This content is provided by a sponsor.

PRESS RELEASE.

Geneva, Switzerland, May 15, 2025 – TRON DAO , the community-governed DAO dedicated to accelerating the decentralization of the internet through blockchain technology and decentralized applications (dApps), has adopted Chainlink Data Feeds as the official data oracle solution for the TRON ecosystem. This upgrade follows TRON DAO joining the Chainlink Scale program in October 2024.

The integration of Chainlink Data Feeds represents a strategic enhancement for TRON’s DeFi infrastructure, reinforcing security and reliability across the ecosystem. By adopting Chainlink as the official oracle solution, TRON DAO ensures that DeFi applications on the network benefit from the Chainlink standard for verifiable data.

“We’re excited that the TRON community has upgraded to Chainlink Data Feeds as the official data oracle solution for the TRON network, following TRON DAO’s decision to join the Chainlink Scale program earlier last year to accelerate its ecosystem’s growth. With over $5.5 billion in DeFi TVL on TRON now secured by Chainlink oracles, this upgrade marks a major milestone in the TRON DAO community’s commitment to leveraging robust and scalable DeFi infrastructure,” said Thodoris Karakostas, Head of Blockchain Partnerships at Chainlink Labs.

By leveraging Chainlink’s verifiable data infrastructure, TRON DAO continues to advance its mission of fostering a decentralized, transparent, and secure blockchain ecosystem. Developers and DeFi projects building on TRON can now utilize Chainlink’s trusted data solutions to create innovative and secure DeFi applications.

“By integrating Chainlink Data Feeds as the official oracle solution, TRON DAO is strengthening its DeFi ecosystem with a secure and reliable infrastructure,” said Sam Elfarra, Community Spokesperson for TRON DAO. “This transition empowers developers to build more scalable and resilient DeFi applications on TRON.”

As part of this transition, support and reliance on WINkLink as the oracle solution for TRON is discontinued. This move further strengthens TRON’s DeFi landscape where JustLend , the largest DeFi lending application on TRON, and others including the JustStable DeFi application and the USDD protocol will provide over $5.5 billion in total value locked (TVL), which will be secured by the Chainlink standard.

About TRON DAO

TRON DAO is a community-governed DAO dedicated to accelerating the decentralization of the internet via blockchain technology and dApps.

Founded in September 2017 by H.E. Justin Sun, the TRON blockchain has experienced significant growth since its MainNet launch in May 2018. TRON hosts the largest circulating supply of USD Tether ( USDT) stablecoin, exceeding $73 billion. As of May 2025, the TRON blockchain has recorded over 306 million in total user accounts, more than 10 billion in total transactions, and over $23 billion in total value locked (TVL), based on TRONSCAN.

TRONNetwork | TRONDAO | X | YouTube | Telegram | Discord | Reddit | GitHub | Medium | Forum

Media Contact

Yeweon Park

About Chainlink

Chainlink is the standard for onchain finance, verifiable data, and cross-chain interoperability. Chainlink is unifying liquidity across global markets and has enabled over $20 trillion in transaction value across the blockchain economy. Major financial market infrastructures and institutions, such as Swift, Fidelity International, and ANZ Bank, as well as top DeFi protocols including Aave, GMX, and Lido, use Chainlink to power next-generation applications for banking, asset management, and other major sectors. Learn more by visiting chain.link .

________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP is currently trading between $2.54 and $2.57 over the last hour, with a market capitalization of $150.38 billion. Over the past 24 hours, it has seen a trading volume of $5.6 billion and an intraday price range between $2.52 and $2.63.

XRP

On the 1-hour chart, XRP’s bullish momentum shows signs of exhaustion, despite the recent upward movement. After peaking at $2.651, the price action has been marked by consecutive red candlesticks and declining volume, which signals a potential short-term retracement. The appearance of a bearish divergence—indicated by lower volume accompanying tests of similar price levels—suggests a cooling phase. Traders may find opportunities by watching support around $2.55–$2.57; however, a break below $2.54 may lead the price to test the $2.50 level rapidly, warranting caution for short-term positions.

XRP/USDC 1H chart via Binance on May 14, 2025.

XRP/USDC 1H chart via Binance on May 14, 2025.

