Mexico Looks Past Trump Threats With $2.7 Billion Port Expansion

Mexico is looking beyond the incoming Trump administration’s threats of tariffs, betting on a bright future for global merchandise trade no matter what actions its northern neighbor and biggest trading partner takes.

Author of the article:

Bloomberg News

Alex Vasquez

Published Nov 23, 2024 • 4 minute read

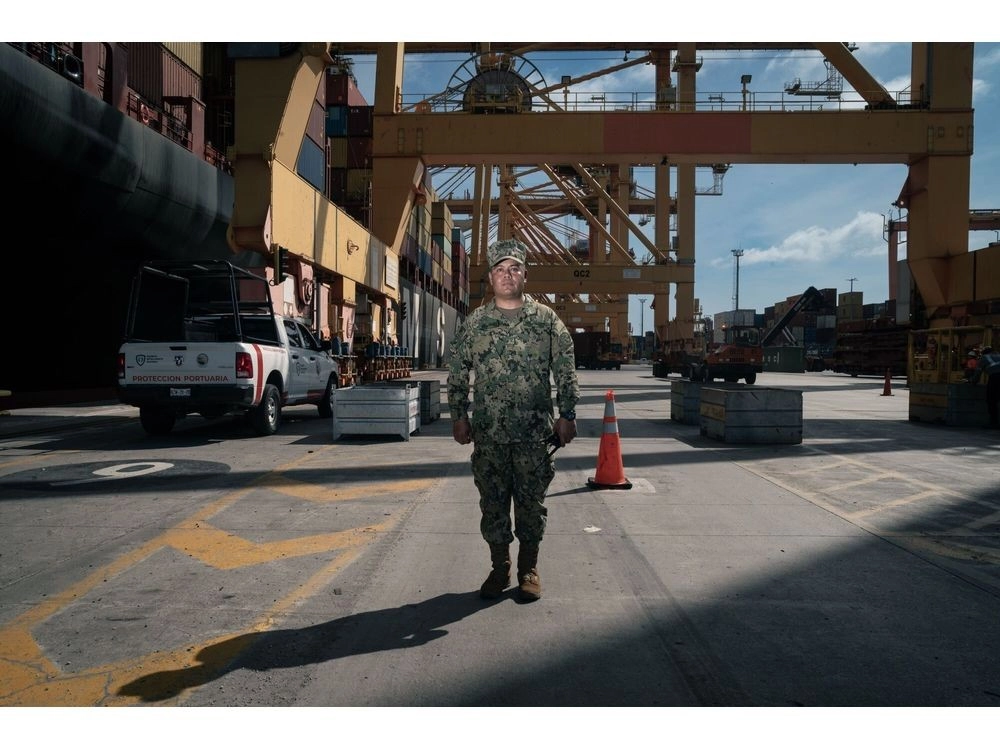

Captain Luis Martinez Cabrera Photo by Mayolo Lopez Gutierrez /Photographer: Mayolo Lopez Gutie

Captain Luis Martinez Cabrera Photo by Mayolo Lopez Gutierrez /Photographer: Mayolo Lopez Gutie (Bloomberg) — Mexico is looking beyond the incoming Trump administration’s threats of tariffs, betting on a bright future for global merchandise trade no matter what actions its northern neighbor and biggest trading partner takes.

Article content

Article content

While Donald Trump promises 60% levies on goods imported from China and 20% on the rest of the world, Mexico is making a substantial investment to more than double the capacity of its main commercial port — a show of confidence that imports and exports will increase significantly in the coming years.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The 55 billion-peso ($2.7 billion) expansion of the Navy-run Port of Manzanillo, located in the western state of Colima on the Pacific Ocean, would vault it into the top 20 container ports in the world. That represents a huge leap from its current position of 53rd in the latest Lloyd’s List ranking and would position it as the busiest in Latin America.

With completion targeted for 2030, the expanded port would cover more than 1,800 hectares (4,448 acres) compared with the existing 450 hectares. That additional land and more equipment will allow annual capacity to more than double to 10 million 20-foot containers, said retired Admiral Mario Alberto Gasque, general director of Asipona Manzanillo, the Navy agency that runs the facility.

