BiT Global sues Coinbase over unfairly delisting wBTC while allowing PEPE, WIF to trade

BiT Global accuses Coinbase of manipulating the market to favor its own wrapped Bitcoin product.

Photo: NurPhoto/Getty Images

Key Takeaways

- BiT Global has sued Coinbase for unfairly delisting wBTC to promote its own cbBTC.

- Coinbase is accused of violating antitrust laws and misleading statements regarding wBTC standards.

BiT Global has initiated a lawsuit against Coinbase, alleging the exchange unfairly delisted wrapped Bitcoin (wBTC) to promote its own competing product, Coinbase Wrapped BTC (cbBTC). The company argues that Coinbase’s claim of delisting wBTC due to “listing standards” is false, especially given that the exchange has recently onboarded several meme coins, including PEPE, WIF, and MOG.

The lawsuit, filed on December 13, claims Coinbase violated federal antitrust laws by attempting to monopolize the wrapped Bitcoin market and using its dominant position to harm competition.

BiT Global contends that Coinbase’s stated reason for delisting wBTC due to “listing standards” is contradicted by the exchange’s recent approval of several meme-based digital assets. The complaint specifically cites Coinbase’s recent listing of PEPE, WIF, and MOG.

$MOG is a crypto coin with no intrinsic value or expectation of financial return. Just because some people are getting ridiculously rich buying crypto doesn’t mean you definitely will. MOG is to be used strictly for getting laid and for entertainment purposes only,” the lawsuit wrote, citing MOG’s own disclaimer.

“Coinbase’s decision to list Mog just two weeks after delisting wBTC demonstrates that the decision had nothing to do with standards, and everything to do with unfairly and fraudulently pushing wBTC out of the market,” the complaint argues.

BiT Global also alleges that Coinbase made false and misleading statements about wBTC’s compliance with its listing standards, through the delisting announcement.

The lawsuit demands more than $1 billion in damages and calls for injunctive relief to avert additional harm.

The filing comes ahead of wBTC’s trading suspension on Coinbase. The exchange first announced the delisting of the product on November 19.

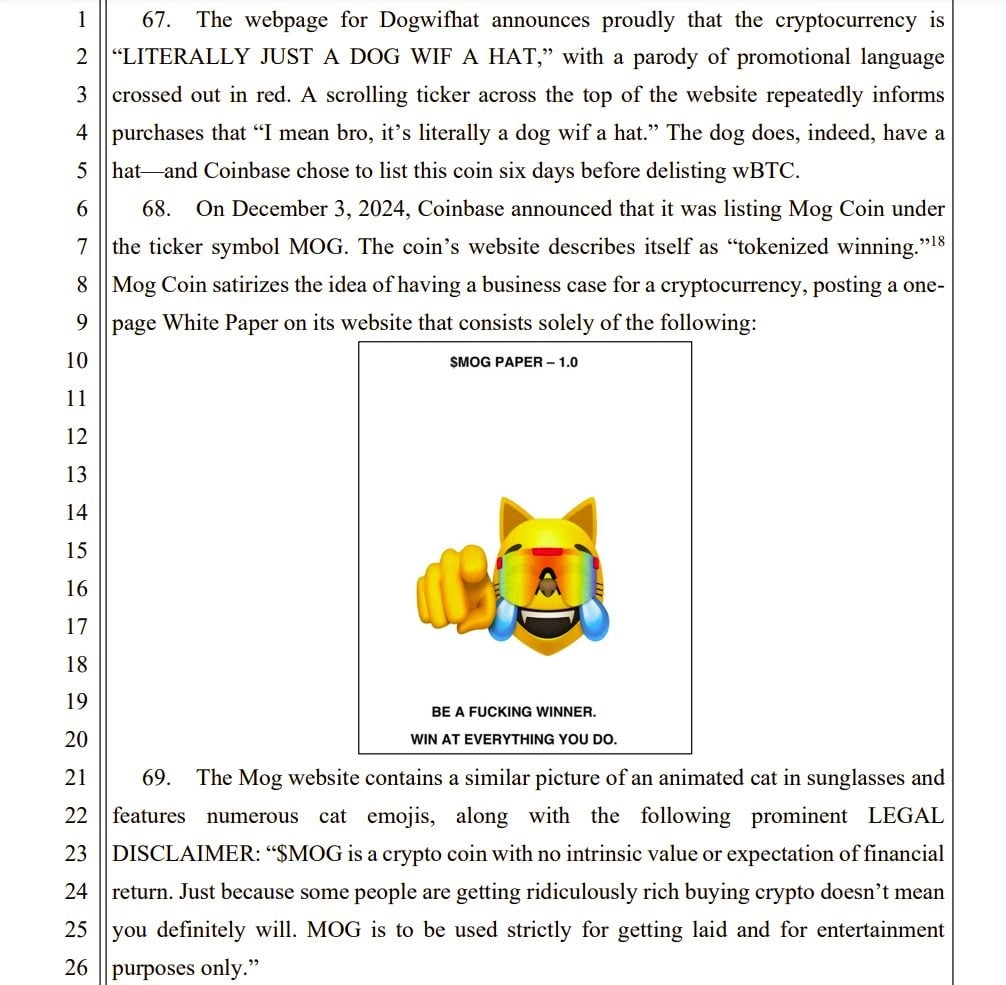

Disclaimer