Tethers USDT is only 81.5% compliant with the GENIUS Act, per the Q2 reserves report. But Tether still has a 3-year window. The CEO recently stated that theyll issue a new stablecoin focused on the U.S. market.

U.S. President Donald Trump signed the stablecoin bill, the GENIUS Act, into law on the 18th of July. This marked a historic shift for regulated issuers of digital dollars on blockchain rails.

Crypto and AI czar David Sacks hailed it as a way to update archaic payment rails with revolutionary stablecoin payment systems. He added ,

For every digital dollar in a crypto wallet, there will be a traditional dollar reserved in a US bank account, creating trillions of dollars of demand for U.S. Treasuries.

With clear rules, now the focus will shift to potential issuers, and the dominant player, El Salvador-based Tether (USDT) , has hit headlines again.

Tethers 3-year window and U.S. plans

Commenting after the bill became law, Nic Carter, partner at crypto-focused VC Crystal Island Ventures, said ,

Under GENIUS, Tether (in its current form), would be phased out from being used by domestic service providers within 3 years.

Carter was referencing the GENIUS Act , section 3(b), which states,

Beginning 3 years after enactment, it shall be unlawful for a digital asset service provider to offer or sell a payment stablecoin to a person in the U.S., unless the stablecoin is issued by a permitted payment stablecoin issuer.

Additionally, the law requires that the issuer hold 100% of the reserves in cash, cash equivalents, or U.S. short-term treasury bills (T-bills).

Earlier in the year, J.P. Morgan reported that Tethers reserve backing was only 84% compliant with the GENIUS Act at that time. This was based on its T-bills, cash, and cash equivalents.

In response, Tether CEO, Paolo Ardoino, dismissed the report and stated that the firm was very liquid with over $1B in quarterly profits from T-bills interest alone.

Now, in mid-2025, the firm was still short of the 100% reserve compliance.

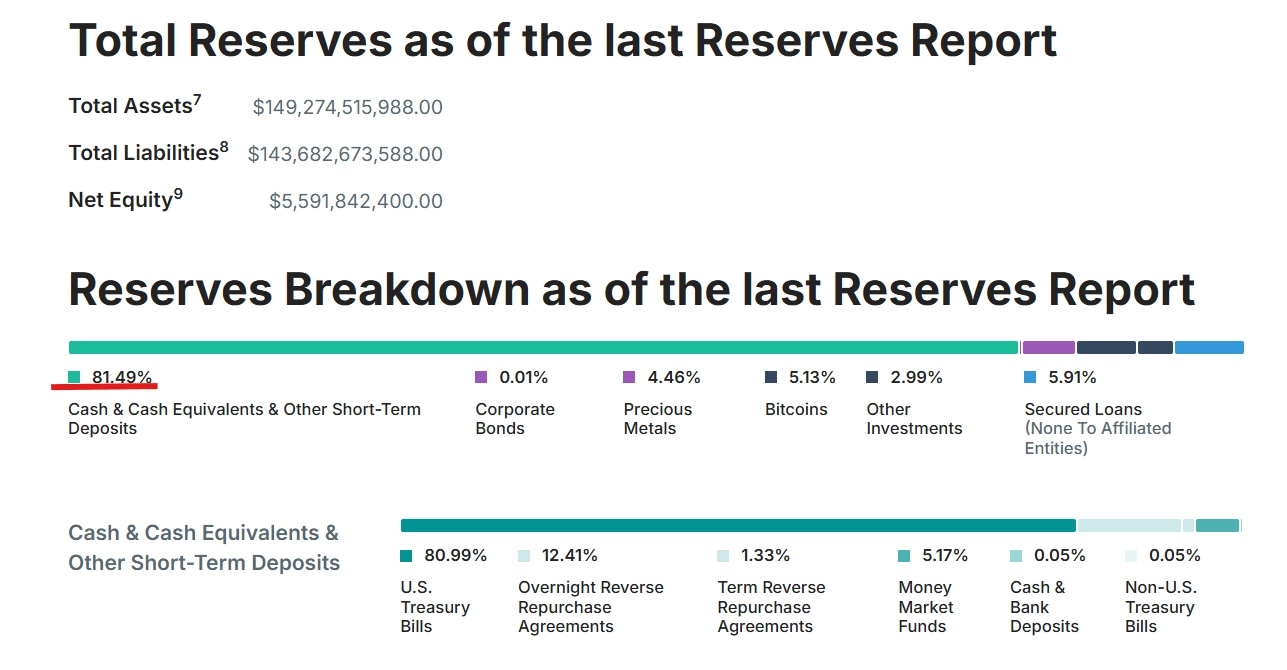

The Q2 2025 reserves report showed that Tethers cash and T-bills exposure accounted for 81.49% and the rest was in Bitcoin [BTC] , precious metals, and loans.

Source: Tethers Q2 reserves report

That said, last month, Ardoino stated that USDT will be focused on emerging markets, but Tether will explore a new stablecoin for the U.S. market with a yield-sharing feature like other issuers.

Meanwhile, federal agencies like the Federal Reserve and the Treasury Department are expected to issue regulations implementing the Act within six months, per Pillsbury Law .

Those regulations will likely be finalized and become operational by early to mid2026, as specified in the promulgated regulations.