Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

HSBC is struggling to find a replacement for chair Mark Tucker. A relatable problem, probably, to many British boards. BP just named a new chair; Prudential seeks one, too. Finding the right balance of experience and availability can be a real chore. Yet if HSBC were based on the other side of the Atlantic, there might be a simple solution: give the job to the chief executive.

Nothing provokes pearl-clutching among UK investors and heavyweight governance watchers as the idea of combining the chair and CEO roles. Its simply not the done thing. Shareholder advisory service ISS calls it a serious breach of good practice given the chairs importance in keeping the chief in check. The UKs corporate governance code asks companies to comply with the principle of separating the two jobs, or explain. Almost all comply.

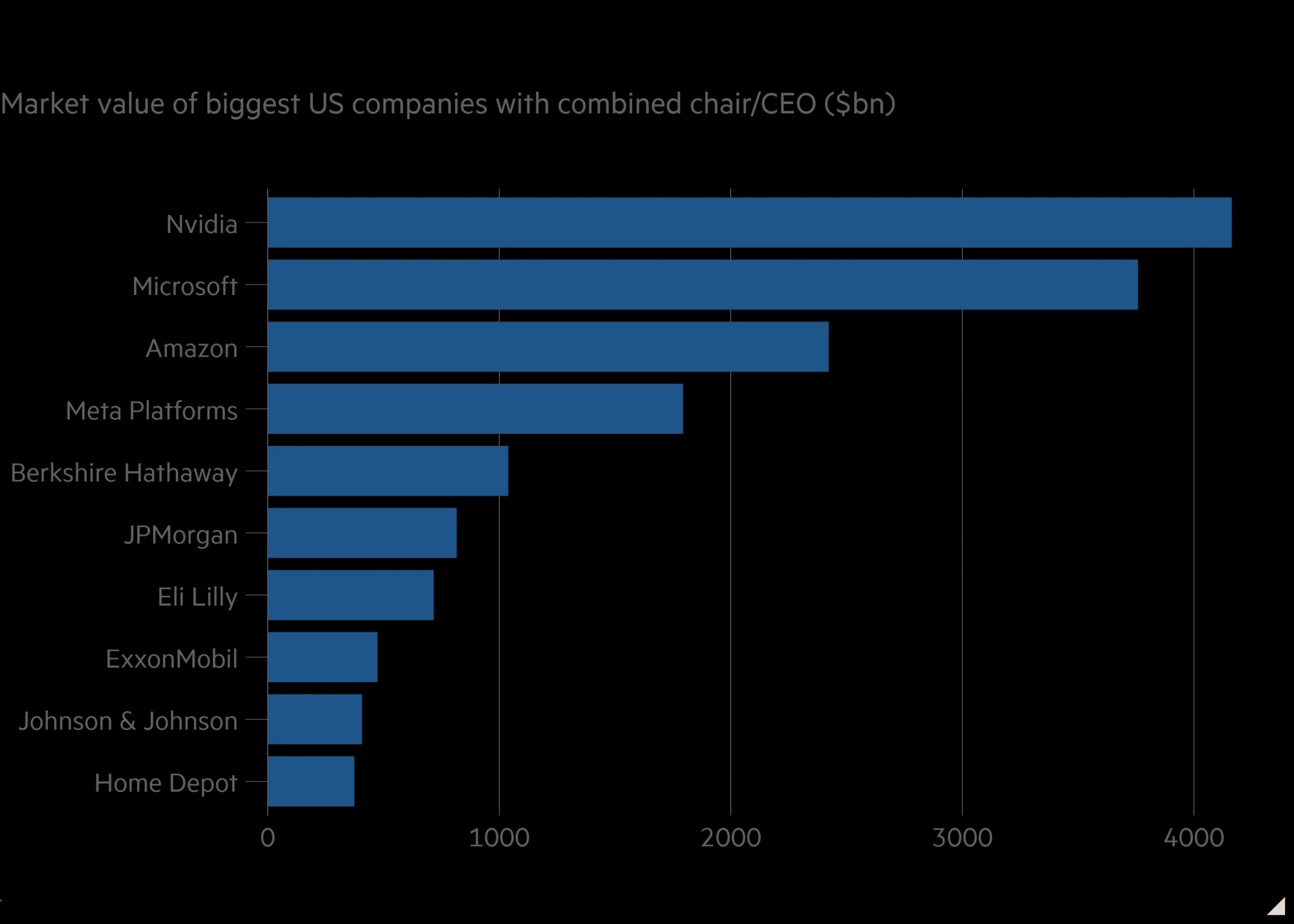

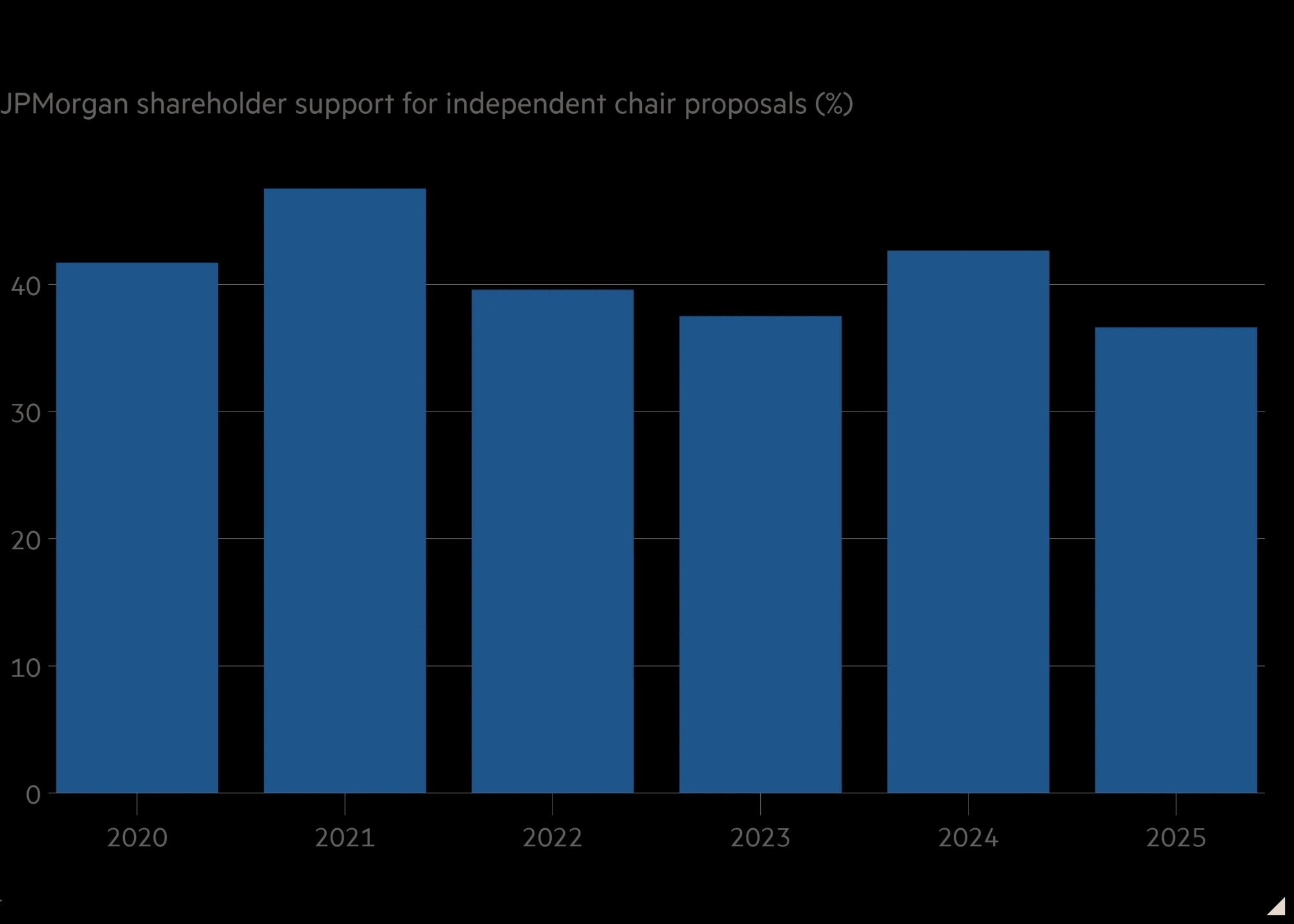

Americans arent fully convinced. About two-fifths of S&P 500 companies combine the two roles, including six of the biggest 10 by market capitalisation. And while the number is falling, shareholders still dont seem to care much. This year, companies fielded 31 proposals to split the chief executive and chair role, down from 44 in 2024, according to Freshfields. Not one received majority support; the average vote was 31 per cent in favour.

