Chainlink & Ethereum Hit Historic Lows: Opportunity In Market Pain?

You are here: Home / News / Chainlink & Ethereum Hit Historic Lows: Opportunity In Market Pain?

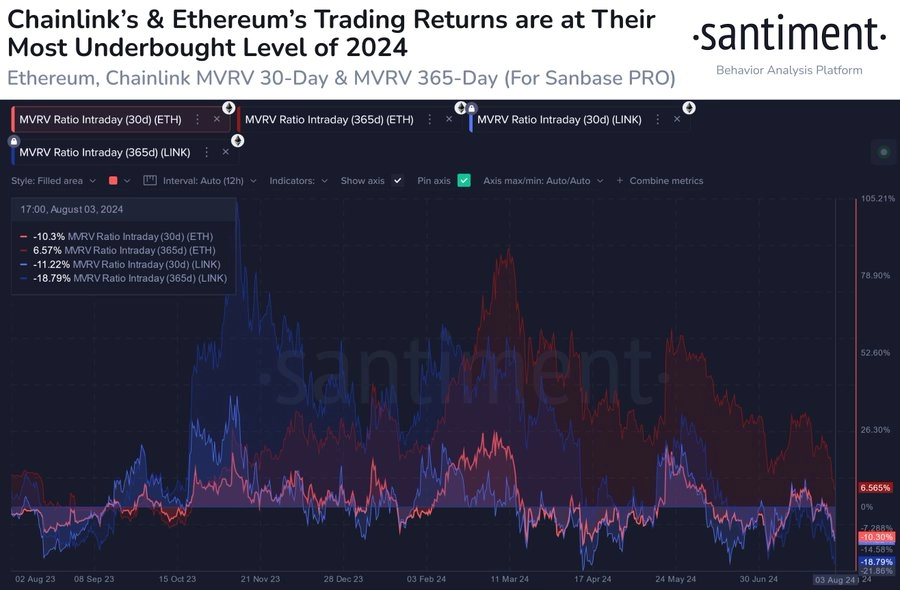

Renowned analytical platform Santiment reported that both Chainlink and Ethereum have reached an all-time low in the 30-day and 365-day average of trading returns. In a recent post on X, the platform highlighted this considerable decrease in return, pointing out the current trends in these large cryptocurrencies.

According to Santiment analysis, Chainlink and Ethereum trading returns have gone extremely low in the short-term and long-term trading. This trend portrays a declined performance over the last one month and year for this company.

Such trends were typically viewed in the past as a signal of buying opportunities. According to Santiment’s statistics, it is possible that the famous Wall Street phrase “blood in the streets” is true in this case, which means significant trading losses, and, therefore, the right time to perform a strategic stake. This view stems from the experience of analyzing the existence of favorable entry times which come with negative feelings to other players in the marketplace.

Chainlink And Ethereum’s Volatile Swings

However, the more recent analysis done by Santiment for the trading intervals does the opposite of the earlier trading periods of highlighting the problems that Chainlink and Ethereum traders are faced with. These fluctuations highlight the random and unpredictable nature of cryptocurrency markets where large swings can be expected in both short term and long term periods.

Insights from Santiment offer a useful angle from which one could analyze the current market trends. Santiment also pointed out at the present paltry rates of chain link and Ethereum indicating that there are market changes which might impact future trading.

Such data is crucial to traders and investors for the purpose of their decision making especially when markets are extremely volatile. The recent report on Chainlink and Ethereum served as an excellent example of how the digital asset markets are constantly evolving, and how crucial it is to pay close attention to market trends.

The recent research report of Santiment provides insights into Chainlink and Ethereum trading profitability, which displays the lowest value of short-term and long-term average rates. This situation calls for the review of trading strategies since investors weigh the prospects of the market at the time they are deciding on the action to take.