Oil rallied almost 3% on Tuesday morning as tensions in the Middle East continue to escalate.

Will Israel Strike Irans Upstream Infrastructure?

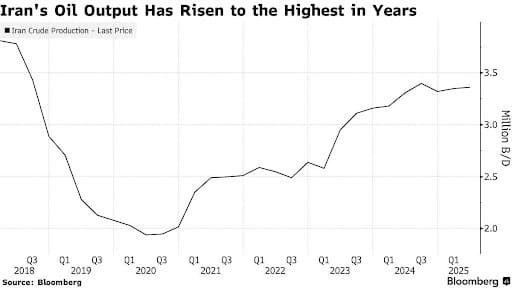

- As the Israel-Iran war shows no signs of abating, market participants are speculating whether Israel could target Irans oil export infrastructure after its strikes on the South Pars gas field. - Up until now, Iranian oil exports have seen no impact from the barrage of missile strikes with May exports posting a multi-year high of 1.8 million b/d and June loadings keeping the same pace so far. - Iranian producers of methanol, ammonia and urea have mostly shut production in a precautionary way, following strikes on the Tehran refinery, which the Iranian side reciprocated by hitting Israels 195,000 b/d Haifa refinery.

- Israel has no crude production of its own, relying for imports to meet its downstream needs, however the Leviathan and Tamar fields could be targets for Irans missile strikes, prompting the Israeli government to shut both fields down.

Market Movers

- US oil major ExxonMobil (NYSE:XOM) has started to drill the Lukanani-2 well using the Stena Carron drillship, seeking to build another production hub around the field that already saw one successful discovery in April 2022.

- The executive board of Canadian producer MEG Energy (TSE:MEG) urged the companys shareholders to reject the $4.5 billion hostile takeover bid from Strathcona Resources, calling the bid inadequate.

- French oil major TotalEnergies (NYSE:TTE) has purchased a 25% interest in Chevrons US Gulf of America offshore portfolio for an undisclosed sum, covering 40 federal exploration leases.

- Japans Mitsubishi Corp (TYO:8058) is in negotiations with private equity-held US shale producer Aethon Energy Management to buy its Haynesville assets for $8 billion, failing to reach a deal with UAEs ADNOC.

Tuesday, June 17, 2025

Oil trading has seen some of its most volatile days in recent history as non-stop missile strikes exchanged between Israel and Iran ratcheted up fears of potential supply disruptions from the Middle East. Amidst unsubstantiated reports of the two sides seeking a ceasefire, the risk premium is back in the ICE Brent as the global crude benchmark remains around the $75 per barrel mark.

Diesel Gains the Most from Middle East Flare-up. US diesel futures saw an unprecedented surge in the wake of the Israel-Iran hostilities, rising even steeper than crude oil to $2.38 per gallon and improving the ULSD crack to a whopping $28 per barrel, as markets feared supply disruptions from the Middle East.

Worlds Largest Gas Field Reduces Output. Israels strikes on Irans section of the South Pars field, the continuation of Qatars North Dome play into Iranian territorial waters, debilitated one of the four refining units of Phase 14 with a capacity of 4 bcm per year or 2% of the countrys output.

Egypt Doubles Down on Fuel Oil. Unable to tap into Israeli pipeline gas supplies after the forced halt of the Leviathan and Tamar offshore gas fields, Egypt is reportedly preparing to issue a hefty 1-million-tonne import tender for fuel oil, facing rolling blackouts amidst peak summer temperatures.

Chinese Refinery Runs Dip Even Lower. Chinas refinery throughput posted a 1.8% year-on-year decline to average 13.92 million b/d in May, the lowest levels since August 2024 as many refiners took capacity offline for maintenance works and saw operating rates decline to a mere 73%.

Urals Back to Trading Above Price Cap. As the European Union mulls lowering the oil price cap for Russia from $60 per barrel to $45 per barrel, the rise in global crude prices has brought the price of Moscows benchmark Urals grade back into non-compliant territory, around $62-63 per barrel.

UAE Expands into Australias Offshore Gas. ADNOC, the national oil company of Abu Dhabi, has offered almost $19 billion for Australias gas-focused producer Santos (ASX:STO), offering a premium of more than 27% to the Adelaide-based producers Friday closing price of $4.52 per share.

Russia-Ukraine Refinery Warfare Drags on. Overshadowed by the Israel-Iran conflict, the moratorium on energy infrastructure attacks between Russia and Ukraine is no longer intact, with Moscow claiming to have struck Ukraines only remaining refinery in Kremenchug.

A New Franco-Malaysian Tandem is Emerging. Frances state energy firm TotalEnergies (NYSE:TTE) continued its buying streak in Malaysian gas assets operated by Petronas, taking new stakes in several offshore areas, including blocks SK301b and SK313 with proven gas reserves of 4 TCf.

China Approves Mega Agriculture Merger. Following months of waiting, Chinas market regulator has granted conditional approval to the $34 billion merger of agricultural giants Bunge (NYSE:BG) and Glencore-backed Viterra, despite noting that the new giants market share could reduce competition.

EU to Ban New Russian Gas Deals Despite Vetoes. Overriding the opposition of Hungary and Slovakia, Brussels is preparing to formally ban EU Russian gas and LNG imports by the end of 2027, adding momentum to TTFs pricing upside as Europes gas benchmark rose to �38 per MWh.

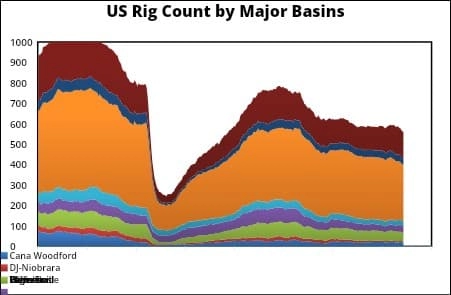

OPEC Shuns Demand Worries. In its monthly report, OPEC curbed its 2026 outlook for non-OPEC supply to 730,000 b/d amidst expectations of stagnating US supply, whilst the oil group kept demand projection for both 2025 and 2026 intact, maintaining that economic growth will remain robust.

Glencore Takes Root in Singapore. Aster Chemicals and Energy, a joint venture between global trader Glencore and Indonesias Chandra Asri, agreed to fully acquire a 70,000 b/d condensate splitter in Singapore, buying the remaining half from petchem firm PCS, boosting its refining capacity.

UAE Tanker Collision Scares Markets. In what was initially believed to be a result of a missile strike, two oil tankers collided and caught fire near the Strait of Hormuz, with a VLCC carrying Iraqi oil to Zhoushan, China hitting a ballasting tanker that was slowly moving away from its anchorage in Khor Fakkan.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com