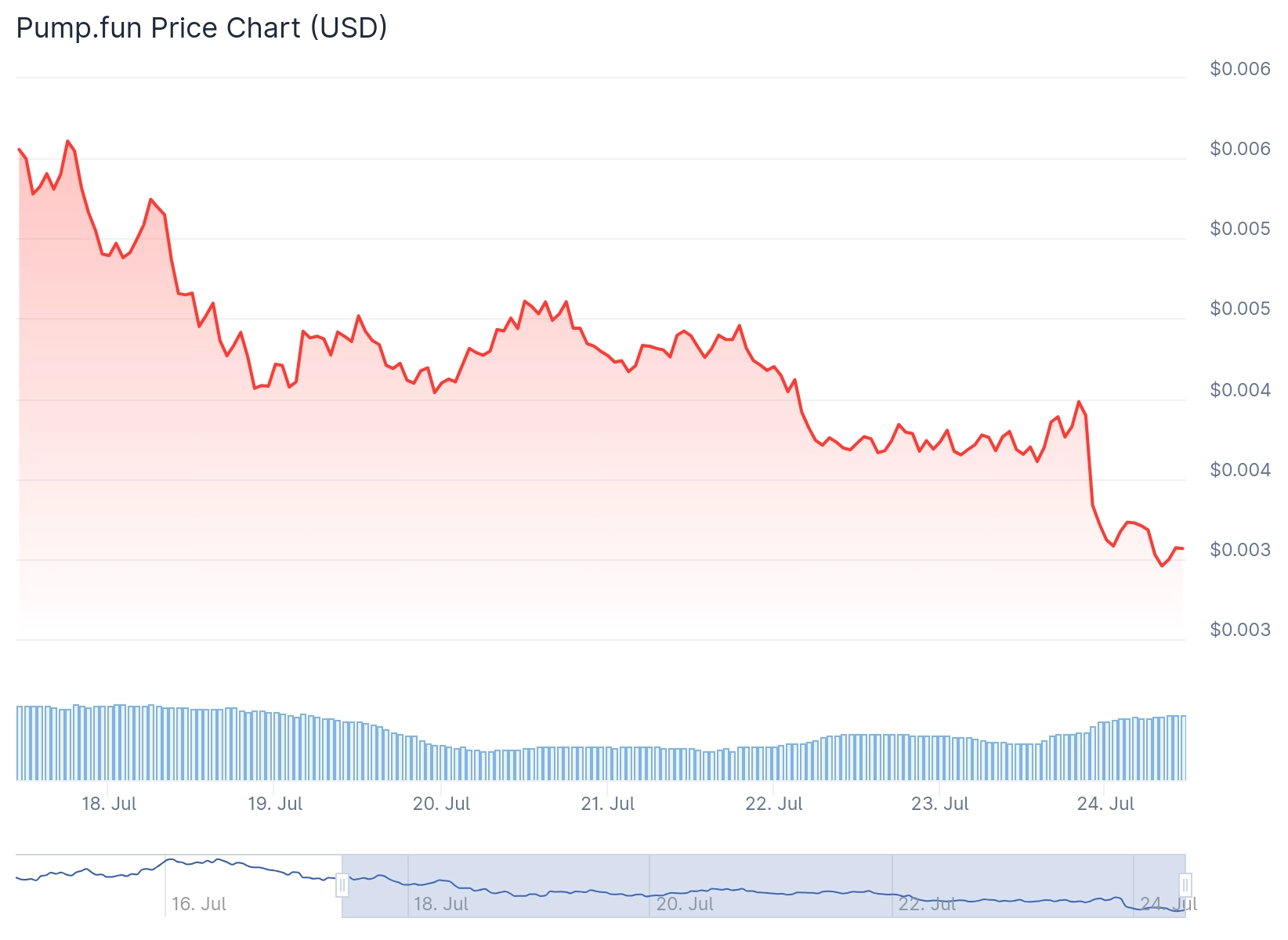

PUMP token price faced heavy selling pressure on Thursday, dropping 17% from a local high of $0.00369 to $0.00305 within 24 hours. The decline came after Pump.fun cofounder Alon Cohen confirmed that the highly anticipated airdrop would not happen soon.

Pump.Fun (PUMP) Price

Pump.Fun (PUMP) Price

The token briefly recovered to $0.003243 but remained down 11% on the day. This extends a longer selloff that began after the tokens launch earlier this month.

PUMP has now fallen more than 52% from its all-time high of $0.0068 reached on July 16. The token is trading below its initial coin offering price of $0.004, which has prompted fresh concerns among investors.

Source: TradingView

Source: TradingView

Speaking in a July 23 interview with Michael ThreadGuy Jerome, Cohen walked back earlier expectations about the airdrop timeline. He said the team still plans to deliver an airdrop but will prioritize execution and ecosystem growth over speed.

Were going to keep our word, but the airdrop is not going to take place in the immediate future, Cohen stated. He added that the team wants the distribution to be meaningful and executed well.

The cofounder explained that Pump.funs priority is to boost ecosystem growth and trading volumes first. He said the team hopes to bring back attention and hype organically rather than relying on giveaways.

Large Holders Exit Positions

On-chain data revealed that large holders were cutting their losses after the airdrop delay news. According to Lookonchain, two wallets likely tied to private sale investors sold 1.25 billion PUMP tokens.

The sales were worth around $3.8 million at roughly $0.00305 per token. These holders realized a loss of $1.19 million on their positions.

The selling pressure reflects broader disappointment among PUMP holders who had expected a near-term airdrop. Crypto enthusiast Shotgun noted that the token hit a new all-time low of $0.00337.

An early user claiming over $1 million in trading volume criticized the teams approach. The user accused the team of turning their back on loyal supporters who helped build the platform.

Legal Challenges Expand

Legal pressure on Pump.fun is also intensifying. On July 23, law firms Burwick Law and Wolf Popper filed an expanded lawsuit against the platform.

Pumpdotfun Litigation Update

Burwick Law, on behalf of plaintiffs, filed a new complaint in federal court in the Southern District of New York alleging RICO claims against Anatoly Yakavenko, Raj Gokal, Dan Albert, Lily Liu, Austin Federa, Solana Labs, Solana Foundation, Alon&

Burwick Law (@BurwickLaw) July 23, 2025

The amended complaint adds the Solana Foundation, Solana Labs, and members of the Jito team as defendants. The lawsuit accuses them of participating in a scheme that may have violated U.S. financial laws.

The complaint cites potential violations of the Racketeer Influenced and Corrupt Organizations Act. It also mentions various securities and anti-money laundering rules.

Solana cofounders Anatoly Yakovenko and Raj Gokal are among the named defendants. Executives from the Solana Foundation and Jito Labs management are also included.

The plaintiffs claim these parties actively participated in designing the token and fee structure for Pump.fun. They argue this goes beyond being passive observers of the ecosystem.

The complaint alleges that Pump.fun, operated by UK-based Baton Corporation, lacks proper user verification. It also claims the platform fails to monitor for suspicious activity and exposes users to financial crime risks.

Pump.fun launched in early 2024 and became popular on Solana for allowing users to create memecoins quickly. The platform approached $1 billion in revenue during the meme coin boom.

The public token sale sold out within minutes, and PUMP price initially surged 16% in premarket trading on Hyperliquid. However, the momentum proved short-lived as utility failed to match early expectations.

Market commentators say the absence of near-term airdrop hype is exposing PUMPs underlying weaknesses. The ecosystem must now prove it can sustain itself without relying on speculative demand.

The Solana Foundation and Jito Labs have not responded publicly to the legal complaints.