Aave, Link, Ondo Experience Surge: Analysing the Top Performers of the Week

- The global crypto market cap has reached US$3.71 trillion amid extreme greed sentiment.

- Aave’s price surged 46% week-on-week, currently trading halfway to its all-time high.

- Aave community considers halting operations on Polygon due to risks from a new governance proposal.

- Chainlink and Ondo see significant gains, driven by new partnerships and institutional adoption.

The crypto market continues to trend upward, with the global crypto market cap reaching US$3.71 trillion (AU$5.81 trillion), while the Fear and Greed Index remains in Extreme Greed territory.

Related: Sui Hits All-Time High Amid Strategic Partnership Announcement

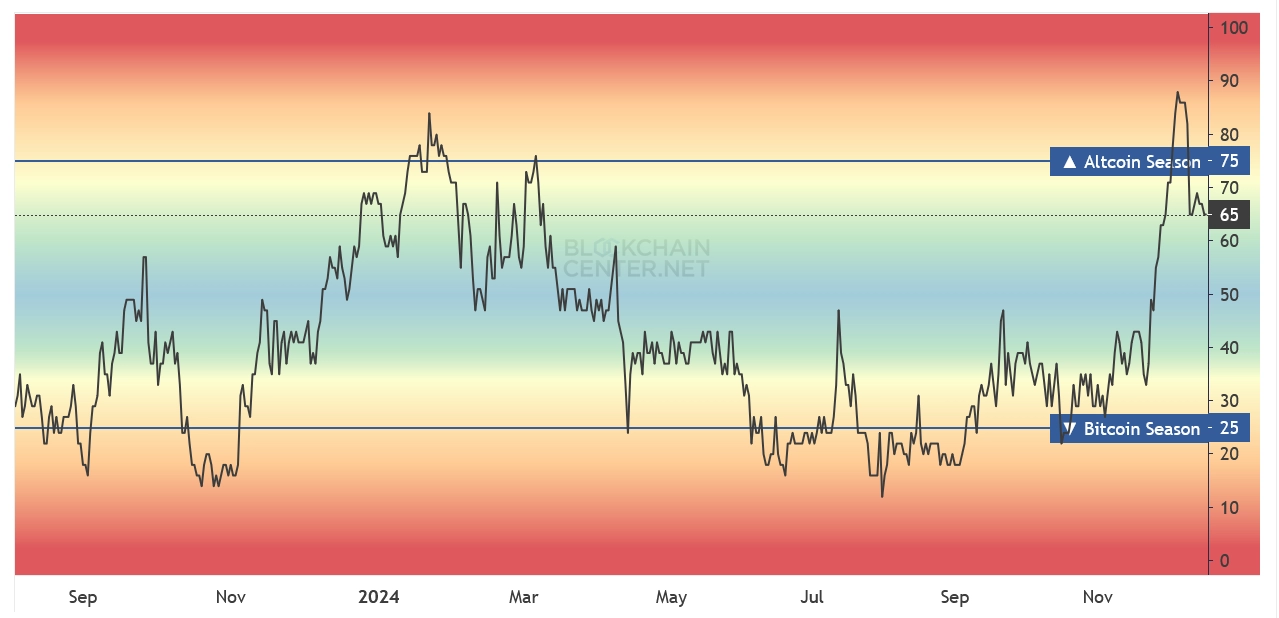

And while – according to the altcoin season index – altseason is still not here yet, there are some altcoins outperforming Bitcoin.

Altcoin Season Index, source: blockchaincenter.net

Altcoin Season Index, source: blockchaincenter.net

One of the strongest weekly gainers is Aave (AAVE), which has rallied 46% week-on-week. Currently Aave trades for US$378.92 (AU$594.26), just over half-way to its all-time high (ATH) of US$666.68 (AU$1,045.57) from May 2021.

Advertisement

Aave (AAVE), annual chart, source: CoinMarketCap

Aave (AAVE), annual chart, source: CoinMarketCap

Aave’s surge was in part driven by substantial purchases from World Liberty Financial (WLFI), a DeFi protocol linked to Donald Trump, sparking increased demand and trading volume. However, despite this, the rally has somewhat slowed over the past few days, following community concerns over a Polygon collab.

The Aave community is considering halting operations on the Polygon network following a proposal by Aave founder Marc Zeller to reassess the risk profile of bridged assets.

X user 0xWenMoon explains that Aave’s proposal to potentially cease operations on Polygon is a reaction to a Polygon governance proposal, which could result in assets on the network being partially collateralised by Aave’s competitors.

This poses a significant risk to Aave, as it would expose their liquidity providers to the risks associated with their competitors.

0xWenMoon’s comments view Aave’s move as a rational business decision and risk management strategy, and also as a strategic threat to Polygon, emphasising that if the bridge proposal is accepted, Aave might withdraw from the network.

Link and Ondo Continue Their Rally

Meanwhile Chainlink (LINK) continues its rally toward US$30, currently trading for US$28.91 (AU$45.36), up 29% week-on-week.

LINK, which was also on the shopping list of WLFI, recently joined Emirates NBD banking group in an interesting new partnership and introduced Cross-Chain Interoperability Protocol (CCIP) on the Ronin network.

Related: Ethereum Poised for New All-Time High in Q1, Says Analyst

CCIP is going from strength to strength as adoption continues and collaborations include large corporations and banks.

Ondo (ONDO) is another medium-large cap crypto benefitting from tokenisation and institutional adoption. Ian De Bode, Chief Strategy Officer at Ondo Finance explained that they see tokenisation as a means for Trad-Fi players to “tap into crypto rails as a new distribution mechanism”.

ONDO has increased 30% week-on-week, currently trading for US$1.99 (AU$3.12), and has reached a US$2.77 billion (AU$4.34 billion) market cap.