Supreme leaders are a recipe for misfortune. But separate chairs arent the only way to hold the CEOs feet to the fire. JPMorgan, like nearly two-thirds of S&P 500 companies that combine the jobs according to the Conference Board/ESGAUGE, argues this is the role of the lead independent director, whose job is to act as a liaison for shareholders, and generally check the board is running as it ought to. Having an independent chair is no guarantee of a well-behaved chief executive either, as Tesla has amply shown.

Putting too much emphasis on the chair risks turning down the volume on the other members of the board, who ought to be acting collectively to keep the company on track. Better to have directors who are, say, taxed with making annual site visits and reporting back to the board and can take joint responsibility for firing the CEO if needed than one strong personality and others who nod along.

Of course, where roles are combined, other board variables matter more. There, the US really does offer some examples to avoid, such as an excessively generous interpretation of how long one can be independent for: Ford Motors John Thornton has been on the board since 1996. Separately, Thornton also happens to be lead director at three other companies. Google parent Alphabets chair yes, Alphabet has a chair has been on the board for more than 20 years.

Now is a good time for the UK to gently question long-held views. The pressure is on to attract companies lured by US markets, where valuations are higher and governance rules more flexible. Britain now permits dual-class shares, for example, for many years unthinkable. Good governance should always command a premium, but the idea that splitting CEO and chair roles is sufficient or absolutely necessary deserves debate.