Blockchain TVL Trends: Bitcoin, Ethereum, and Hyperliquid See Significant Inflows

Bitcoin, Ethereum, and Hyperliquid saw significant TVL increases in the past week driven by strong investor inflows.

Bitcoin, Ethereum, and HYPE Lead the Way

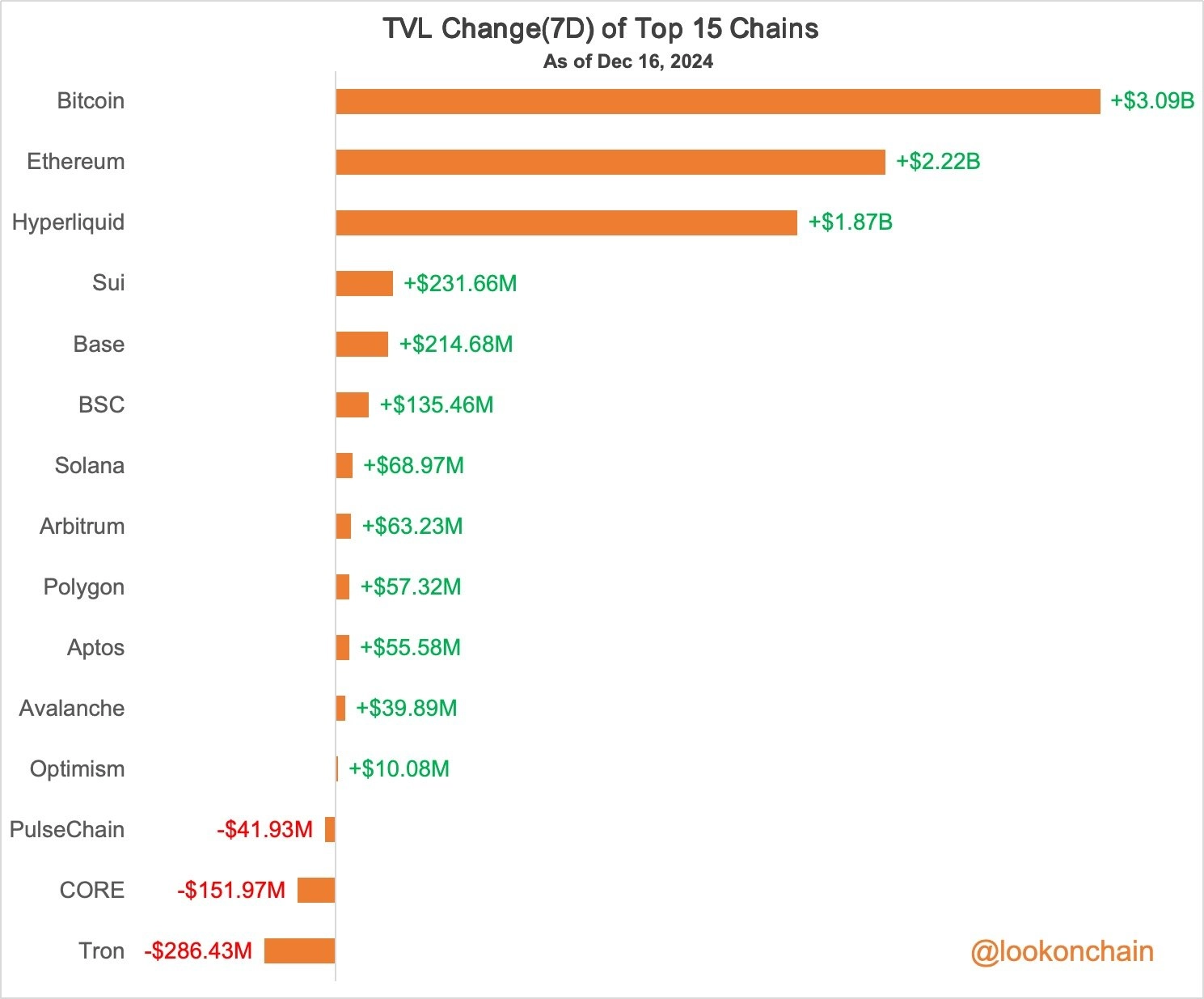

The total value locked (TVL) in Bitcoin, Ethereum, and Hyperliquid rose by $3.09 billion, $2.22 billion, and $1.87 billion respectively over the last seven days. This is according to data from Lookonchain, a smart money onchain tracker which noted a significant inflow of funds into the three networks.

Concurrently, chains like Sui, Base, and Binance smart chain (BSC) witnessed significant rises in TVL. Sui rose by $231.66 million, Base rose by $214.68 million, and BSC rose by $135.46 million.

On the flip side, Tron, Core, and Pulsechain saw significant decreases in TVL with $286 million, $152 million, and $41.93 million, respectively. These reductions may be attributed to factors like reduced user activity or a shift in investor preferences toward more prominent networks.

This surge in TVL for BTC comes on the back of a new all-time high of $106.5K driven by institutional interest in bitcoin spot ETFs. With its robust ecosystem of decentralized applications and price hitting $4,000, Ethereum continues to attract significant capital inflows. While less established than Bitcoin and Ethereum, Hyperliquid’s innovative features may be driving its appeal among blockchain enthusiasts.

X users were enthusiastic about Hyperliquid’s TVL surpassing popular chains such as Base. @KamBenBrik said, “Hyperliquid will capture a significant amount of TVL from Ethereum and the L2s. The hyper performance era.” @mikocryptonft also remarked, “HyperliquidX

is on HYPE growth right now. TVL just passed that of Base at $4.09 billion.”

With TVL serving as a key indicator of network health and investor confidence, the focus on utility, scalability, and innovation remains central to capturing and retaining value. For now, Bitcoin, Ethereum, and Hyperliquid are riding a solid wave of momentum.