Annual volumes at that level would put Manzanillo on par with the Port of Los Angeles, the busiest US gateway for maritime trade.

Among the main products the port receives from more than 140 countries are materials for the automotive industry, agricultural products and steel, Gasque said. The public sector will fund about a quarter of the investment, with the private sector financing the rest.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Article content

The port has already received written expressions of investment interest from several private companies, including Mexico’s Ferromex, a Grupo Mexico Transportes railroad unit, said Cesar Sandoval, planning manager at Asipona Manzanillo.

Increasingly, though, ports are getting entangled in geopolitical tensions. The US and Canada have both expressed concern about Mexico becoming a back door into North America for China. And US-based consulting firm Rhodium Group said in a report last month that Chinese direct investment in Mexico is six times higher than shown in official statistics.

An adviser to Trump’s transition team has even threatened 60% tariffs on goods from anywhere shipped through Chinese ports across Latin America, a direct challenge to the new Chinese-owned port in Chancay, Peru, that was inaugurated this month by President Xi Jinping. The threat could also affect Mexico: China operates several port concessions from Ensenada in the north on the Baja California coast to Lazaro Cardenas and Veracruz in the south.

But Mexican President Claudia Sheinbaum, who is set to visit the Manzanillo facility on Saturday, insists her government has a plan to substitute many of its imports from China with goods made locally, both by Mexican and foreign firms. She is also pushing back forcefully against US and Canadian criticism.

Article content

The idea China is using Mexico as a back door to the US “is not correct,” the president said Friday during her daily press briefing. “Automobiles manufactured in Mexico, whether they are exported to the United States or stay in Mexico, have only 7% content of products coming from China. In the United States, it is 9%,” Sheinbaum added.

During a tour organized by the Navy at the Manzanillo port’s facilities, several Asipona officials said they weren’t concerned that Trump’s threats would affect the port’s expansion plans.

Although China is the main country that moves merchandise through Manzanillo, the port also receives goods from other Asian countries like Japan and South Korea, according to Julieta Juarez Ochoa, the facility’s commercialization manager. That’s on top of goods from the US, Canada, Australia and Latin American nations including Chile and Ecuador, she added.

“We are not really worried about it, because we are aware of the dynamism of Mexican ports,” Juarez said of Trump’s promised tariffs. “We continue growing, we continue seeking to be an efficient and dynamic port and there are going to be many options for Mexico.”

Article content

Earlier this year, Mexico imposed tariffs designed to curb the flow of steel from China after the US complained it was ending up in products shipped north across the border, undermining fair competition. Sheinbaum’s officials have also been talking about how to close their own trade imbalance with China and strengthen ties with their North American partners.

Canadian Prime Minister Justin Trudeau has also said his government has concerns about Mexico’s trade with China amid an upcoming review of the North American free-trade deal overhauled during Trump’s first administration scheduled for 2026. Trudeau remains hopeful the three countries can work constructively on the issues over the coming months.

Some Canadian provincial leaders, including the premiers of Ontario and Alberta, argue Canada should pursue a bilateral trade deal with the US due to Mexico’s more open trade with China. But so far neither Trudeau nor Chrystia Freeland, his deputy prime minister who previously led continental trade talks, have backed that call.

“We are seeking to continue moving forward without being slowed down by the geopolitical situation,” Gasque said. His agency wants Mexican ports to be able to “adapt to the political situation that exists at any given moment.”

Article content

Drug interdiction is also among the incoming Trump administration’s priorities. And the Manzanillo port continues to work on improving its security protocols to attract more customers, especially after commitments made between Mexico and the US to reduce trafficking.

“We have increased our technological capacity to detect illicit substances, including precursor chemicals for the manufacture of synthetic drugs such as methamphetamine and fentanyl,” said Captain Luis Martinez Cabrera, chief of information and risk analysis at the facility.

—With assistance from Maya Averbuch, Robert Jameson, Brad Skillman and Travis Waldron.

Article content