City staff are now charged with conducting a thorough analysis of this proposal.

Key Takeaways

- The Vancouver City Council has approved a motion to make the city "Bitcoin-friendly."

- Mayor Sim advocates for the adoption of Bitcoin as a means to protect the city’s purchasing power from inflationary pressures.

Vancouver City Council has greenlit a proposal to explore the incorporation of Bitcoin into municipal financial operations, including the possibility of holding Bitcoin as a reserve asset and accepting it for payments.

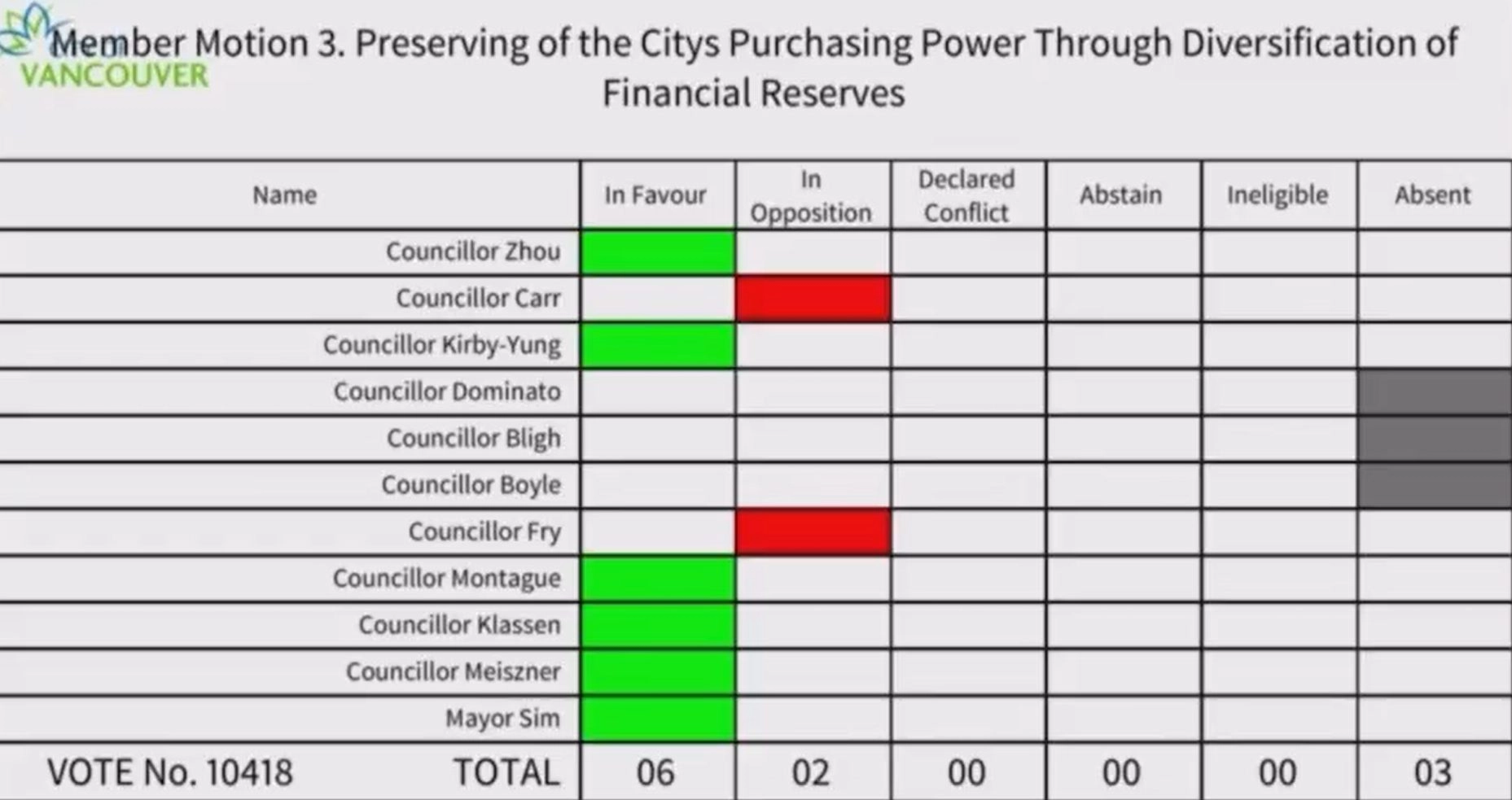

The motion, submitted by Mayor Ken Sim, passed during a council meeting on Wednesday with the support of six councilors, effectively directing city staff to explore the feasibility of making Vancouver a “Bitcoin-friendly city.”

Mayor Sim, who owns shares in Coinbase Global Inc., believes that adopting Bitcoin as part of the city’s financial strategy will help safeguard its purchasing power against inflation. He has pledged to donate $10,000 worth of Bitcoin to the city.

“Our family is going to donate $10,000 to the City of Vancouver in the form of bitcoin and this is going to be a gift to the city that we love,” he said during the meeting. “We totally believe in the benefits of this and we’re putting our money where our mouth is.”

The proposal has faced opposition from local experts and government officials due to Bitcoin’s price volatility.

The Ministry of Housing and Municipal Affairs stated that neither the Community Charter nor the Vancouver Charter recognizes crypto as payment for “municipal services or other transactions.” The ministry also confirmed that local governments cannot hold financial reserves in digital assets.

Green Councilor Pete Fry, who opposed the motion, expressed concerns about illicit activities.

“In the absence of any really specific acknowledgement of … the very serious issues around money laundering and the history in this city, I don’t think this is a step in the right direction,” he said.

City staff is now tasked with analyzing the initiative and delivering a detailed report by the end of Q1 2025, examining the risks, benefits, and practical considerations of Bitcoin asset management. The plan includes consulting with financial advisors, crypto experts, and community stakeholders.

The push for Bitcoin adoption has been on the rise since Donald Trump’s election victory. Trump has expressed intentions to create a more favorable regulatory environment for the crypto industry.

The trend is now expanding on a global scale, with discussions around a strategic Bitcoin reserve gaining traction among other nations’ lawmakers. Last month, Switzerland’s Canton of Bern passed a proposal to explore Bitcoin mining as a solution to excess energy utilization and power grid stabilization.

Disclaimer