- SUI price surged 14% in 24 hours to reach $4.26, breaking out of a multi-week consolidation phase

- Trading volume spiked 146% to $2.25 billion, indicating strong institutional and retail interest

- SEC acknowledged 21Shares filing for a SUI ETF, fueling speculation about regulated institutional investment

- Technical analysis shows a bullish cup-and-handle pattern with potential targets reaching $10

- Liquidation clusters around $4.4-$4.6 could trigger a short squeeze pushing prices toward the $5 milestone

Sui has posted strong gains over the past 24 hours, climbing 14% to reach $4.26. The move marks a clear breakout from weeks of sideways trading.

SUI Price

SUI Price

The rally gained momentum after breaking above the $4.20 resistance level. This technical breakthrough ended a prolonged consolidation phase that had kept the token range-bound.

Trading volume tells the story of increased interest. The 24-hour volume jumped 146% to $2.25 billion, pointing to large-scale buying activity from both retail and institutional participants.

Source: TradingView

Source: TradingView

The Relative Strength Index sits at 61.3, suggesting the token has room to climb before reaching overbought territory. Technical analysts have identified a bullish cup-and-handle formation on the daily chart.

This pattern typically indicates continued upward momentum. Some analysts are targeting $10 as a long-term price objective based on this formation. The token is currently trading above its 50-day exponential moving average at $3.05.

ETF Filing Adds Institutional Interest

The SEC has officially acknowledged 21Shares filing for a SUI exchange-traded fund. This development has sparked fresh speculation about regulated institutional capital entering the Sui ecosystem.

While ETF approval remains uncertain, the acknowledgment alone has provided a catalyst for increased trading activity. The filing represents a step toward mainstream financial product offerings for SUI.

Institutional interest appears to be growing across multiple fronts. The combination of ETF speculation and technical breakouts has created a favorable environment for continued price appreciation.

Ecosystem Growth Supports Price Action

Suis decentralized finance ecosystem continues expanding. The total value locked recently reached $2.33 billion, driven primarily by protocols like Suilend and NAVI.

New cross-chain integrations have also boosted utility. NEAR Protocols Intents integration has expanded accessibility for users across different blockchain networks. These developments strengthen the fundamental case for SUIs price appreciation.

Bitcoins recovery provided additional support for the altcoin rally. BTC bounced $3,000 from $114,500 to $117,000, lifting overall cryptocurrency market liquidity by $70 billion in a single day.

The next technical resistance level sits near $4.34. Traders are watching the 161.8% Fibonacci extension zone as a potential price ceiling for the current move.

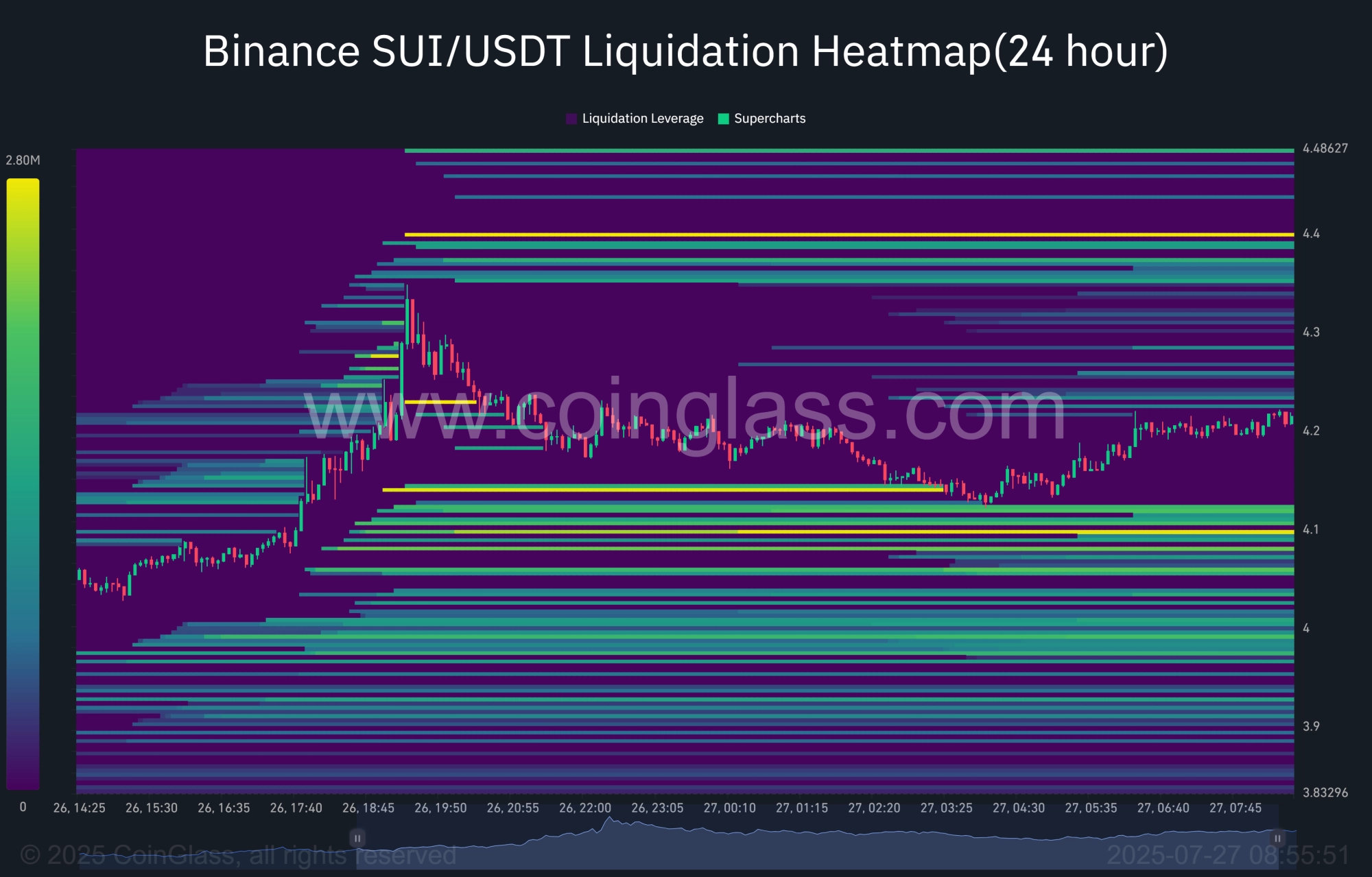

Source: Coinglass

Source: Coinglass

Liquidation data shows clusters of stop-losses around $4.4 to $4.6. If SUI pushes into this zone, forced buybacks could trigger a short squeeze effect.

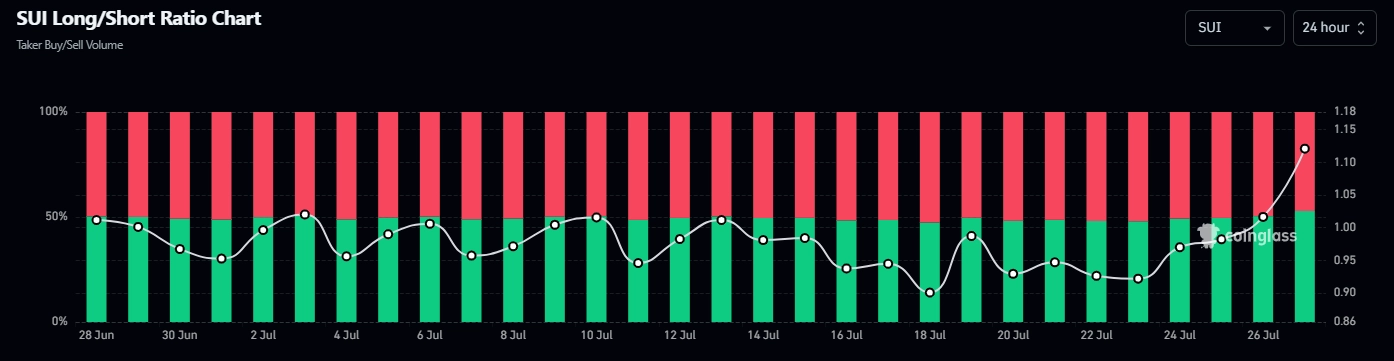

Source: Coinglass

Source: Coinglass

The Long/Short Ratio currently stands at 51%, indicating that bullish positions remain dominant in derivatives markets. This positioning suggests continued confidence in upward price movement.

Current price structure maintains a bullish bias as SUI approaches the psychological $5 level. The combination of technical momentum, institutional interest, and ecosystem growth supports the potential for further gains.

The tokens RSI indicates an oversold condition on longer timeframes, suggesting room for additional upward movement. Trading above the 23.6% Fibonacci level at $3.85 provides technical support for the current rally.