Ripple Approved in UAE to Enter $400B Trade and $40B Remittance Markets

Ripple secures first DFSA license for blockchain payments in the UAE, opening access to a $400B trade hub with regulated cross-border services and RLUSD stablecoin.

Ripple Targets $400B UAE Trade Hub With Fully Regulated Cross-Border Payments

Ripple shared insights on May 1, highlighting a major regulatory achievement in the United Arab Emirates (UAE), as it became the first blockchain-powered payments company to receive licensing from the Dubai Financial Services Authority (DFSA).

The license permits Ripple to offer its cross-border payments platform, Ripple Payments, across the region—a move seen as pivotal for the company and digital asset adoption in the Middle East. The company noted:

Ripple is the first blockchain-powered payments provider to be licensed by the Dubai Financial Services Authority (DFSA) to bring its flagship cross-border payments solution, Ripple Payments, to businesses across the region.

The company positioned this milestone as a catalyst for broader innovation and confidence in digital finance. According to Ripple: “This licensing milestone helps legitimize real-world applications of digital assets in the Middle East and will beget innovative financial services for institutions and retailers alike. Ripple is fueling this transformation by providing the trusted payments, custody and stablecoin solutions that banks, fintechs, and crypto businesses need to support and scale their digital asset strategies.”

Ripple opened its Dubai office in 2020 and has since grown its regional footprint, now accounting for 20% of its global customer base in the Middle East. The region’s embrace of blockchain solutions has been fueled by favorable regulations, rising enterprise adoption, and a young, tech-forward population.

The blockchain firm emphasized the practical implications of its new licensing status in one of the world’s largest trade and remittance corridors, stating:

DFSA licensing approval allows Ripple to offer fully regulated cross-border crypto payments in the UAE. For businesses operating in the $400B trade hub, one of the world’s largest, and a $40B remittance market, this means expanded access to faster, more cost-effective and transparent international transactions.

In addition to offering regulated payments, Ripple is rolling out RLUSD, its enterprise-grade USD-backed stablecoin, to further support secure, compliant, and scalable blockchain-based financial solutions in the region.

Michael Saylor: Bitcoin Will Be $10M Before Financial Advisors Say 'Good Idea' to Buy

Michael Saylor’s $10 million bitcoin prophecy gains traction as trillions remain locked behind advisor restrictions, signaling a massive institutional breakout is only just beginning.

$10M Bitcoin? Saylor Says That’s When Financial Advisors Finally Get It

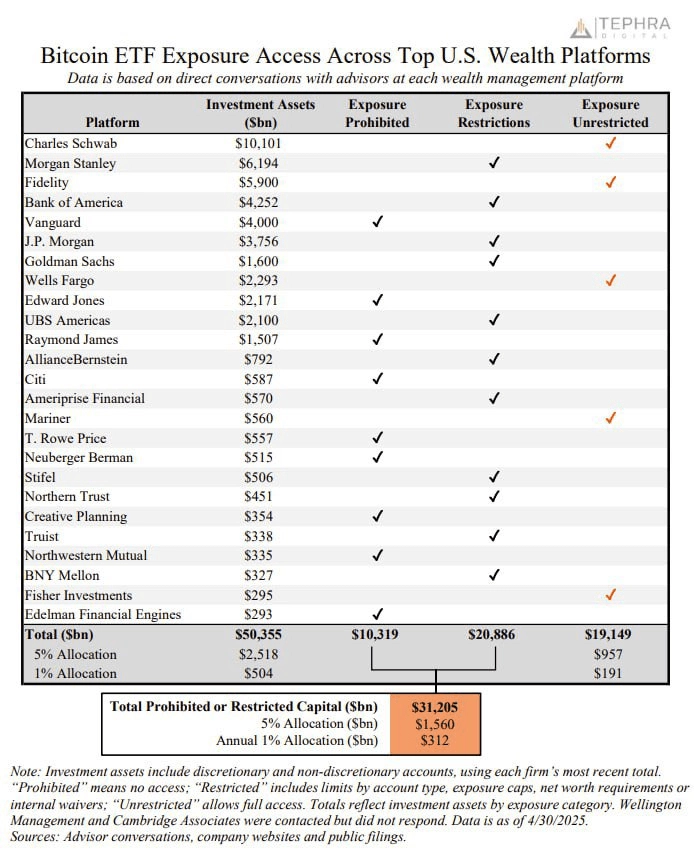

Wealth management firms controlling more than $50 trillion in assets continue to limit access to bitcoin exchange-traded funds (ETFs), according to a chart published by Tephra Digital on April 30. Strategy’s executive chairman, Michael Saylor, shared the chart and commented on the delayed adoption curve among financial advisors. He stated on social media platform X:

By the time your financial adviser says it’s OK to buy bitcoin, it’ll cost $1 million. When they say it’s a good idea, it’ll be $10 million.

The analysis, based on direct conversations with advisors, sorted ETF access into three categories: prohibited, restricted, and unrestricted. Despite surging demand after regulatory approval, only about 38% of the assets are housed in firms offering unrestricted access to bitcoin ETFs.

Firms such as Charles Schwab, Fidelity, and Wells Fargo have opened the door fully, offering exposure without limits and accounting for $19.1 trillion in assets. However, approximately $20.9 trillion is tied to platforms with restricted access, which includes conditions based on account type, exposure limits, or investor eligibility. Another $10.3 trillion is completely cut off from ETF access, with platforms like Vanguard, Edward Jones, and Citi continuing to bar any exposure to bitcoin ETFs.

Tephra Digital underscored the magnitude of these restrictions by estimating potential capital flows. If just a 5% allocation to bitcoin ETFs were allowed on platforms currently prohibiting or limiting access, as much as $1.56 trillion could be invested. Even a 1% allocation would account for $312 billion. While critics emphasize market volatility and regulatory concerns, bitcoin supporters argue that dismantling these access barriers could accelerate mainstream institutional adoption. The chart illustrates not only current accessibility but also the scale of unrealized capital that could shift markets if policy positions at these wealth platforms evolve.

Tags in this story

Image Credits: Shutterstock, Pixabay, Wiki Commons