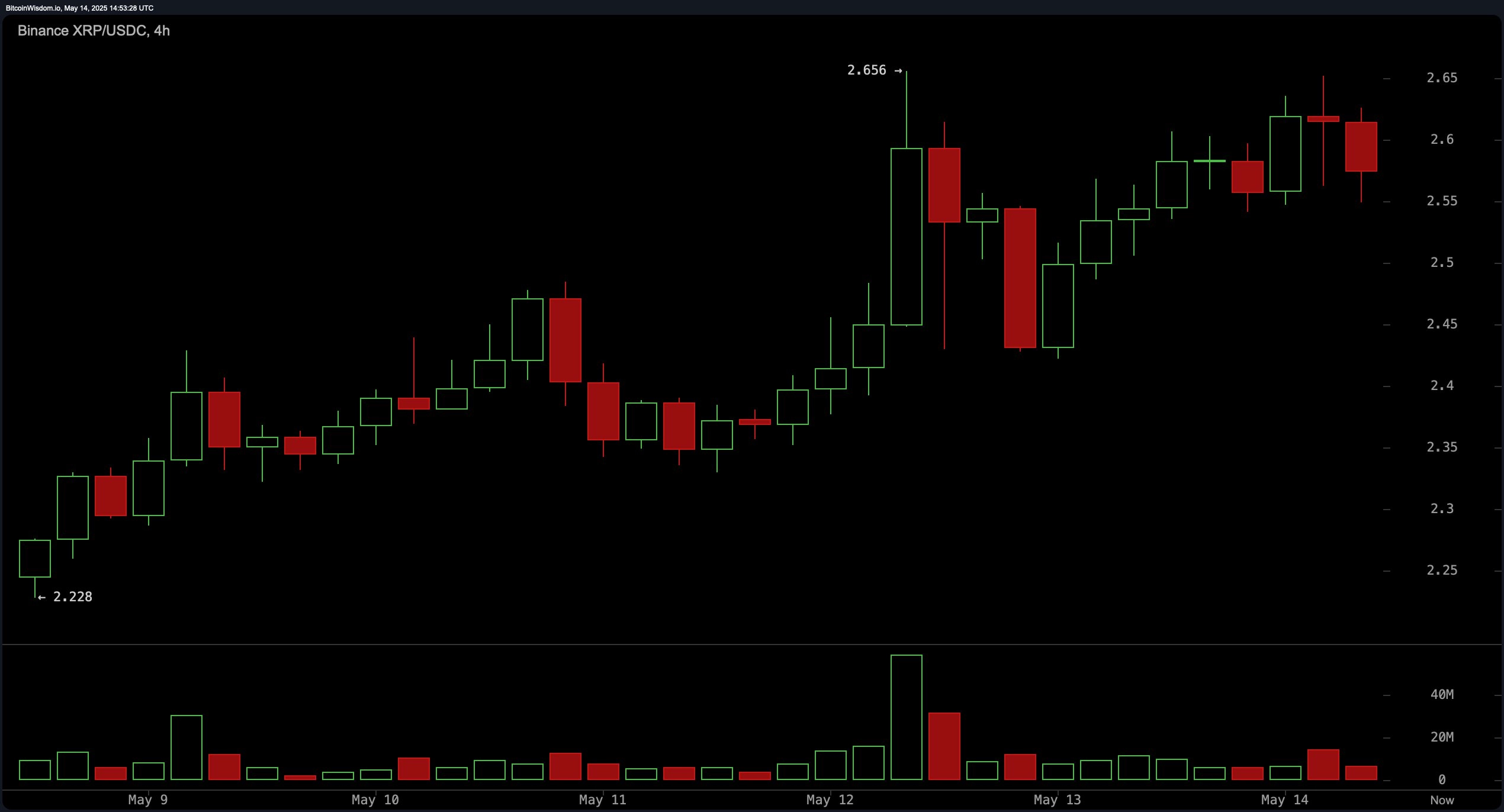

The 4-hour chart presents a sustained uptrend, although early signs of waning momentum are apparent. Price action following a large bullish candle has transitioned into a series of indecisive candlesticks, potentially forming a bullish flag or signaling the beginning of a distribution phase. A notable upper wick rejection at $2.656 illustrates heightened selling pressure near that resistance. As long as XRP holds above $2.50, the medium-term bullish structure remains intact. Entries near the $2.45–$2.50 range could present favorable risk-reward setups, while a confirmed breakout above $2.66, supported by increased volume, could validate a continuation to higher price targets.

XRP/USDC 4H chart via Binance on May 14, 2025.

XRP/USDC 4H chart via Binance on May 14, 2025.

The daily chart analysis highlights a strong bullish breakout that recently propelled XRP past former resistance levels around $2.30, reaching a high of $2.656. A substantial surge in buying volume validated the upward move, although the current formation of small-bodied candles reflects indecision and potential consolidation near the recent peak. Key support levels now lie at $2.30 and $2.10, which previously acted as resistance. A strategic entry point for swing or position traders would be on dips toward the $2.30–$2.40 range, especially if volume confirms a bounce. A decline below $2.10 would compromise the broader bullish structure and suggest a deeper correction.

XRP/USDC 1D chart via Binance on May 14, 2025.

XRP/USDC 1D chart via Binance on May 14, 2025.

The oscillator indicators provide a mixed outlook. The relative strength index (RSI) at 67.92130 and Stochastic at 84.12581 both remain in neutral zones, indicating neither overbought nor oversold conditions. The commodity channel index (CCI) at 180.06346 signals a potential sell, suggesting prices may be extended above their mean. Meanwhile, the average directional index (ADX) at 21.30462 also shows neutrality, lacking a strong trend confirmation. Positive momentum is observed with the momentum reading at 0.41380 and the moving average convergence divergence (MACD) level at 0.09519, both suggesting ongoing buying interest.

All moving averages continue to support a bullish stance. Both the exponential moving averages (EMA) and simple moving averages (SMA) for the 10, 20, 30, 50, 100, and 200 periods indicate bullish signals. Specifically, the exponential moving average (10) stands at $2.41372, and the simple moving average (10) is at $2.36197, both sitting below the current price, reinforcing the short-term bullish outlook. Long-term indicators such as the exponential moving average (200) at $2.02880 and simple moving average (200) at $2.14926 reflect strong underlying support for XRP, aligning with the uptrend visible on higher timeframes. This unified bullish consensus across moving averages underscores a robust trend continuation scenario, barring significant macro or technical disruptions.

Bull Verdict:

XRP’s consistent support across all major exponential and simple moving averages, alongside bullish momentum signals from the moving average convergence divergence (MACD) and momentum indicators, underpins a strong technical foundation for further gains. If buying volume resurfaces on dips and resistance at $2.66 is decisively broken, XRP could accelerate toward $2.70 and beyond, validating a continuation of the uptrend.

Bear Verdict:

Despite the bullish trend on higher timeframes, warning signs on the 1-hour and 4-hour charts—such as bearish divergence, declining volume, and resistance rejection at $2.656—suggest a possible near-term pullback. A failure to hold support at $2.50 and especially a breach below $2.45 would likely trigger a deeper correction, potentially challenging the $2.30 level and undermining the current bullish structure.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons